Bitcoin

Bottom’s up? How investors are looking at Bitcoin right now

The crypto-markets continue to slide lower than usual as Bitcoin [BTC] tumbled to a new low on 19 June. Moreover, the king coin breached a prior cycle’s all-time high for the first time in its history after dropping below $18k. This has piled on more pressure on investors who are struggling in these extreme market conditions.

New day, new history

Bitcoin fell below its 2017 all-time high for the first time in its history after dipping below $18k. In the last 24 hours alone, it dipped to as low as $17,700. However, it soon recovered and stood at $18,350. One of the major reasons for the uptick is the multi-fold increase in the volume of the network. Currently up by a whopping 83%, volume estimates are signalling a potential rally in the coming days.

There are even suggestions that BTC has found its local bottom in the current crash. After rejecting the $20k support, investors believe $17,500 can be the new bottom. There is evidence to support this hypothesis.

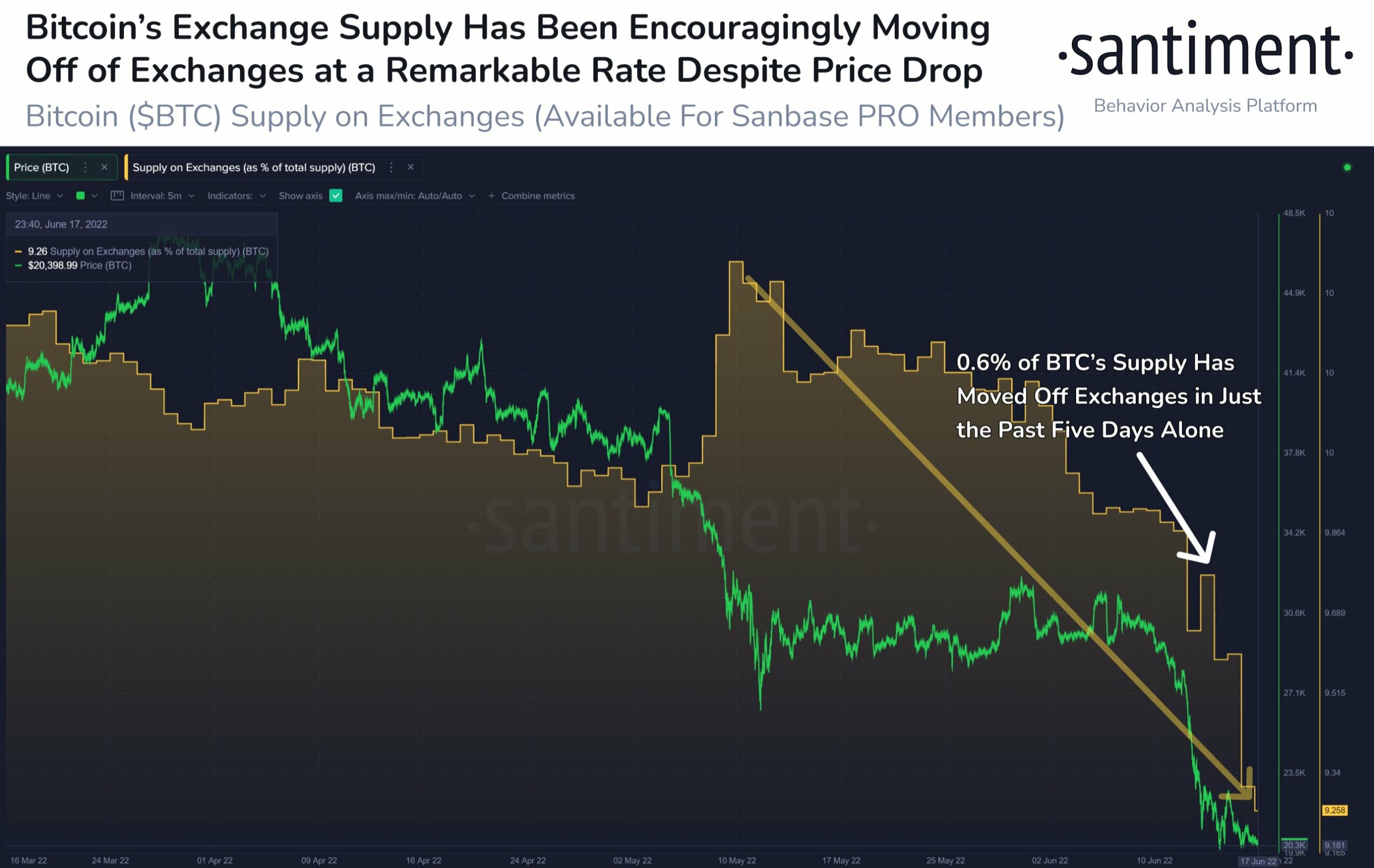

As per Santiment, Bitcoin’s supply on exchanges has dropped massively in recent days. As shown below, 0.6% has moved off exchanges in the last five days alone. This means there is growing consensus that the worst is over and a rally is on the cards for Bitcoin.

“This is indicative of hodlers who stuck with BTC through this downfall being content with volatile markets at this point, and willing to ride it out.”

Latest Glassnode data also suggests the same. It revealed that Exchange Outflow Volume (7D MA) hit a two-year high today at 4,128.6 BTC. This metric previously reached its high back in May 2021 at 4,066.2 BTC.

With outflows gaining strength, this could be the signal for whales to start accumulating the “discounted” prices of BTC.

Striking a dilemma

While exchanges may be emptying out BTC, here is a metric that suggests more pain down the line. According to Santiment’s analysis

, Bitcoin saw the biggest realized losses this week.This was estimated by using the network realized profit loss metric. This also throws light on investor pain during a week in which the crypto shed almost 33% of its value.