Can Bitcoin [BTC] capitalize on Ordinals’ latest achievement

![Can Bitcoin [BTC] capitalize on Ordinals’ latest achievement](https://ambcrypto.com/wp-content/uploads/2023/05/BTC-1.png)

- The increase in Ordinals fees caused a surge in miners’ revenue.

- However, metrics for BTC were bearish, suggesting a further price decline.

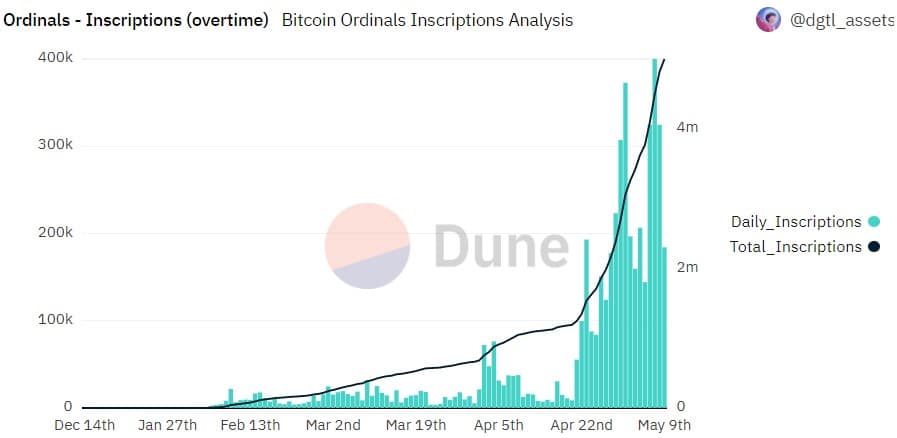

Bitcoin [BTC] Ordinals is creating new milestones every other day. Recently, the number of daily inscriptions reached a new all-time high.

As per Dune’s data, the number of daily Ordinals inscribed exceeded 400,000 on 7 May, pushing the total Ordinals inscribed to date to over 5 million.

Is your portfolio green? Check the Bitcoin Profit Calculator

During the initial days of Ordinals’ launch, image type Ordinals had the highest market share. However, later things changed as at the time of writing, text-type ordinals dominated.

Miners are enjoying the episode

While the daily number of inscriptions hit a new all-time high (ATH), Ordinals fees paid overtime also followed the same track and set a new record on 8 May.

On the other hand, as per Glassnode, miners’ revenue skyrocketed in the last few days as evident from the massive spike on the chart.

Nonetheless, the number of miners declined during that period as BTC’s hashrate fell significantly. But it was interesting to note that at press time, BTC’s hashrate had gained upward momentum.

BTC failed to act in the right fashion

BTC, however, has failed to capitalize on Ordinals’ achievements as its price action has remained pretty dormant. According to CoinMarketCap, BTC was down by more than 1% in the last 24 hours. At the time of writing, it was trading at $27,704.83, with a market capitalization of over $535 billion.

A possible reason for this decline can be the FUD surrounding Bitcoin, which can be attributed to Binance. There was an outflow of 117,359 BTC, and an inflow of 10,036 BTC, followed by an additional outflow of 40,184 BTC.

Due to these transactions, many assumed that Binance was liquidating its Bitcoin holdings, thus, propelling negative sentiments in the market.

Metrics remain bearish on Bitcoin

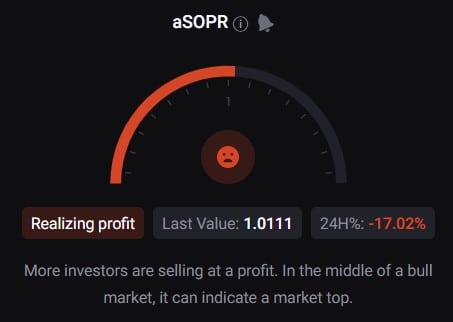

CryptoQuant’s data revealed quite a few metrics that suggested the downtrend could go on for a bit longer.

For instance, BTC’s net deposits on exchanges were high compared to the last seven days. This was a negative signal as it indicated higher selling pressure. BTC’s aSORP was also red, suggesting that more investors were selling at a profit.

Read Bitcoin’s [BTC] Price Prediction 2023-24

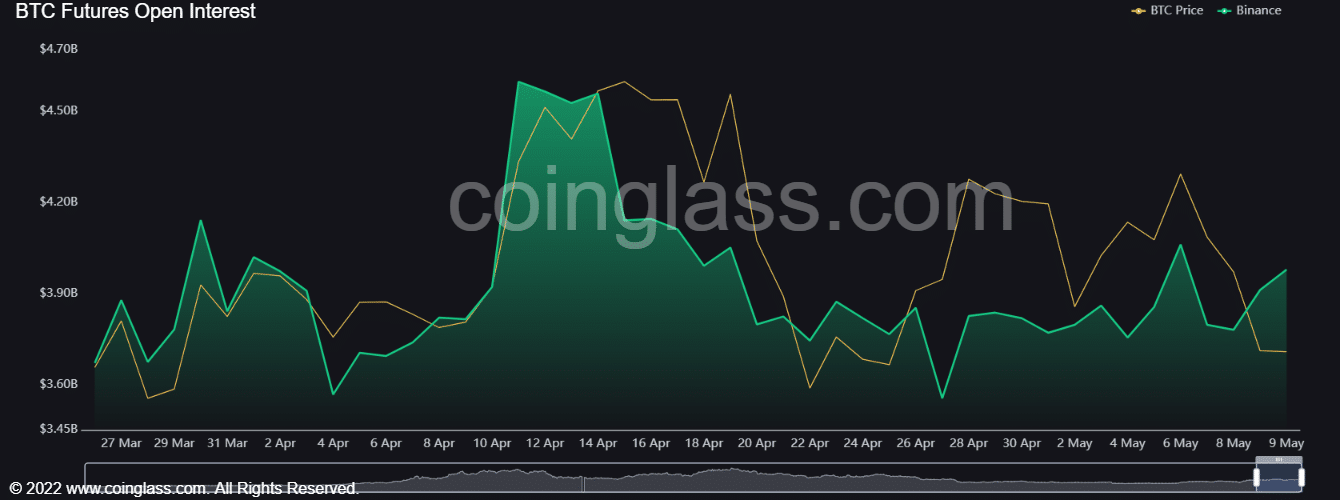

According to Coinglass, BTC’s open interest increased over the few days. An increase in open interest means that new or additional money is coming into the market, which suggests that the ongoing price trend might continue.