Calculating the odds of Optimism [OP] sliding down to $2 this week

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- The bias seemed to be firmly bearish on the daily chart

- Lower timeframes also showed strong bearish sentiment

Optimism [OP], at press time, was trading near its lowest point, a level it reached on 5 March. Following the weekend dump, the price bounced to the $2.5-zone but faced rejection around that area of resistance. The bounce in price coincided with the update that Optimism recently shared regarding the Goerli nodes.

Read Optimism’s [OP] Price Prediction 2023-24

Owing to the uncertainty around Bitcoin and the sentiment across the market, it appears likely that OP could see further losses over the next two weeks. And yet, another bounce towards $2.5 can not be discounted.

A range formation, sustained dump, or a bullish breakout for OP?

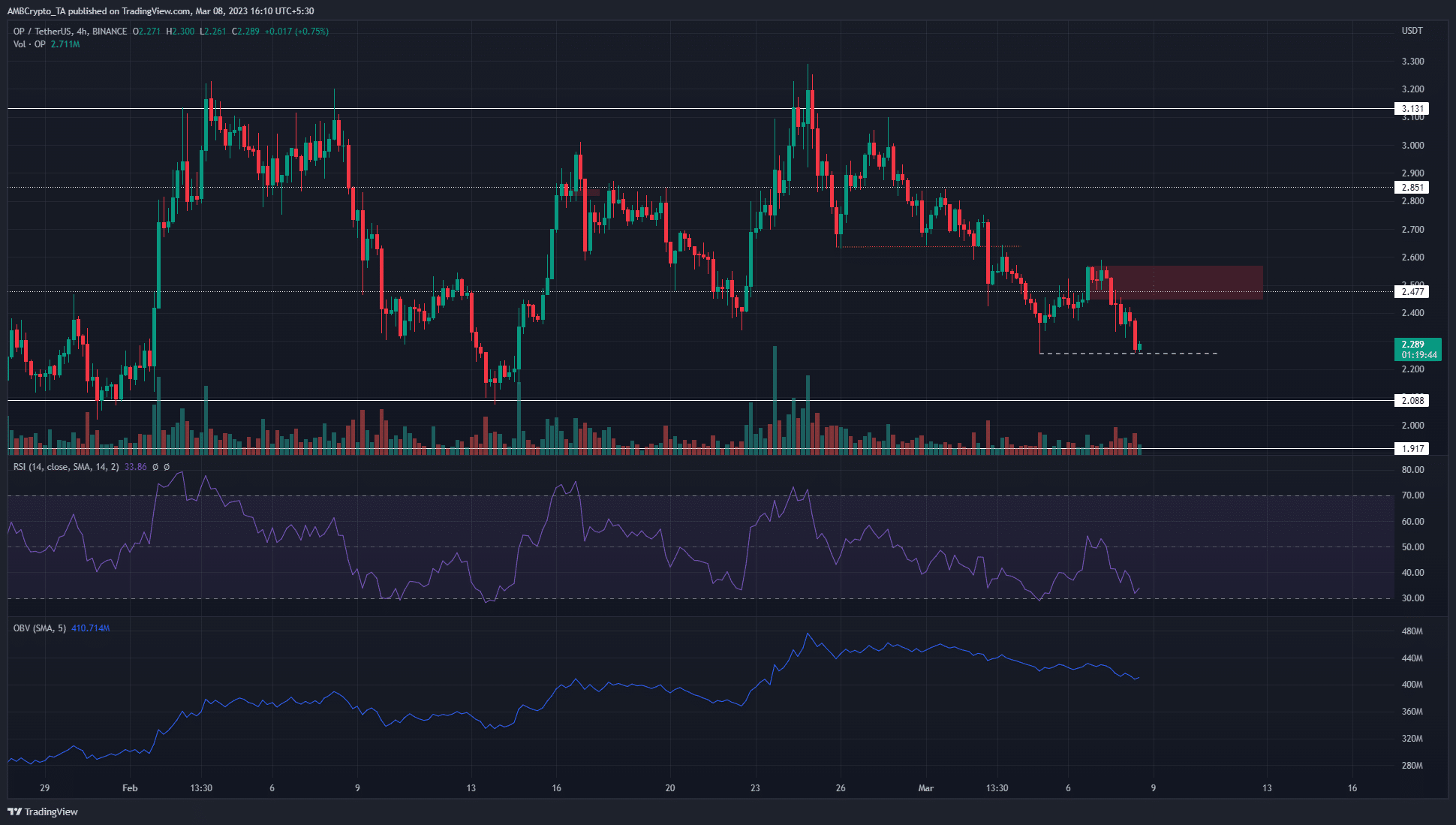

The 4-hour charts showed a clear break in the market structure on 3 March, when a higher low on the chart was breached. The same level was later retested as resistance before further losses. At press time, the price sat atop the most recent lower low at $2.25, one marked by the dotted white line.

Two scenarios could unfold in the coming days. One was a bounce in price towards the $2.5-mark to revisit the previous bearish order block before the next move south. The next scenario would be a straight drop below $2.25, one which would be indicative of aggressive selling across the market.

