Can Cardano find its footing after ADA’s 10% drop?

- Developments on Cardano returned to its peak.

- ADA’s price fell by almost 10% and might slip below $0.60.

According to IntoTheBlock, Cardano [ADA] has again thumped other Layer-1 blockchains to the top spot in development activity. Interestingly, the project achieved this landmark despite Fear, Uncertainty, and Doubt (FUD) around Hydra.

Hydra is Cardano’s scaling solution whose aim is to lower the cost of processing transactions on the network. However, AMBCrypto reported on the 18th of March that co-founder Charles Hoskinson had addressed the matter.

The surge in development activity means that developers trusted Cardano’s ability to ship out new features regardless of the controversy.

Universal healing on the network

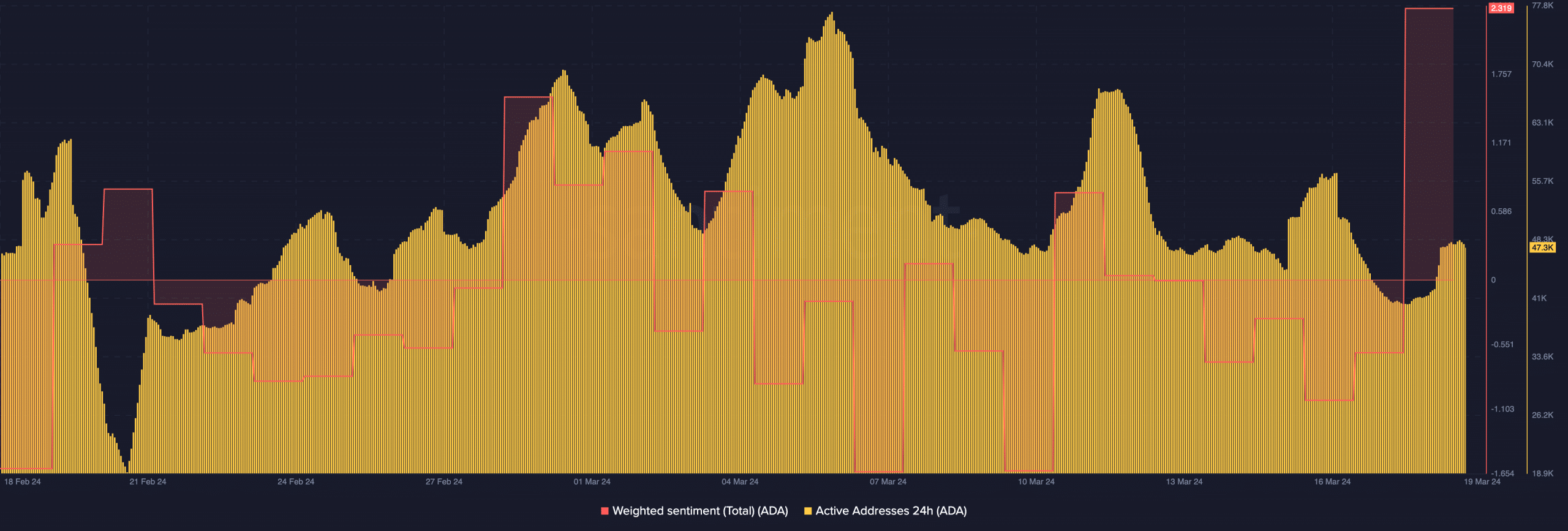

But did the same occur in other parts? At press time, we evaluated the user activity on the network using Santiment’s data.

According to our analysis, the 24-hour active addresses were 36,900 on the 16th of March. But as of this writing, the number had changed and increased to 47,300.

The increase was a bullish signal. The Weighted Sentiment was another vital metric AMBCrypto looked at. For context, Weighted Sentiment, measures the positive/negative commentary about a project on social platforms.

If the reading is negative, it means market participants are bearish on the project. However, Cardano’s Weighted Sentiment rose as high as 2.319.

Though this positive sentiment suggests trust in the network, it might not be a bullish sign for ADA. Sometimes, a reading like this drives investors to buy assets as prices might jump later.

The plunge might be harder

But in ADA’s case, the sentiment was too high, indicating that it might have hit a local top. At press time, ADA’s price was $0.62. This value represented a 9.89% decrease in the last 24 hours. Going by the state of the metric above, the value could decline further.

However, a breach below $0.60, could see ADA bounce and retest $0.70. How about its Total Value Locked (TVL)?

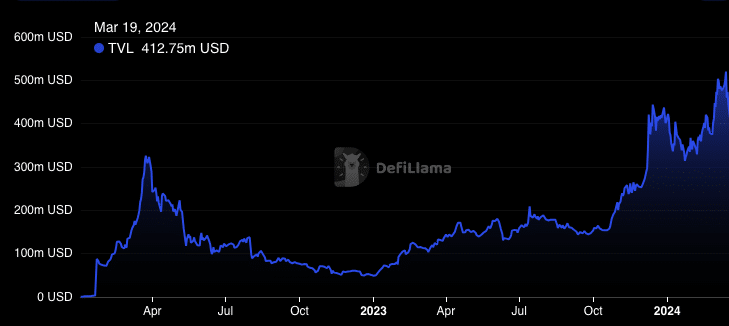

According to DeFiLlama, Cardano’s TVL dropped by 6.86% in the last 24 hours. The TVL is an indicator of a protocol’s health. When it increases, it means that participants have decided to deposit and lock more assets into the chain.

Most times, this is a sign of trust to gain better yield. Therefore, the recent decrease which pulled the metric down to $415.74 million, implies that players were taking out their liquidity.

This could either be a cautious approach or because the protocol has not produced the expected yield.

Is your portfolio green? Check the Cardano Profit Calculator

In the meantime, Cardano’s quick resolution to the FUD might entice some participants to hold ADA. However, the price of the cryptocurrency might not recover within a short while.

Should the widespread market correction continue through the week, ADA’s value might slip as low as $0.55. However, the long-term predictions for the project might remain bullish.