BRETT crypto hits new ATH, then dips – But wait, there’s more!

- BRETT dropped 7.55% from its ATH but sentiment around the token remained bullish.

- Indicators revealed that the price might drop to $0.14 before a bounce appears.

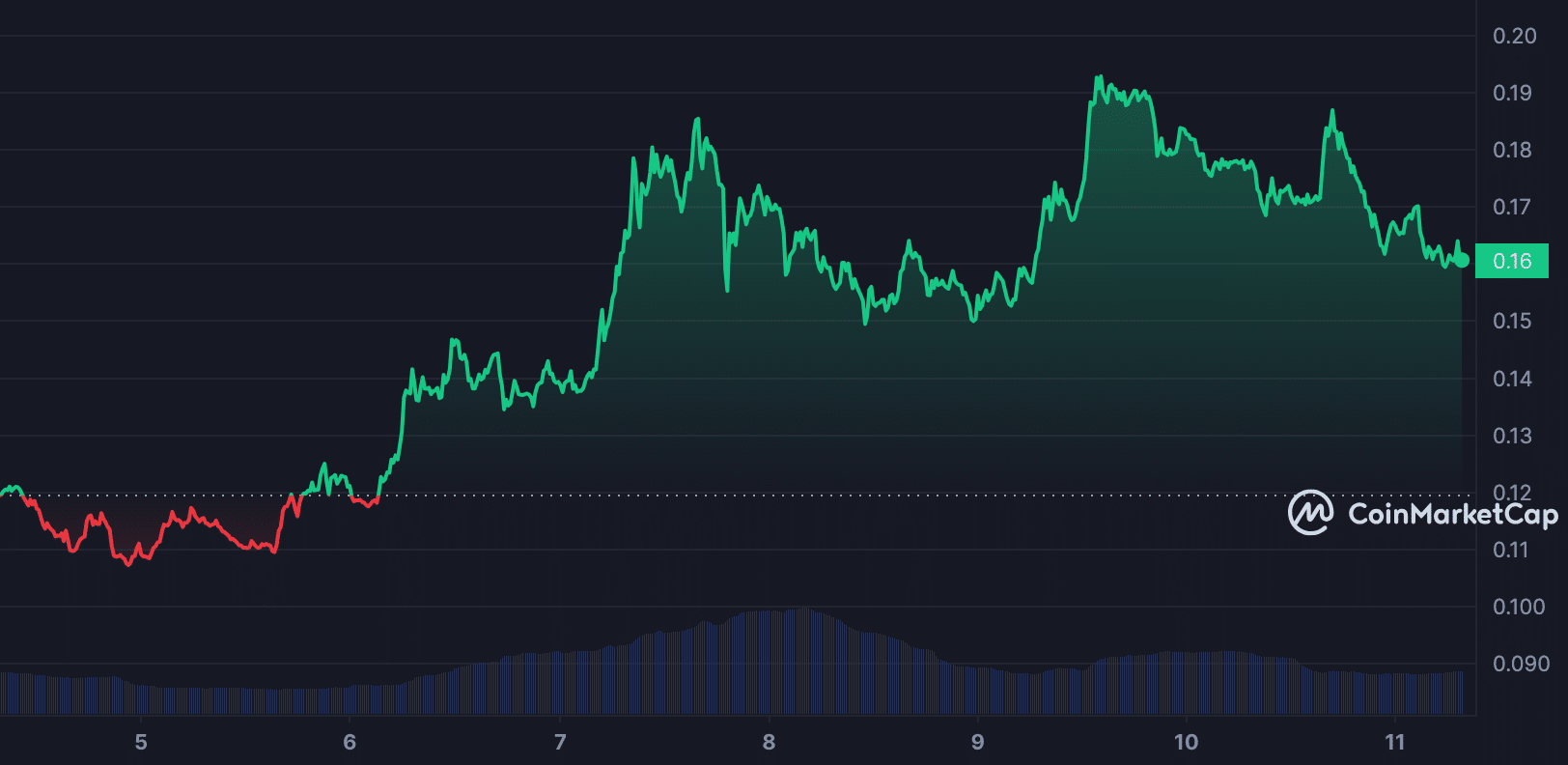

On the 9th of June, Brett [BRETT], a memecoin developed on Base, the Coinbase layer-2 rallied to a new All-Time High (ATH). As of the mentioned date, BRETT’s price was $0.19.

The price increase also ensured that the market cap got close to $2 billion before it fell. At press time, BRETT crypto changed hands at $0.16 with a market cap of $1.61 billion.

