XRP and Litecoin fall after 18% hike, but is there a clear winner?

- XRP and LTC both surged over 18%.

- Their prices have similarly gone down by over 6%.

Following Bitcoin’s [BTC] surge beyond the $70,000 price range, several altcoins experienced a winning streak, with notable surges observed in Ripple [XRP] and Litecoin [LTC].

The question remains: have these altcoins managed to sustain the rally?

XRP and Litecoin lead social and market activity

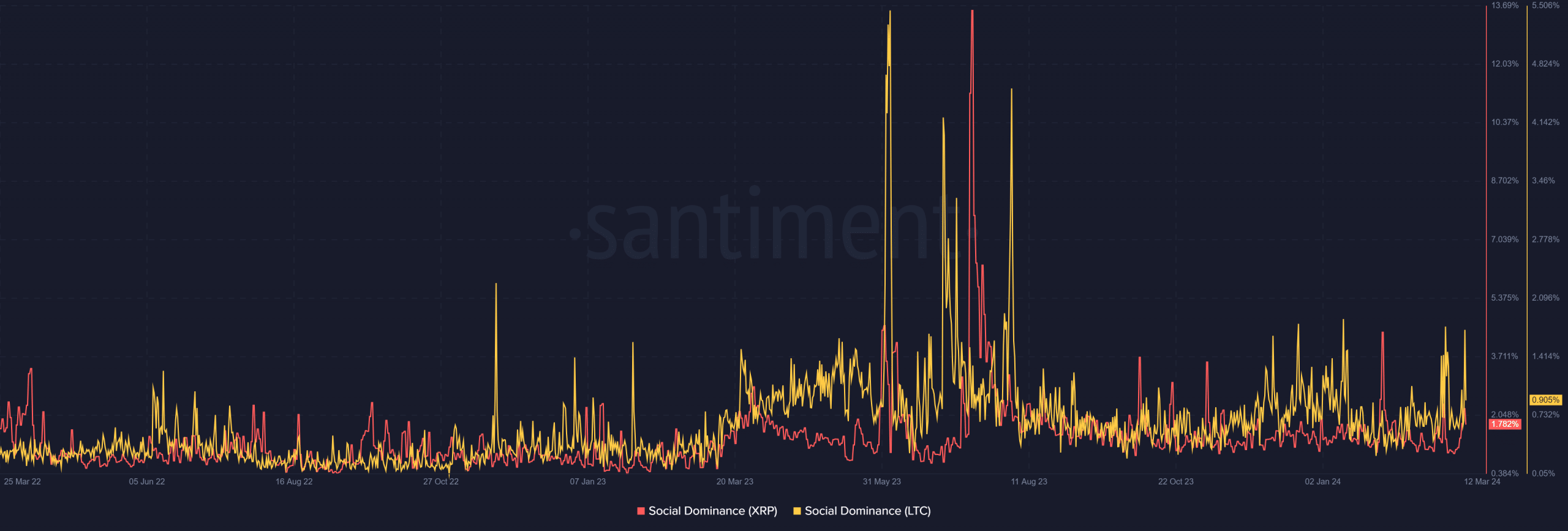

XRP and Litecoin witnessed a surge in social activity at the close of trading on the 11th of March.

While much attention was focused on Bitcoin’s impressive climb, these altcoins experienced notable increases in their Social Dominance.

According to AMBCrytpo’s analysis via Santiment, XRP’s Social Dominance rose to around 2.24%. Litecoin followed suit with a rise to 1.2% on the same day.

These changes were significant, given their previous levels. At the time of this writing, the Social Dominance had fallen to around 1.8% and 0.9%, respectively.

Additionally, AMBCrypto’s look at LunarCrush’s data showed that XRP and LTC led other altcoins in terms of social activity volume.

Santiment’s market activity data also highlighted that XRP and LTC were among the top performers, with over a 13% price increase, trailing only behind Ton.

