Can Polkadot [DOT] break $5 after its falling wedge breakout?

- Polkadot’s breakout from the falling wedge signals potential trend reversal, with $5 as key resistance.

- Whale activity shows confidence, while balanced liquidations suggest cautious optimism ahead of a potential rally.

With Polkadot’s [DOT] upcoming upgrades like JAM v1.0 for decentralized computing, a 64-bit PVM upgrade, and Polkadot 2.0 targeted for 2025, there’s growing anticipation that these developments could drive a recovery phase.

DOT] was trading at $4.49, up 1.74% at press time. However, the bigger question remains whether this breakout can sustain and lead to a broader trend reversal.

DOT’s market overview

Polkadot has experienced an impressive increase in trading volume, up 58.26% to $139.24M.

This surge in volume signals growing interest, likely driven by excitement surrounding the network’s technological advancements.

Additionally, Polkadot’s market cap rose by 1.78%, reaching $6.78B. Therefore, the market shows clear optimism, but the next steps in price action will confirm whether this breakout holds.

Is $5 the next stop?

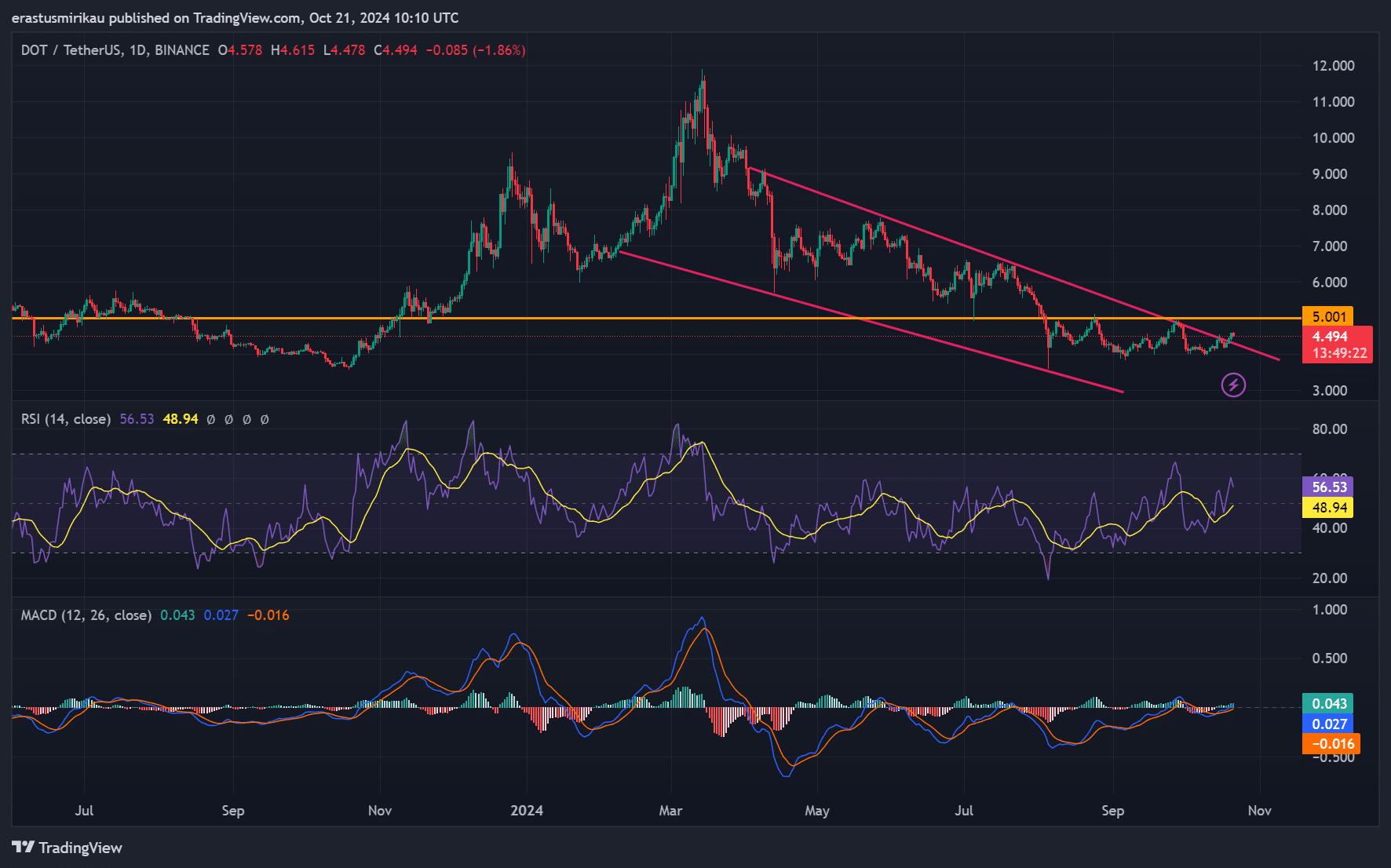

The breakout from the falling wedge, a bullish technical pattern, indicates a potential end to Polkadot’s prolonged downtrend. Priced at $4.49 at press time, DOT faces the next key hurdle – the $5.00 resistance level.

If Polkadot can break above and hold this level, a new bullish cycle could be triggered. However, failure to do so might lead to consolidation, or even a price reversal.

On the technical side, the RSI is currently at 56.53, suggesting neutral-to-bullish momentum. Furthermore, the MACD shows a bullish crossover, indicating that momentum could support further upward movement.

Are the big players backing DOT?