Hence, there are two possible trades – A more conservative approach would be to wait for OP to retest the bearish order block at $2.45-$2.55. A rejection from that zone could be used to enter a short position, with invalidation above $2.59.

On the other hand, aggressive selling in the coming hours could push OP under $2.25. In that scenario, a retest of the $2.25-$2.4 region can be used to short the asset. However, the structure would only be broken on a move back above $2.59, which makes this scenario riskier for traders.

How much are 1, 10, 100 OP worth today?

The RSI was below neutral 50 on the 4-hour chart and the OBV has been on a steady downtrend over the last ten days. This suggested that selling pressure was significant and could continue to remain that way.

To the south, $2 and $1.9 are levels where buyers could force a bounce in prices and where short-sellers can look to book profits.

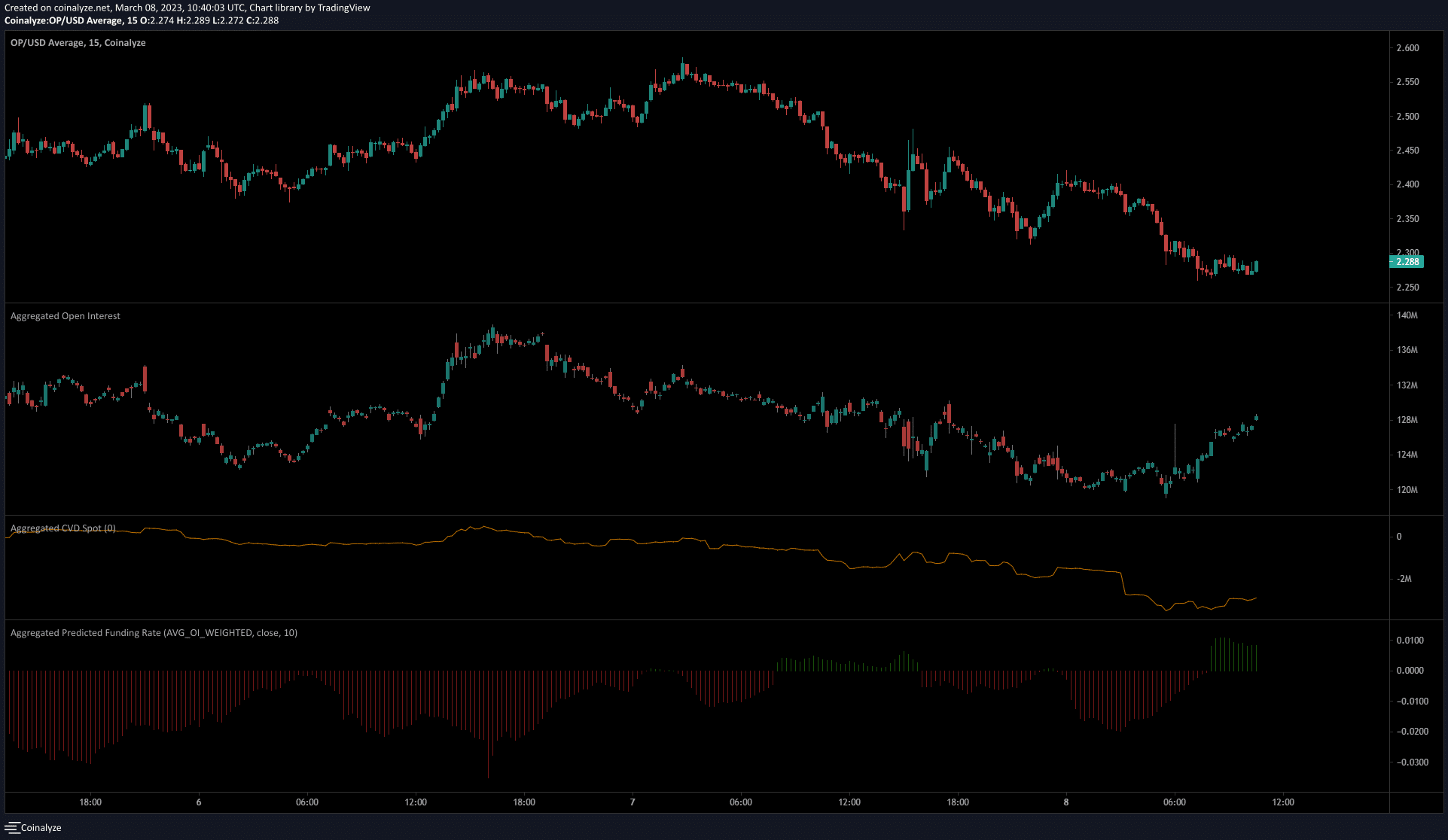

Open Interest suggested aggressive selling could be imminent

Source: Coinalyze

The funding rate was positive, but that was the only bright spot for lower timeframe bulls. OP registered a significant hike in Open Interest, one that measured close to $10 million over the past few hours. During that time, the price was steadily falling on the charts too.

This signalled the high probability of large short positions being opened and was a sign of heavy bearish sentiment. And yet, the spot CVD saw a tiny uptick over the same period – Evidence of some pushback from the bulls.