Can BNB bulls defend the range lows once again

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

A recent report highlighted that even though Binance Coin clung to the support level at $300, all was not well in terms of investor sentiment. Analysis of the higher timeframes such as the daily showed the market bias has been bearish since late April.

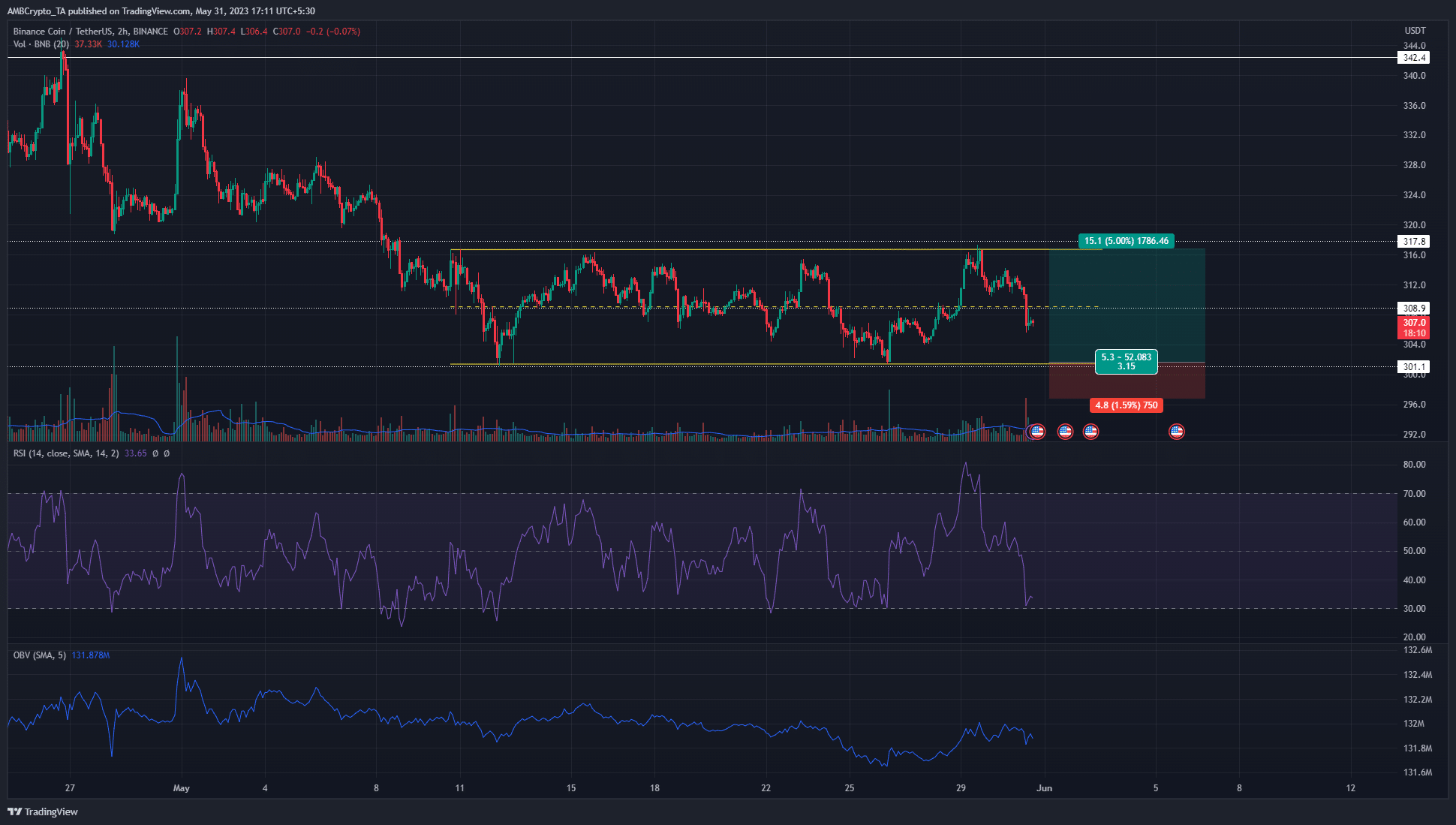

In the past three weeks, the price of Binance Coin has hovered above the $300 mark and has formed a range on the price charts. Traders can look to exploit this range for profits. But will the buyers succeed in forcing another bounce in prices?

Wild swings in short-term momentum but the range was clear as day

The RSI fluctuated from 70 to 30 and back multiple times over the past week. During this time the price of Binance Coin oscillated between $315 and $301. The range, marked in yellow on the charts above, extended from $316.7 to $301.4.

The midpoint of the range at $309 has served well, acting as both support and resistance. At the time of writing, it was resistance, and further short-term losses were likely. The RSI showed a value of 33 to signify strong bearish momentum.