XRP and Litecoin see record volume

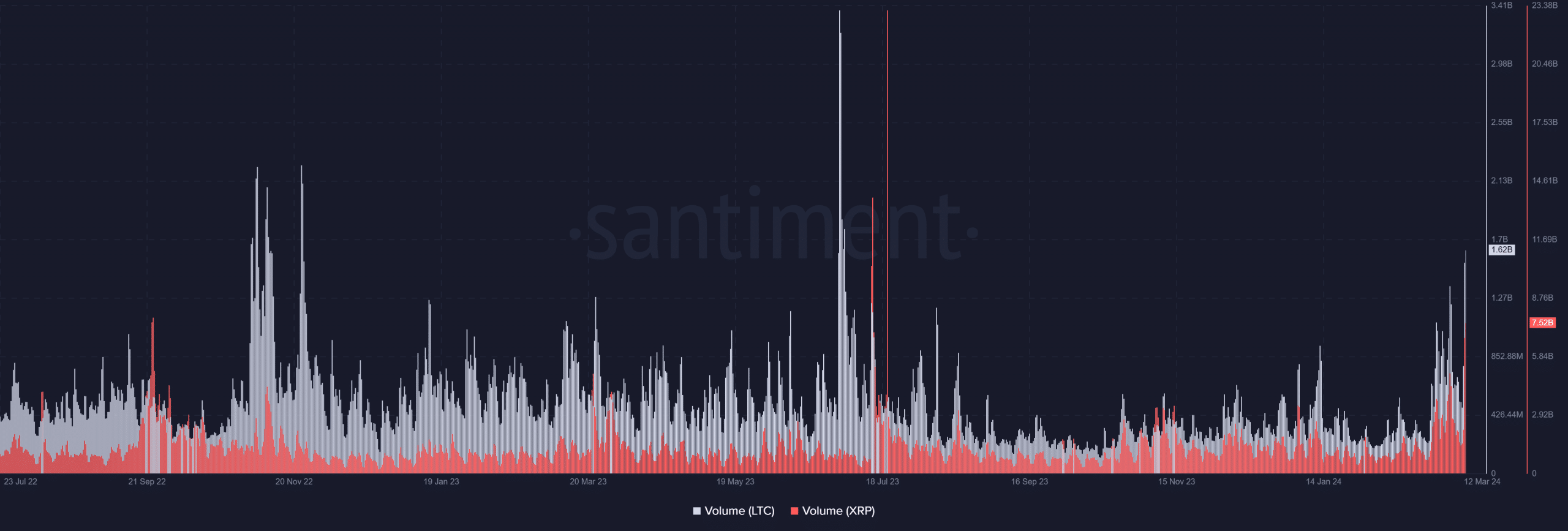

XRP and Litecoin experienced a significant surge in trading volumes as well, reaching levels not seen in months.

On the 11th of March, XRP’s trading volume went over $6 billion, marking the highest volume recorded in over seven months.

At the time of this writing, the volume had further increased to over $7.3 billion, marking another high. The last time XRP observed such a substantial volume was in July, with figures exceeding $23 billion.

Similarly, Litecoin saw a notable increase in volume on the 11th of March, rising to about $1.07 billion after a period of decline.

At the time of this writing, Litecoin’s volume had surged to over $1.6 billion, reminiscent of the June timeframe when the volume exceeded $3 billion.

