BTC Fear and Greed Index at 29: How long will Bitcoin traders remain ‘fearful’?

- Analysis showed that fear has gripped the Bitcoin market.

- BTC continued to break critical support levels.

The recent downtrend in Bitcoin’s [BTC] prices has stirred negative sentiments among traders, resulting in substantial liquidation volumes.

Despite these setbacks, buyers have continued dominating the market, maintaining their positions despite losses.

Fear dominates Bitcoin’s sentiment

Analysis of the BTC fear and greed index on Coinglass indicated that the market was experiencing a high level of fear, with the index at around 29 at press time.

This suggested a significant prevalence of fear among traders and investors.

Also, fear has maintained dominance in over 33% of the observations, making it the prevailing sentiment in the current market trend.

The dominance of fear is further underscored by the high volume of liquidation. This helps explain why this cautious sentiment is so prominent.

More long positions get liquidated

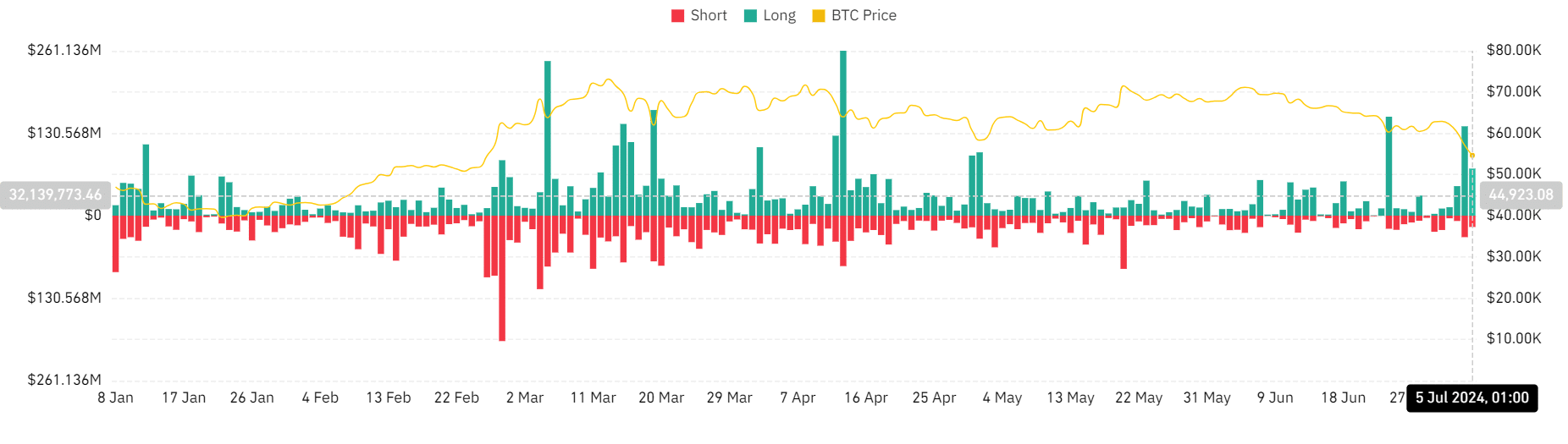

AMBCrypto’s analysis of Bitcoin’s liquidation volumes revealed that over the past 24 hours, more than $256 million has been liquidated.

This period has predominantly seen long positions being liquidated, with the most volume.

Specifically, on the 4th of July, long liquidations were nearly $142 million, while short liquidations were about $34 million, totaling over $170 million.

This amount represented the second-highest liquidation volume in recent months. At press time, the long liquidation volume is over $73 million. Also, the short liquidation volume has exceeded $16 million.

There has been a decline in the derivative volume for Bitcoin over the last 24 hours as well. At press time, the volume was approximately $29 billion, down from over $31 billion recorded on the 4th of July.

This reduction in trading volume is a key factor contributing to the current position of the BTC fear and greed index.

Bitcoin continues to decline

AMBCrypto’s analysis of Bitcoin on a daily time frame has highlighted why the BTC fear and greed index is currently dominated by fear.

Read Bitcoin’s [BTC] Price Prediction 2024-25

We noted that BTC was trading with a decline of over 5%, priced at around $54,240 as of this writing. It concluded the previous trading session with a similar decline of over 5%.

This marked the first instance in more than six months when BTC has experienced consecutive daily declines exceeding 5%. This has contributed significantly to the prevailing market fear.

![Ethereum's [ETH] 11% rebound - Is greed fueling a bottom or is fear driving a trap?](https://ambcrypto.com/wp-content/uploads/2025/04/Ritika-8-400x240.webp)

![Will Chainlink's [LINK] retest flip support into resistance?](https://ambcrypto.com/wp-content/uploads/2025/04/Renuka-57-400x240.webp)