However, the OBV has climbed higher over the past few days. After 25 May, the OBV made a series of higher lows to highlight some buying pressure behind BNB.

It was unlikely that this demand could force a breakout past the range, but a bullish Bitcoin in June could vastly change the outlook.

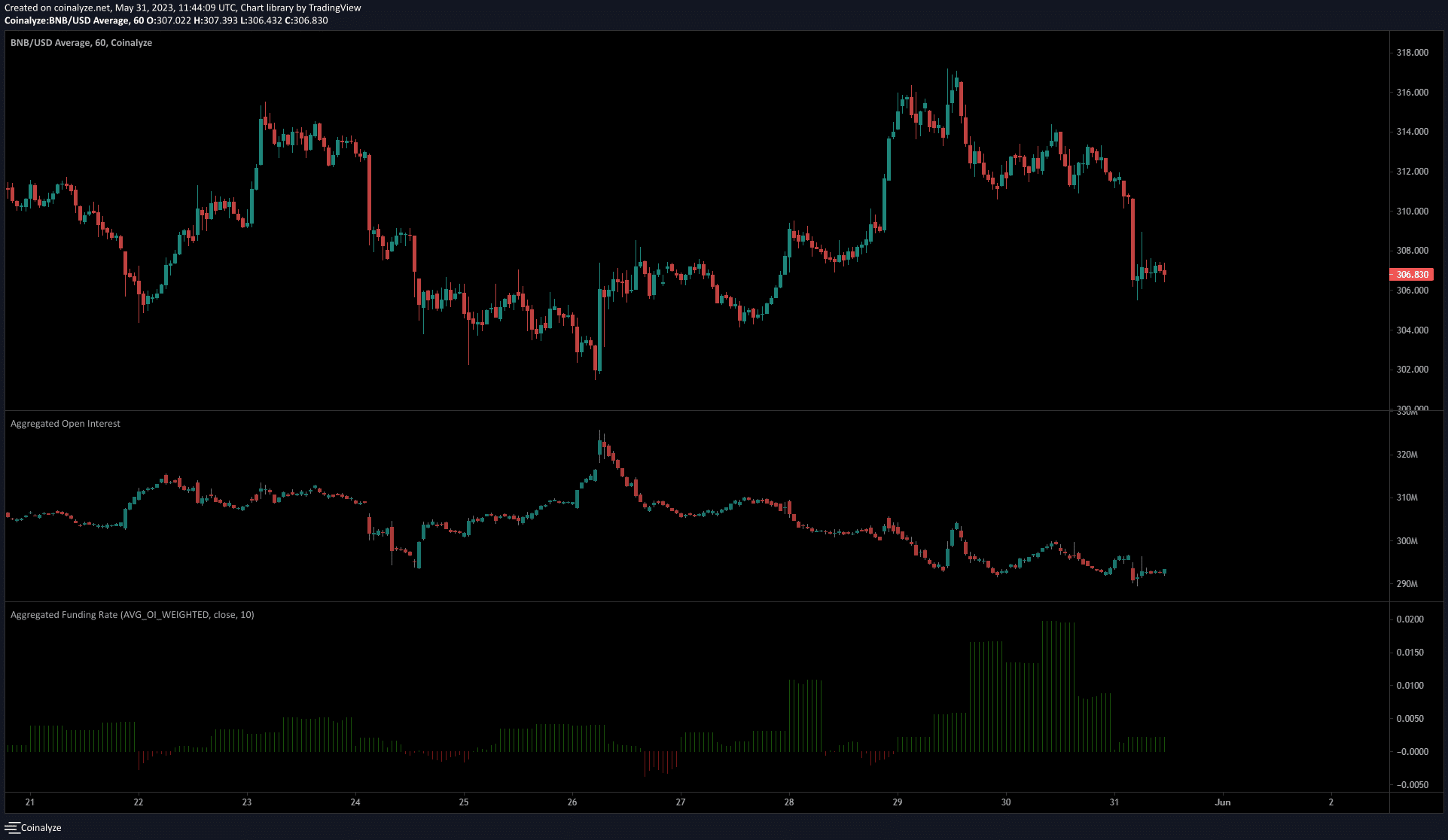

The Open Interest underlined bearish sentiment in the market

Source: Coinalyze

While the OBV crept higher in recent days, the Open Interest was in a steady decline. The funding rate also fell over the past 48 hours, although it remained in the positive territory.

The funding rate slipped below zero on 28 May but recovered quickly. This meant participants hedged short on BNB contracts when the asset climbed to the $310 mark.

Realistic or not, here’s BNB’s market cap in BTC terms

Bulls would also be concerned about the steady downtrend seen on the Open Interest chart since 26 May.

Even though Binance Coin bounced to the range highs at $316, the OI saw only a minor move upward that measured $10 million. This indicated discouraged longs and a prevalent bearish sentiment in the market.