Can ETH’s Shanghai upgrade wash away the disappointment of this latest setback

- Ethereum suffers a setback after malicious validator successfully executes attack leading to millions of stolen coins.

- ETH stuck in limbo as bulls and bears reach stalemate, but a breakout and breakdown might be on the cards.

It has been a while since the Ethereum [ETH] network experienced a successful malicious exploit. Nevertheless, new reports revealed an attack on the network, through which the malicious attacker made off with a large loot. The attacker managed to steal a substantial amount of ETH by interfering with MEV bot transactions.

Is your portfolio green? Check out the Ethereum Profit Calculator

MEV stands short for maximum extractable value and is a system that miners and other participants use to determine profit. This is based on the order in which transactions are recorded on each block.

Initial reports claimed that the malicious validator stole roughly $25 million by invalidating MEV bot transactions and inserting their own counterfeit transactions.

There may be malicious Ethereum verifiers who attack some MEV Bots transactions in the block, invalidate the MEV Bots transactions and replace them with their own transactions. Related MEV Bots have lost about $25 million. The attacker has become a validator 18 days ago…

— Wu Blockchain (@WuBlockchain) April 3, 2023

Reports also suggested that the malicious actor responsible for the attack became a validator as recently as 18 days ago. The attacker reportedly secured the funds and relevant tokens to execute the attack from the Aztec privacy protocol.

Dusk for sandwich bots? A few top mev bots were targetted in blockhttps://t.co/tnlx5tAX1G@peckshield @BlockSecTeam @bertcmiller @samczsun @bbbb

— 3155.eth (@punk3155) April 3, 2023

Facing the tunes it seems

Although the funds lost in the hack represented a significant amount, it was only a fraction of the amount lost in the infamous Ethereum DAO hack.

However, the incident stood as a clear indication that the Ethereum network had serious work to do for ensuring the highest level of security to prevent such events from occurring again in the future. Concerns may also arise over how the event could affect the validators and the level of trust within the Ethereum ecosystem.

Additionally, such incidents often have a negative impact on the price of the underlying asset. A look at ETH’s price action revealed a relatively subdued price performance.

This meant the news of the malicious attack had so far, not pronounced an impact on the value of ETH. ETH was seen hovering between the $1,700 to $1,850 price range over the last few days.

A range exit could be in the works, so let’s look at what to anticipate depending on the outcome. The latest resistance level stood near the 0.786 Fibonacci level.

A bullish breakout could result in the next Fibonacci retest at the $2,055 price level. On the other hand, a strong bearish outcome may trigger a support retest bear the 0.618 Fibonacci level which may coincide with the $1,600 price range.

