California empowers 40M with ‘Bitcoin Rights’ in groundbreaking Digital Assets Bill

- AB 1052 recognizes digital assets as legal payment and protects crypto self-custody rights.

- The bill bars public officials from promoting digital assets with potential conflicts of interest.

California is poised to become the first U.S. state to guarantee digital asset freedoms for its nearly 40 million residents. This is thanks to a sweeping amendment to Assembly Bill 1052.

Renamed from the “Money Transmission Act” to “Digital Assets,” the legislation marks a major shift toward legal recognition of Bitcoin [BTC] and crypto ownership rights.

Amended on the 28th of March by Assembly member Avelino Valencia, the bill affirms self-custody as a legal right. Also, it designates Bitcoin and other digital assets as valid forms of payment in private transactions.

Key protections under California Bill AB 1052

Under the revised bill, individuals and businesses across California can accept crypto as payment for goods and services, with such transactions recognized as legally valid.

Public entities are barred from restricting or taxing digital assets solely because they are used as payment.

The legislation also ensures that Californians can freely store their digital assets using hardware or self-hosted wallets without interference.

AB 1052 introduces a firm line on ethical conduct by banning public officials from promoting or sponsoring digital assets in ways that present conflicts of interest.

This move is designed to enhance trust in how government engages with emerging financial technologies.

Another key provision addresses unclaimed digital assets. If a crypto account remains inactive for over three years, the assets may escheat to the state.

In such cases, holders must transfer the digital property and its private keys, if available, to a qualified custodian designated by the state controller by 2027.

Dennis Porter, CEO of Satoshi Action Fund, emphasized the bill’s broader implications, stating, “If Bitcoin Rights passes here, it can pass anywhere.”

Aligning with a national shift

California joins states like Texas and Kentucky in passing pro-Bitcoin legislation, as crypto-friendly bills reach nearly 100 across 35 states.

The bill’s clarity around digital asset rights may also attract further institutional interest to California, home to Ripple, Solana Labs, and Kraken.

Bitcoin price update

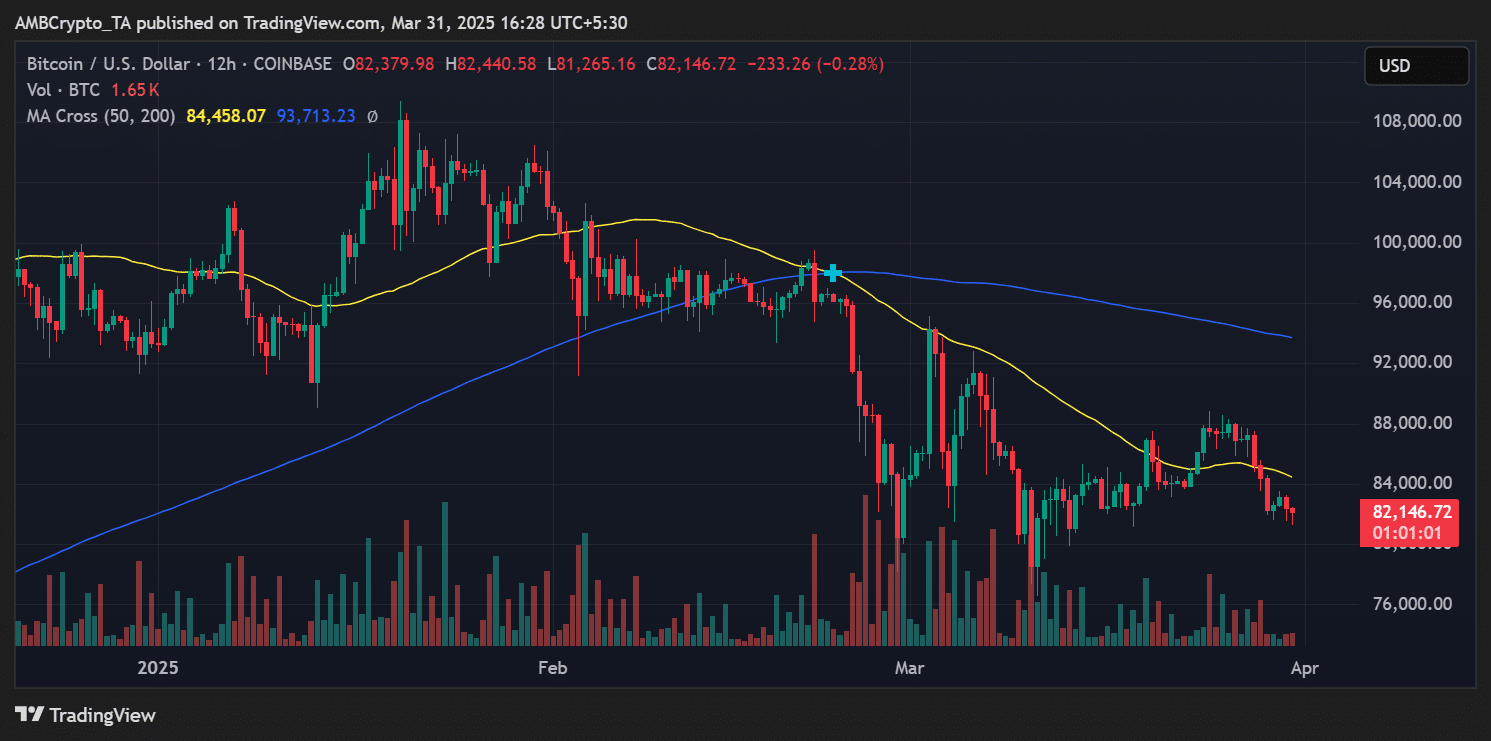

Bitcoin traded just above $81,400 at press time, slipping 1.3% in the past 24 hours.

While price action remains choppy following last week’s peak of $83,500, institutional sentiment appears strong as legislative clarity grows across key U.S. markets.