Dogecoin

Can Dogecoin replicate its 2021 bull run? Key metrics suggest…

Though the price remains 84% down from its highs, data shows it can break the ATH.

- Activity on Dogecoin was low, but mirrors the start of 2021’s run to its ATH.

- The price of the coin might hit $0.13 following an increase in money flow.

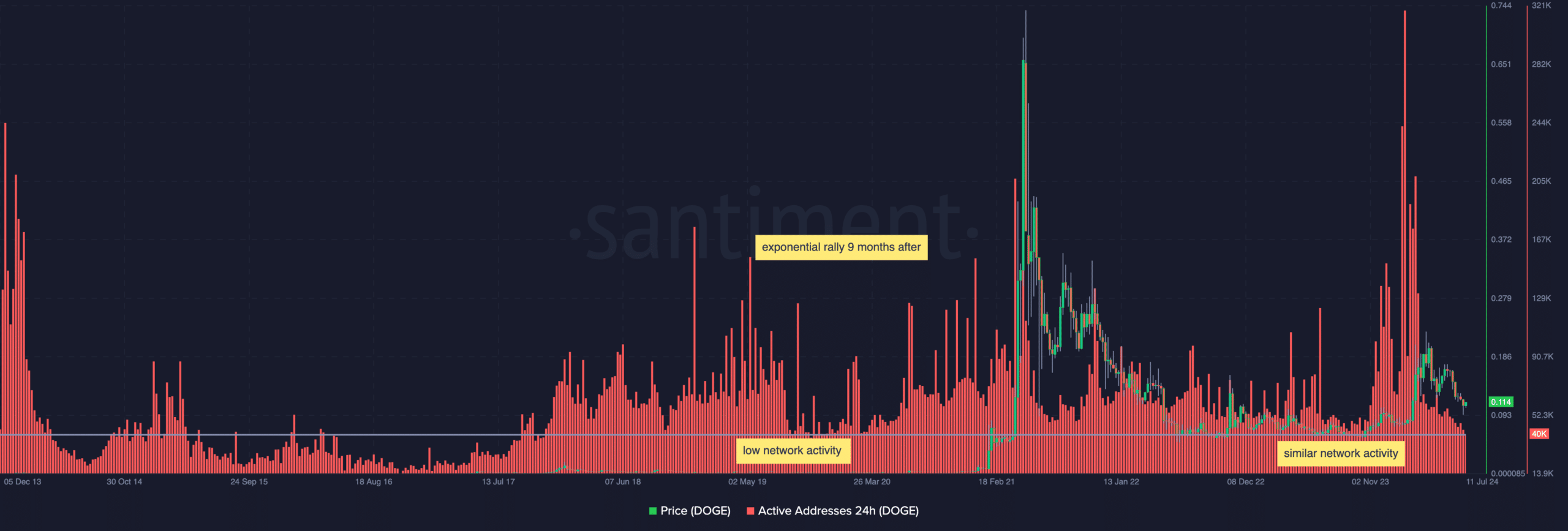

Something intriguing has happened with Dogecoin [DOGE], and market participants should watch this. According to AMBCrypto’s analysis, the memecoin’s 24-hour active addresses was down to 40,000.

Using data provided by Santiment, it was found that this was the same level of network activity that was recorded in March 2020. Nine months after this, Dogecoin began a run that took the price from $0.01 to $0.65 between January and May 2021.

Will it take some months for DOGE to breakout?

In the crypto market, history does not necessarily repeat itself. However, pattern often rhymes. If this historical pattern were to repeat itself, then DOGE could being to move toward an parabolic rally that could begin in March or April 2025.

However, there is also a chance that the price increase might start before the aforementioned period.

As of this writing, DOGE’s price was $0.11. This was a 62.36% increase in the last 365 days. Despite the increase, Dogecoin remained 84.56% down

from its All-Time High (ATH).If a similar situation occurs, the price of the coin might break the ATH before the cycle. However, one other indicator is the coin’s 200-day EMA.

EMA stands for Exponential Moving Average, and measures trend direction over a period of time. At press time, the 200 EMA (yellow) was above the Dogecoin’s price.

Bulls want $0.13 first before going all in

If the price was above it, it would have meant that the bull run was in motion. Since it was below it, it implies that the potential surge has not begun. However, the price was on the brink of surpassing the 20 EMA (blue).

If successful, this could send the price of the coin to the upside. Furthermore, the Chaikin Money Flow (CMF) had risen above the signal line. The CMF tracks money flow into a cryptocurrency.

When it decrease, it means buyers are weak. Therefore, the recent increase implies that buying pressure has increased. If validated, this could spur Dogecoin on a 27.56% increase that takes it to $0.13.

This prediction was also validated by the Bulls and Bears indicators. This indicator shows if the 1% trading a cryptocurrency are buying a coin or selling. Bulls are those buying about 1% of the total volume.

Bears, on the other hand, are those selling about 1% of the total crypto volume. In the last seven days, there has been about 92 bulls and 89 bears.

Should bulls continue to outpace bears, the run to $0.13 might come to pass in the short term. In the long term, the DOGE to $1 predictions might become reality.

Realistic or not, here’s DOGE’s market cap in SHIB terms

However, market participants should be wary. If selling pressure increases, Dogecoin might retrace to $0.10.

However, irrespective of the short-term market condition, DOGE’s long-term potential looks bright.