The token’s price was a 7.55% decrease in the last 24 hours. This decrease could be linked to profit-taking especially as the memecoin has produced an incredible 375% hike in the last 30 days.

Is the local top in?

Some developers launched the BRETT crypto in February 2024, and got the tag “PEPE’s best friend” on the Base Chain. With a growing community, the development was a response to the dominance of memecoin built on Solana [SOL].

As a result, the token became the most valuable cryptocurrency in terms of market cap on Base.

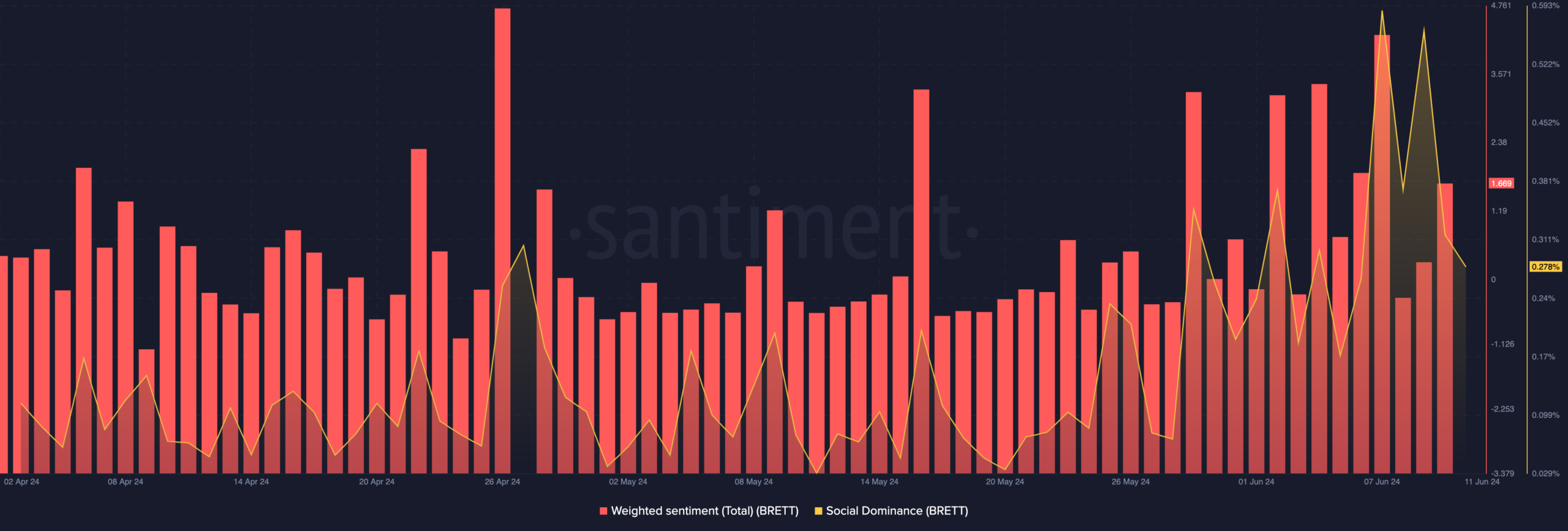

Despite the drop in price, the sentiment around the token remained bullish. Evidence of this reflected in AMBCrypto’s analysis of Santiment’s data.

Provided by the on-chain analytic platform, Weighted Sentiment measures the comments online about a project. A positive reading suggests that a broader bullish perception.

On the other hand, a negative value of the metric indicates higher bearish sentiment on social platform. Another metric that AMBCrypto looked at was social dominance as this could influence the BRETT crypto price.

When the price hit its ATH, social dominance skyrocketed to 0.56. This implies that a surge in discussion around the cryptocurrency. For the price, this could be a sign of a local top.

Hence, it was not surprising that the memecoin retraced later. However, the social dominance also fell.

But the drop is not entirely a bad sign as the decrease in conversation could offer a buying opportunity before BRETT begins another rally.

BRETT may go lower before another rally

At the same time, it is possible for the token’s value to go lower. Therefore, $0.16 may not be the bottom. However, let’s look at BRETT’s potential movement using indicators from the technical perspective.

