Can Bitcoin be independently bullish or bearish for once?

Indecisiveness is the current market sentiment for Bitcoin. While some metrics indicate that a 2nd bullish rally might be incoming, other factors are suggestive of further corrections. With Bitcoin continuing to consolidate in the mid-$30k range, the reset of certain metrics and accumulation activity might project a potential change in the crypto’s price.

Grayscale is squeezing out BTC supply

According to a recent Glassnode insights report, Grayscale has continued on its acquisition march, amassing over 40,000 BTC since the start of 2021. What is even more interesting and important here is that only 26,000 BTC were mined over the same period.

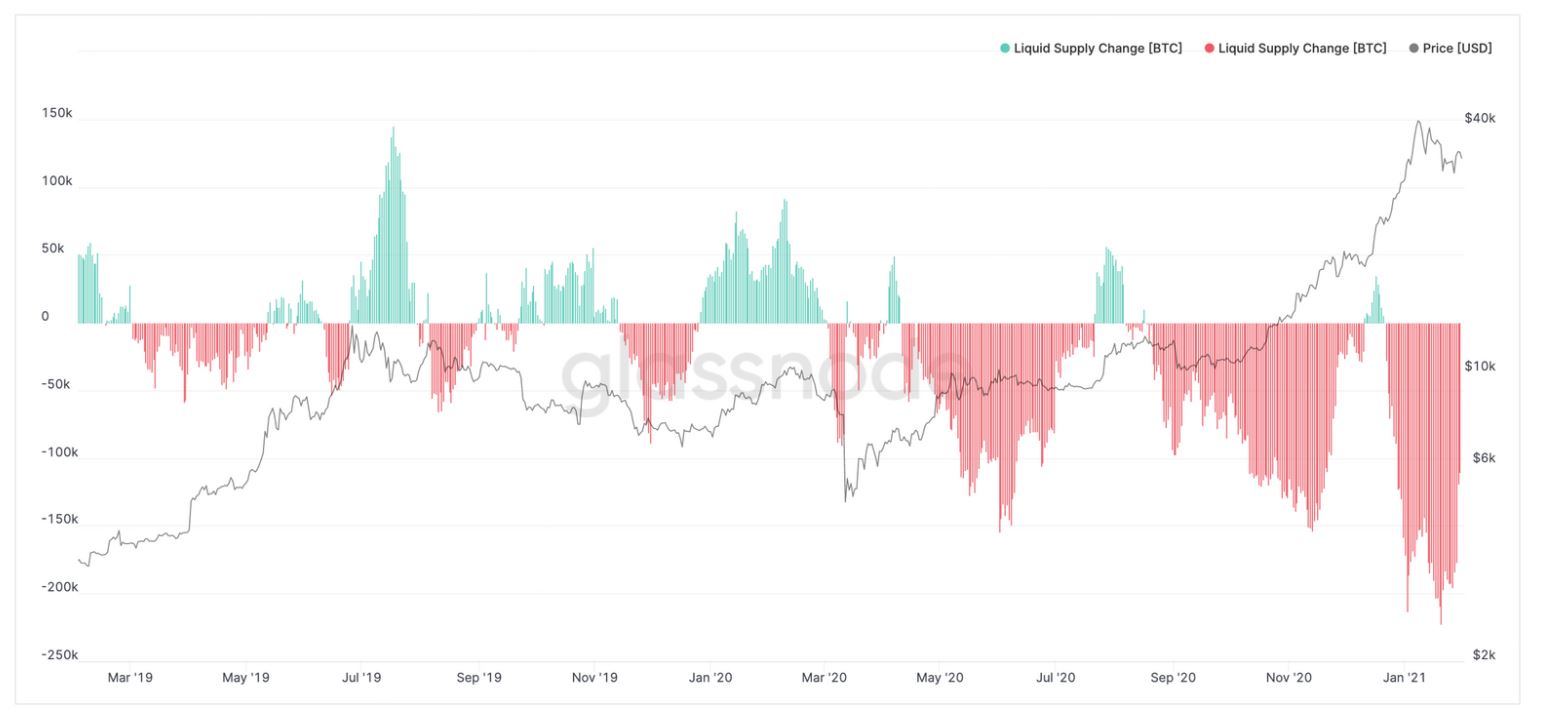

Such activity continues to dry up the active supply for Bitcoin, making it less and less available in the market. However, since more stablecoins are getting minted, BTC’s Stablecoin Supply Ratio has dropped as well.

A low SSR is relative to the number of stablecoins available for Bitcoin, therefore it is always ready to flow directly into Bitcoin’s market. This keeps the bullish narrative open, and Grayscale’s actions do not shy away from the fact that BTC’s liquidity is completed drained as well.

Hence, even though stablecoins are ready to inject momentum into Bitcoin, the largest investments from Grayscale are already taking out the liquid Bitcoin supply.

Can Bitcoin be independent for once?

The idea of Bitcoin’s liquidity was popularized in 2020 when active supply started to flow out of centralized exchanges. The bullish narrative came to be only later after the price registered a massive spike on the price charts.

Regardless, the liquidity and the status of Bitcoin as an investment asset are possibly independent of each other. Ben Caselin, Head of Strategy and Research at AAX exchange, recently spoke to AMBCrypto on the subject,

“It is a continuous cycle. Most of the illiquid supply in the space is due to long-term holdings and when they end up selling their allocations, new investors absorb the selling pressure. A rising or dropping liquid supply of BTC does not take away its potential as an investable asset.”

The rationale behind the statement is solid since Bitcoin is an independent asset, and rising liquid supply would not mean a drop in valuation. Therefore, increasing illiquid supply may or may not be bullish. Here, the question of what is deemed by the larger majority to be outrightly bullish is up for debate, however.

For once, it is important to consider if Bitcoin develops its characteristics based on organic demand and potential, other than just on-chain differences.