Bitcoin

Buying Bitcoin now could result in a loss- Here’s why

Those optimistic about BTC’s price action may need to consider the Short-Term Holders’ (STH) realized price, instead of rushing into a decision.

- Bitcoin erasing recent gains may not be the end of a short-term downtrend.

- Miners have also been selling, indicating that respite may not appear anytime soon.

Investing in Bitcoin [BTC] has long been associated with potential gains. However, the current market dynamics may have raised concerns about the possibility of losses. But that might only be the case if investors decide to accumulate the coin for the short term.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

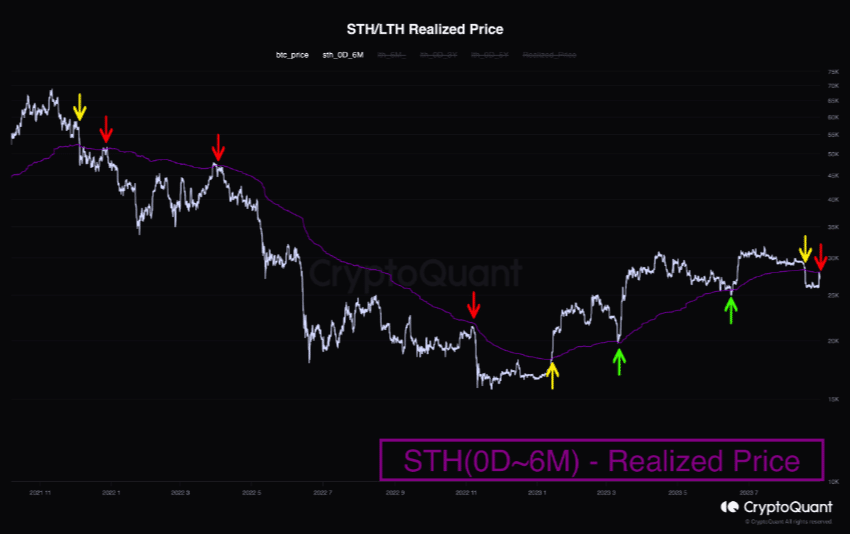

For on-chain analyst crypto sunmoon, those optimistic about BTC’s price action may need to consider the Short-Term Holders’ (STH) realized price, instead of rushing into a decision.

Not the right time to push for gains

sunmoon, who published his opinion on CryptoQuant, opined that Bitcoin could be set for another leg down the charts.

The STH realized price is the average price of the STH holder BTC supply, valued at the day each coin last transacted on-chain. Often considered as the cost basis for short-term holders, an increase in the metric or flip over the Long-Term Holder (LTH) realized price suggests an uptrend.

However, the metric had decreased, indicating the start of another BTC price decrease. Previously, Bitcoin had reached $28,000 on account of Grayscale’s win in court. Unfortunately, the hike only lasted a while, as the coin seemed very close to the value it was before the rally.

And because the STH realized sometimes acts as support or resistance, sunmoon concluded that:

“The recent breakdown in the realized price of short-term holders has led to a downtrend, and the realized price of short-term holders is acting as strong resistance. The downtrend is likely to continue for some time, so those who buy early are likely to lose money.”

Miners take a share of the blame

Another reason, BTC could fall again could be linked to the actions of miners. IT Tech, another pseudonymous analyst on CryptoQuant

explained that the selling pressure was limited to investors alone.Instead, miners’ transfers to spot exchange have been increasing for a while. The analyst noted that:

“In recent times, every major or minor price drop has occurred while miners were sending their Bitcoins to SPOT exchanges. This action, of course, increased the selling pressure, eventually leading them to sell on the market.”

In coming to the conclusion, IT Tech used the seven-day Moving Average (7-day MA) miners’ wallet to exchange metrics. Miners’ moving their coins to the exchanges includes the purposes of selling to cover the cost or to prepare for possible sale.

Is your portfolio green? Check out the

BTC Profit CalculatorMost times, the selling actions include the immediate need to cover the cost or to make excess gains by selling at the price they consider to be over-valued.

From the chart shared above, there were numerous spikes on several occasions. This was confirmation of miners’ intent to sell BTC. At press time, Bitcoin was back below $26,000, losing 4.64% of its value in the last 24 hours.