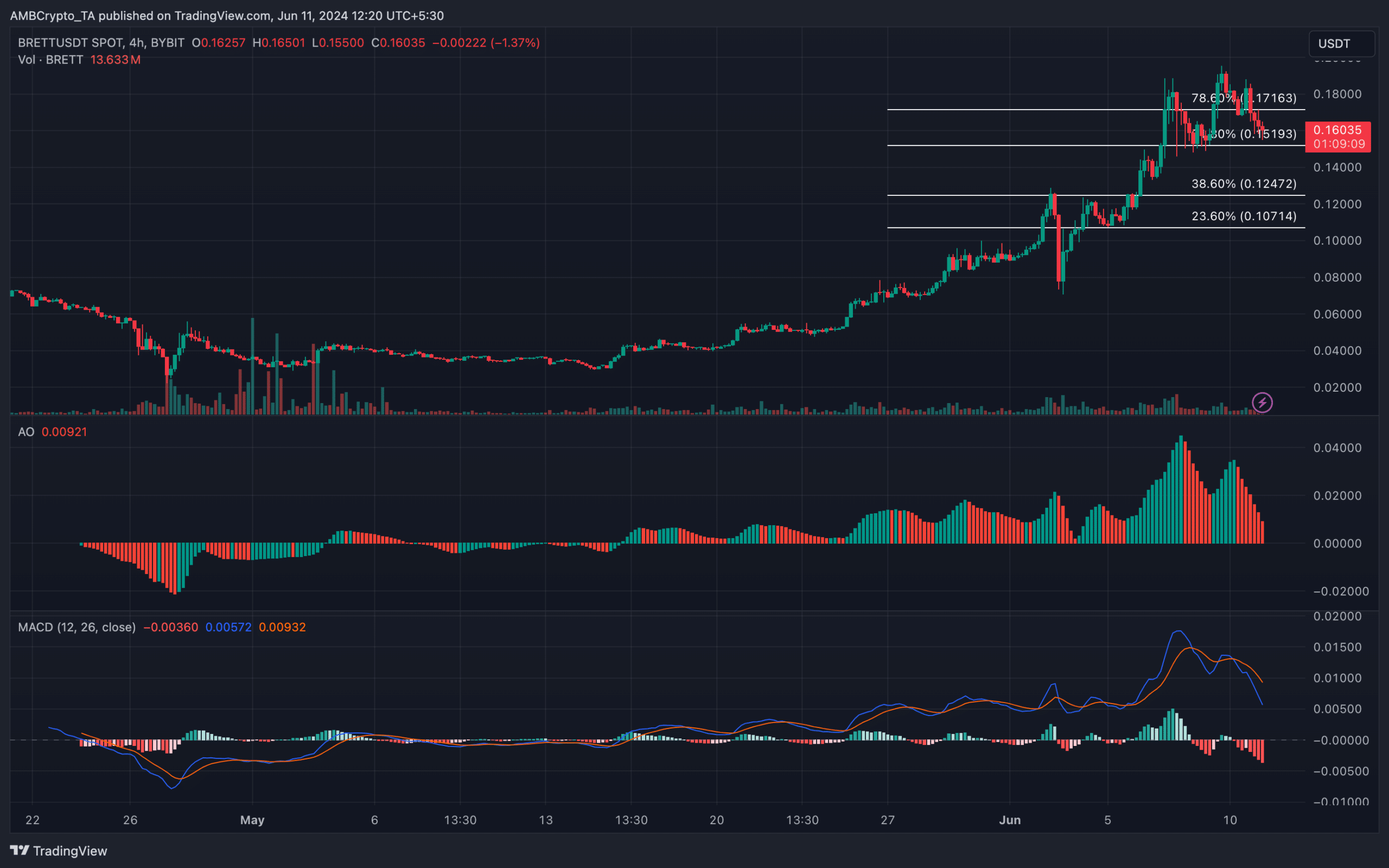

According to the 4-hour chart, the 0.382 Fibonacci was at $0.12, indicating that this price was a nominal pull back. As such, if selling pressure increase, BRETT could plunge but might find support at this point.

Further, the 0.618 Fib positioned at $0.15 which could be a good entry should bulls defend BRETT crypto price. However, the Awesome Oscillator (AO) reading decreased.

With glaring red histogram bars, the AO showed that the token’s momentum was heading downwards. Reinforcing this position was the Moving Average Convergence Divergence (MACD) which also measures momentum.

As of this writing, the MACD reading was negative. The position of the Exponential Moving Averages (EMAs) also supported a decline. At press time, the 12 EMA (blue) had crossed below the 26 EMA (orange).

This indicated that sellers had outpaced buyers. Assuming it was the other way around, the price action might have been in favor of buyers.

Realistic or not, heres’ BRETT’s market cap in PEPE terms

By the look of thing, BRETT’s price might drop to $0.14 or as low as $0.12. However, this bearish outlook could be invalidated if buying pressure resumes.

Should this be the case, the price could rise higher than $0.20.

![Sei [SEI]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-13-400x240.webp)