Can Avalanche [AVAX] return huge gains? Here’s what to know

![Avalanche [AVAX]](https://ambcrypto.com/wp-content/uploads/2024/08/ABDUL-WEBP-1200x686.webp)

- In the long term, Avalanche is poised to potentially trade above $100, as historical trends indicate.

- This expected rally could be driven by the forthcoming final AVAX token vesting unlock on August 20th.

Avalanche [AVAX] is still recovering from a market-wide slump that drove its price down to $17.29 — a low not seen since November 2023.

As of now, AVAX has registered a 2.05% increase in its price, now at $21.07, with its market cap rising to over $8.2 billion. Its trading volume has also jumped by 30%, signaling readiness for a rally.

AVAX Prepares for a surge to $100

Crypto analyst Kaleo highlighted the strengthening ETH/BTC ratio as a precursor for layer 1 (L1) EVMs like Avalanche to gain momentum, setting the stage for a rally.

The ETH/BTC ratio indicates Ethereum’s [ETH]performance compared to Bitcoin [BTC]. An increase in the ratio suggests that Ethereum is appreciating faster than Bitcoin, or Bitcoin is depreciating while Ethereum remains stable or grows.

This change hints at market momentum and interest, potentially making Ethereum, and by extension Ethereum-compatible platforms like Avalanche, more attractive to investors.

In a chart, Kaleo noted that AVAX is at a historical crossroads similar to the one seen before the 2021 rally that pushed it to a peak of $147.

In the words of the analyst,

“Pump to start the year, bleed off, send to $100+.”

While technical patterns signal an optimistic outlook, Kaleo also mentioned a significant fundamental catalyst that might aid this rally to the forecasted region.

He wrote,

“The final major AVAX token vesting unlock (9.45M AVAX / ~$200M) happens August 20th. After this one, there are no new tokens left to distribute to team and strategic partners.”

This final unlock is seen as a bullish indicator, signaling maturity and stability in Avalanche’s distribution strategy.

It boosts investor confidence and can stabilize the token’s price by preventing sudden surges in available supply.

While Kaleo’s view on AVAX is optimistic, AMBCrypto has examined other fundamental indicators.

Fundamental outlook on Avalanche

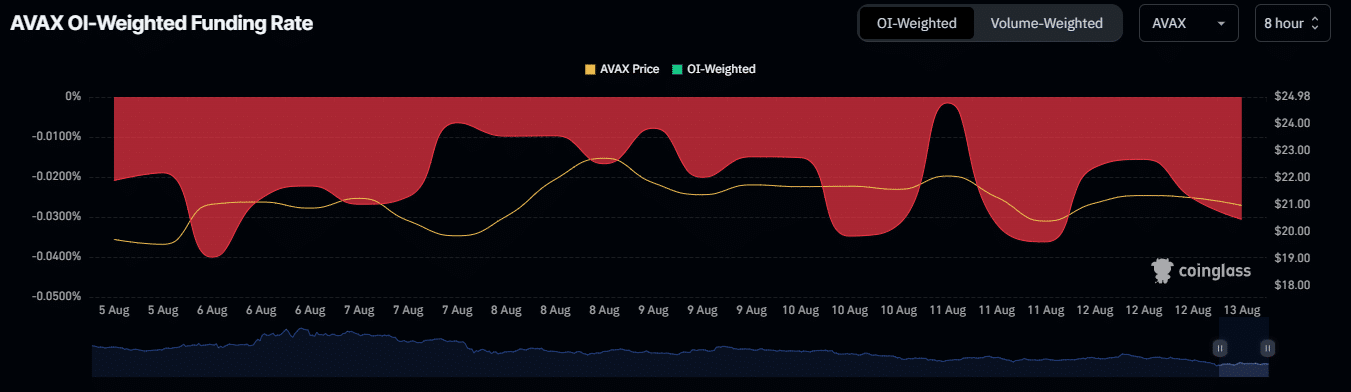

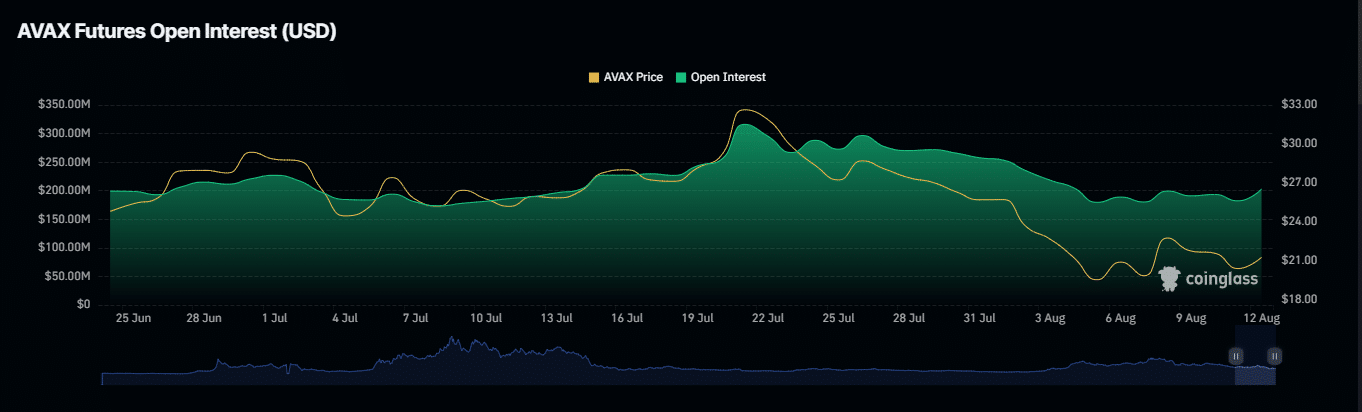

On the fundamental side of Avalanche, AMBCrypto examined its open interest and OI-weighted Funding, which showed mixed signals in the market at the time of writing.

On the one hand, the OI-weighted Funding Rate has been predominantly negative since August began, at -0.0306% at press time.

A predominantly negative OI Funding Rate indicates bearish sentiment, as it means short position holders are paying fees to long position holders, expecting the asset’s price to decrease.

On the other hand, the Open Interest has been on a notable rise in the past few days, since the 5th of August when AVAX traded at its 2024-low.

Is your portfolio green? Check out the AVAX Profit Calculator

Until press time, the Open Interest has seen an 8.14% increment, valued at $202.11 million.

An increase in Open Interest generally signifies new money entering the market and higher participation, which can lead to greater liquidity and a potential price increase.