Can BNB bulls defend this psychological support zone? Gauging…

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The H4 structure was bearish, but the confluence of support just beneath could initiate a rally.

- This event could be heavily dependent on Bitcoin.

Tether’s [USDT] dominance fell from 8.24% on 11 March to 6.6% on 17 March. During this period, Bitcoin [BTC] and altcoins like Binance Coin [BNB] registered enormous gains, as investors moved funds from the stablecoin back into crypto assets.

How much are 1,10,100 BNBs worth today?

The markets have not been as bullish in the past few days. With Bitcoin near the $29.2k resistance, speculators and investors could be sidelined in expectation of large volatility after compression on the lower timeframes. Can Binance Coin hold on to a psychological support level if the market turns tumultuous?

The confluence of support at the $300 region will be attractive to the aggressive buyer

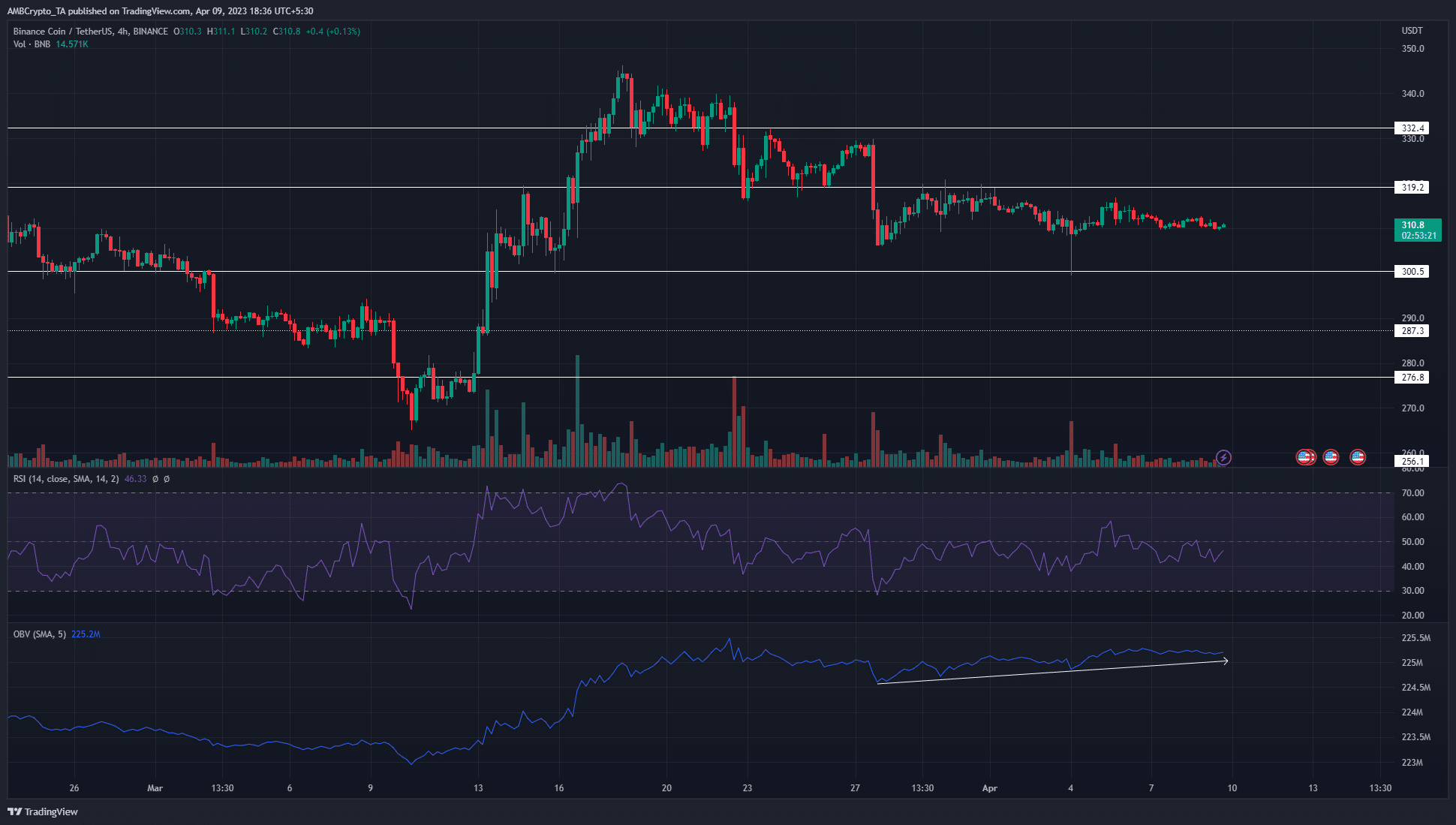

The four-hour chart showed Binance Coin in a downtrend after the rally to $330 in March. This was only a pullback after the large rally from $260 in early March, but the structure was bearish on H4. The RSI also showed bearish momentum and had a slight edge.

