Bitcoin

BTC, ETH pave the way as short positions surge

Market turbulence fuels short position surge as traders embrace declines as a potential opportunity. Amidst uncertainty, could the bearish trend spark a bullish revival?

- Long positions have seen over $36 million in liquidations compared to around $6 million for short positions.

- The crypto market has maintained its $1 trillion market cap despite the decline in crypto market caps.

During the previous week, most of the leading cryptocurrencies in the crypto market experienced declines. As a result, some traders have initiated short positions in the market, speculating on continuing the downward price trend.

The crypto market sees more short positions

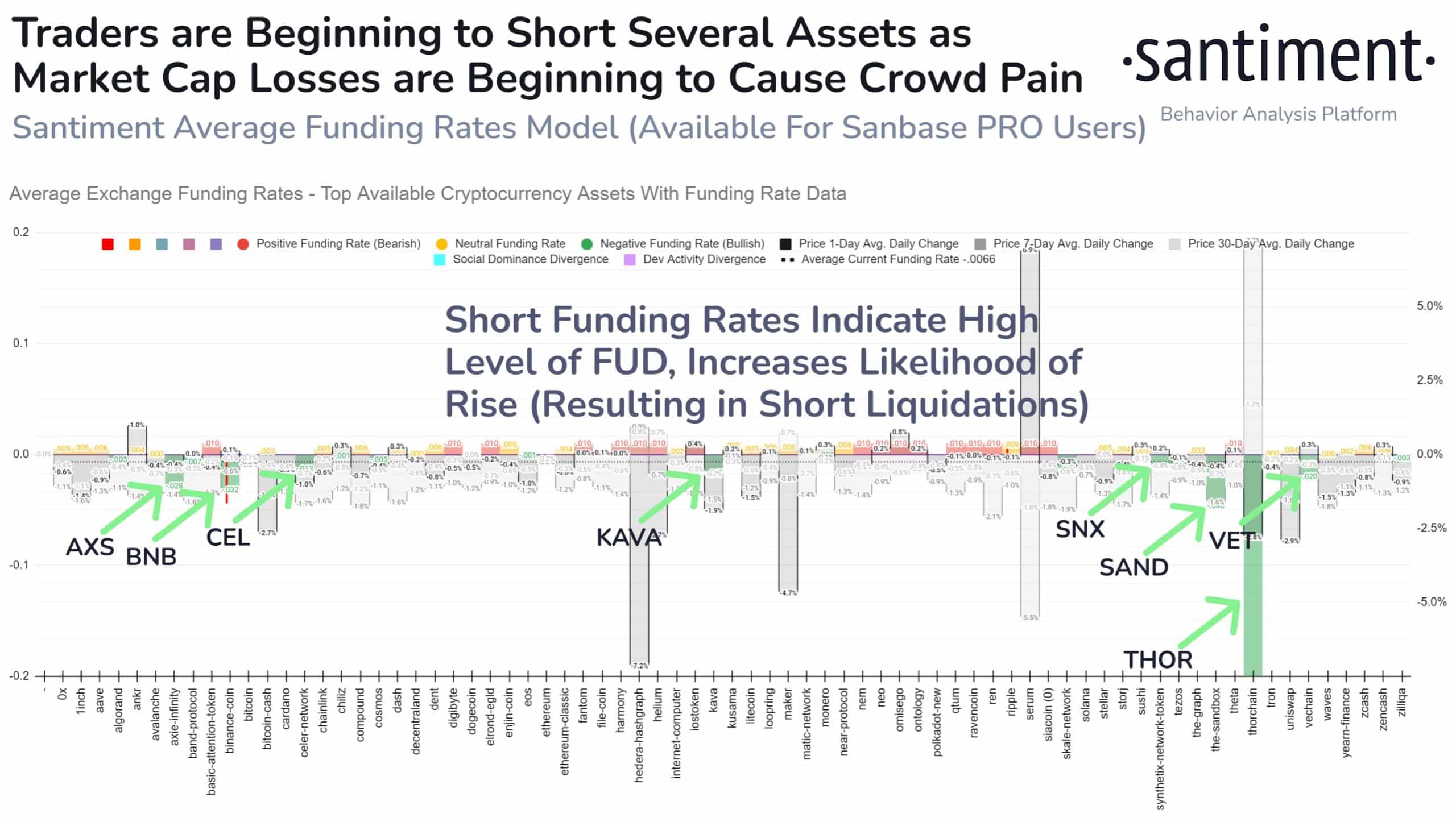

A recent post by Santiment showed that the prevailing position in the crypto market was short. Many traders were seemingly embracing short positions across most assets, a response to the declining prices.

The escalating short positions, evident through the negative funding rate, could trigger Fear, Uncertainty, and Doubt (FUD) and lead to more liquidations.

Although these short positions might mirror a pessimistic market sentiment, they could also serve as a precursor to a bullish trend. This is because bullish traders might seize the opportunity presented by the price dip to initiate buying activity.

Crypto market short vs. long positions

According to data from Coinglass, the ongoing decrease in crypto market

prices has resulted in fewer liquidations for short positions than for long ones. An examination of the liquidation chart revealed substantial liquidation activity for long positions on 15 and 16 August.The trend has persisted up to the time of this writing.

On 15 August, long positions experienced liquidations exceeding $122 million, in contrast to approximately $9.5 million for short positions. Moving to 16 August, long position liquidations reached $111 million, while short positions faced around $15 million in liquidations.

As of this writing, long positions have encountered approximately $37 million in liquidations, while short positions have seen approximately $6 million.

Furthermore, scrutinizing the long/short ratio for top assets by market capitalization on Coinglass emphasized the prevalence of short positions. Bitcoin’s [BTC] short position surpassed $15 billion at press time, juxtaposed with long positions totaling over $13 billion. For Ethereum [ETH], short positions were around $5.9 billion, whereas long positions were around $5.4 billion.

Similarly, Ripple [XRP] and Binance Coin [BNB] exhibited significant figures. At press time, long positions and short positions for XRP sat at over $1 billion and $960 241 million, respectively. Meanwhile, BNB’s long and short positions were at $241 million and $232 million respectively during the same period.

The crypto market maintains the $1 trillion capitalization

Despite the observed decrease, CoinMarketCap

data indicated that the crypto market had upheld its capitalization above $1 trillion. However, the data from CoinMarketCap revealed that the collective market capitalization had declined by approximately 1.7% as of this writing.Furthermore, within the last 24 hours, major cryptocurrencies such as BTC, ETH, BNB, and XRP have experienced declines in value of around 2%, 1.7%, 1.4%, and 2.3%, respectively.

Over the past week, these declines have been more pronounced, with BTC and ETH encountering drops of over 3%, BNB experiencing a decrease of over 4%, and XRP seeing a decline of over 6%.