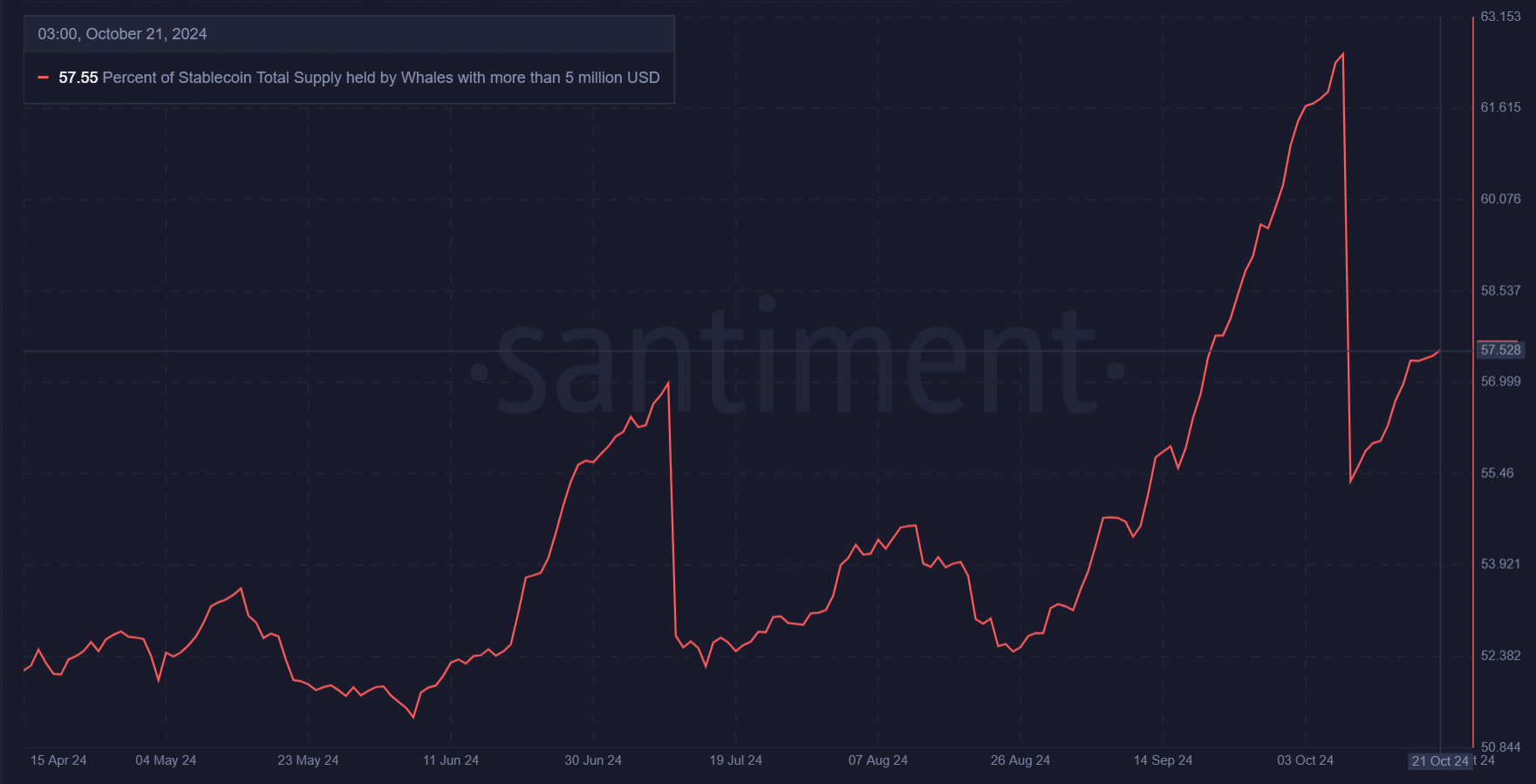

Whale activity reflects strong market sentiment. 57.55% of the stablecoin supply is controlled by whales holding more than $5 million, showing that large investors maintain confidence in DOT’s long-term outlook.

Tthis suggests bullish sentiment from influential holders, likely supporting a sustained recovery.

Liquidation analysis: Shorts at risk?

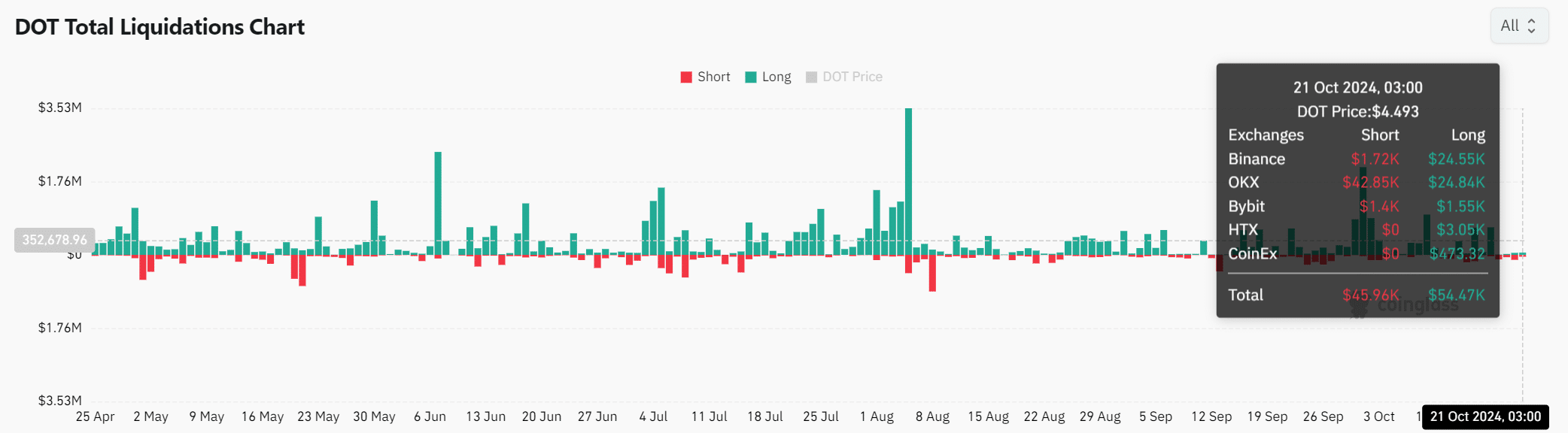

Polkadot’s liquidation chart reveals $45.96K in shorts were recently liquidated, compared to $54.47K in longs. This balanced liquidation activity suggests cautious market sentiment.

However, if the price breaks past $5.00, we could see a surge in short liquidations, further fueling the upward trend.

Read Polkadot [DOT] Price Prediction 2024-2025

Will Polkadot break the $5 barrier?

Polkadot’s breakout from its falling wedge, combined with increasing trading volume and strong whale activity, signals a potential trend reversal.

With upcoming upgrades adding to the bullish momentum, DOT is well-positioned to break the $5.00 resistance level. If it successfully does so, a sustained upward trend could follow.