How many are 1,10,100 ETHs worth today

ETH holders should take note of…

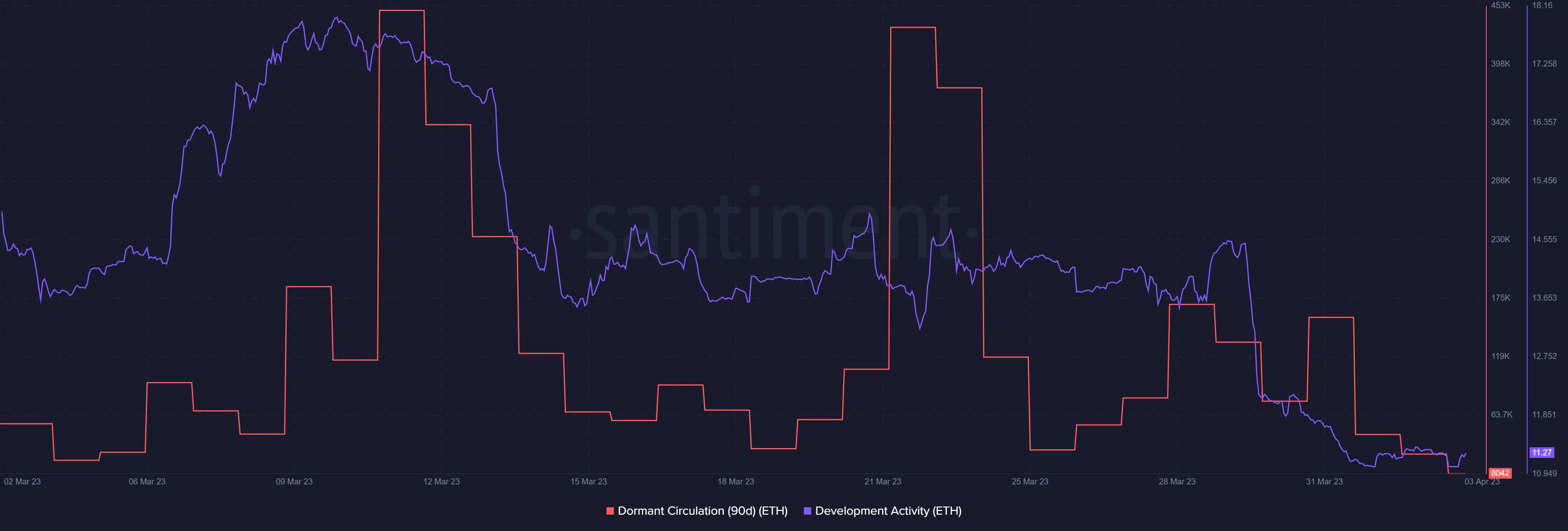

Some of ETH’s metrics underscored a lower confidence in the market. For instance, both the dormant circulation and development activity metrics were at their lowest four-week levels at press time.

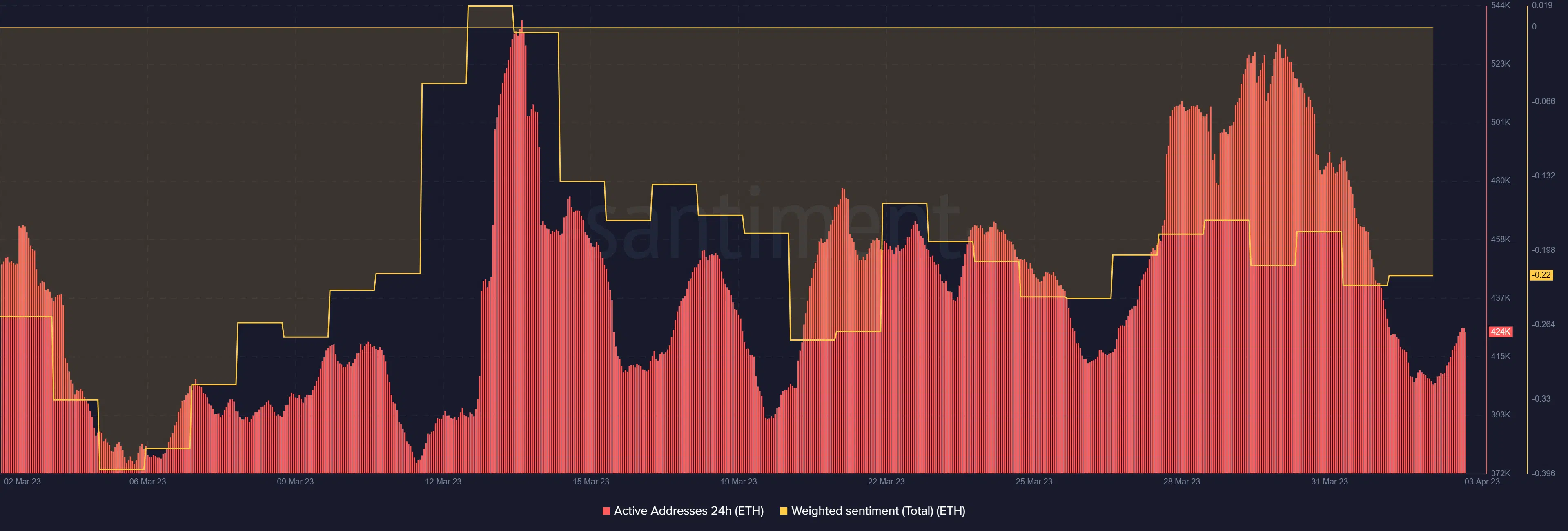

Furthermore, ETH’s weighted sentiment also reflected the aforementioned observation considering that it witnessed a slight downfall since the start of April. This could be a sign that investors were switching to bearish expectations.

The sharp drop in daily active addresses also confirmed the market’s reaction after hitting a resistance wall.

The eventual outcome, however, would depend on a variety of factors such as a resurgence of bullish demand, or a massive sell off and the market’s overall outcome. But with the Shanghai upgrade around the corner, some excitement could be expected.