XRP and Litecoin unable to sustain the rally

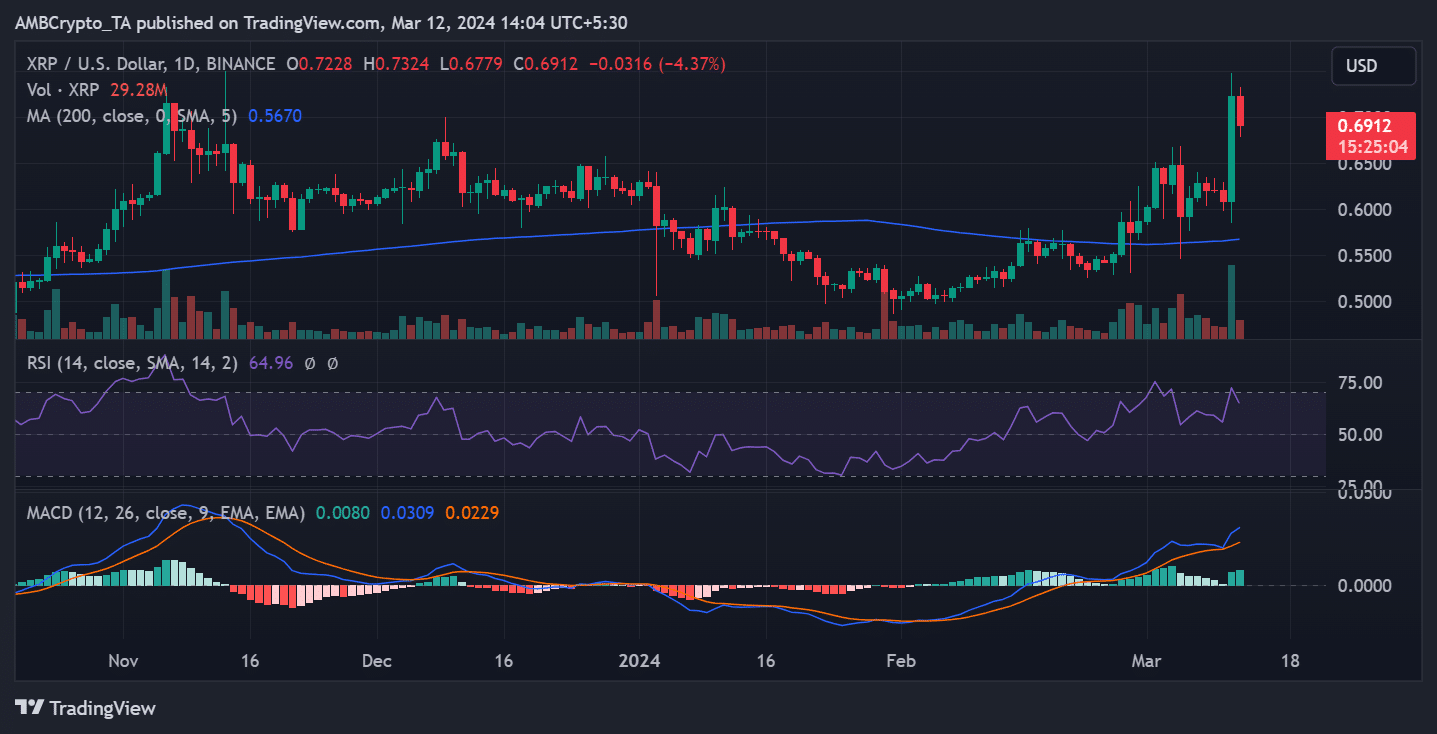

XRP and Litecoin experienced a substantial surge in price on the 11th of March, leading to increased volume and social activity.

XRP’s price rose by over 18%, reaching approximately $0.72, marking its most significant surge since July 2023. However, at the time of this writing, it had declined by over 6%, trading at around $0.69.

The decline indicated challenges in sustaining the rally.

Also, the surge in volume suggested dominance by sellers in trading activities.

Similarly, Litecoin witnessed an 18% surge on 11 March 11, reaching around $103.8, a level not seen since 2023.

Despite this notable increase, Litecoin’s price couldn’t maintain the momentum, experiencing a decline of over 6% to around $97.2 at the time of writing.

Furthermore, the Relative Strength Index (RSI) for both altcoins dropped below 64. Analysis showed that while the surge briefly pushed the RSI above 70, it fell back below as the prices dropped.

The RSI state suggested that XRP and Litecoin were still in strong bull trends despite the minor setbacks.

Supply in profit shows different patterns

In the last 24 hours, both XRP and Litecoin exhibited similar price trends. However, a closer look at the total supply in profit revealed that XRP had a higher proportion than Litecoin.

Is your portfolio green? Check out the LTC Profit Calculator

AMBCrypto’s analysis of the total supply in profit metric on Santiment showed that XRP had about 91.3 billion coins in profit. The number constituted over 91% of the total supply at the time of writing.

On the other hand, Litecoin’s analysis showed that over 58.1 million of its supply was in profit, representing around 78.2% of the total supply at the time of writing.