Yet, the uptrend on the OBV indicated a healthy demand behind BNB. Moreover, the $300 mark is a round-number psychological line of defense for the bulls. It served as resistance for a good part of January and was flipped to support in February. At the time of writing, it was a support level once more.

The higher timeframe charts showed that the $300 and $320 levels have been important in the months of August, September and October 2022, and further back in the past as well. Hence, aggressive buyers can use a move into the $300-$305 to bid BNB. However, if the price slides below the $300 level, it will be likely to slide lower to $291 and $276.

Realistic or not, here’s BNB’s market cap in ETH’s terms

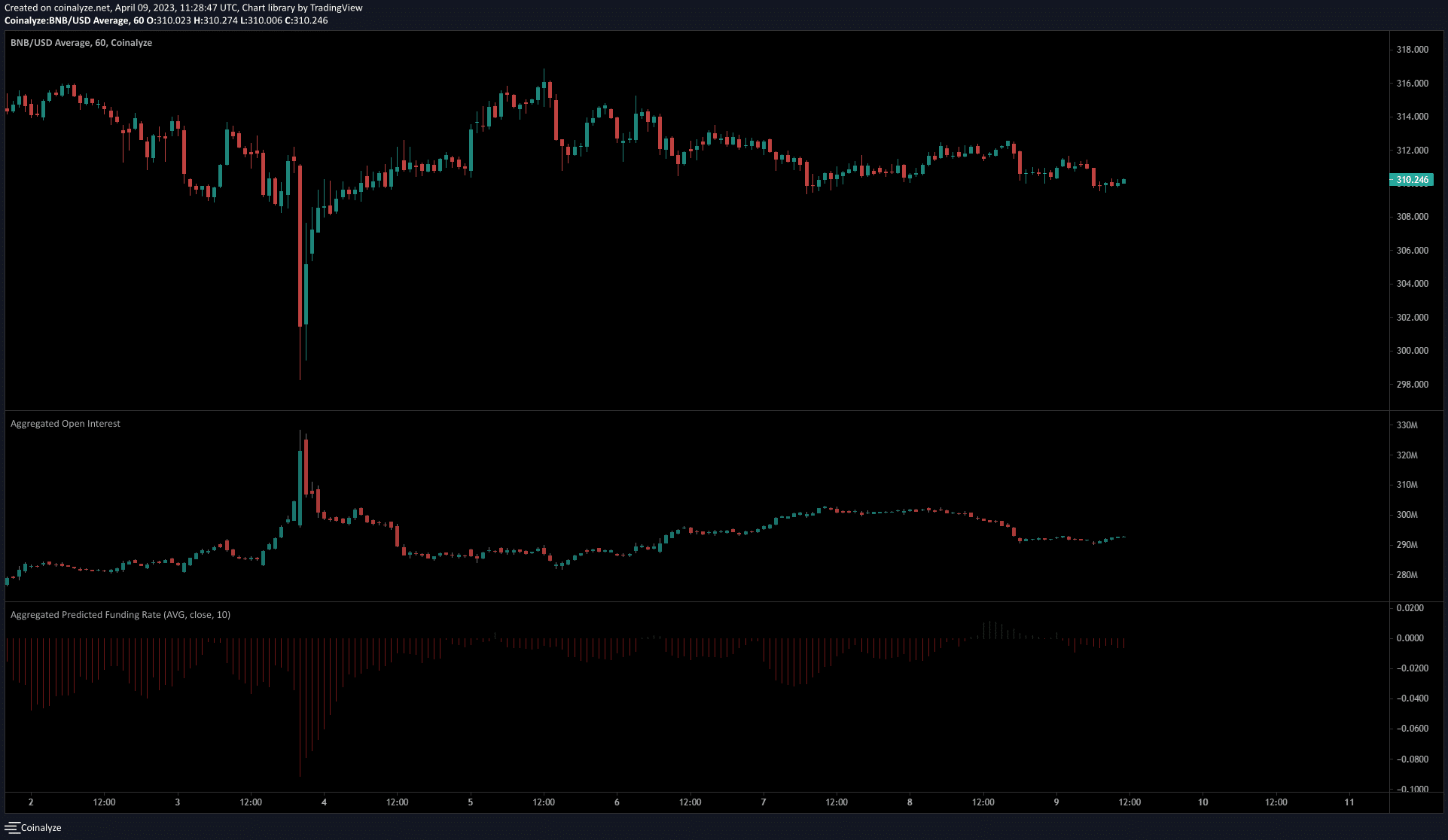

The Open Interest showed bearish sentiment was prevalent

Source: Coinalyze

The funding rate was negative and showed long positions paid funding fee to the short positions. This was another way of saying the bears were in the majority. Moreover, the one-hour chart above showed Open Interest rising on 5 and 6 April, when BNB prices were in decline.

This highlighted strong bearish sentiment behind the exchange token, as speculators were likely entering short positions during the times when the prices fell. Therefore, a plunge in BTC prices and a shift in sentiment across the market could plunge BNB quickly below $300.