Can Floki’s rising open interest trigger a bullish breakout?

- Floki consolidates within a bullish pennant, approaches key resistance at $0.00017553.

- Positive technical indicators and rising open interest suggest strong market sentiment, indicating a potential breakout.

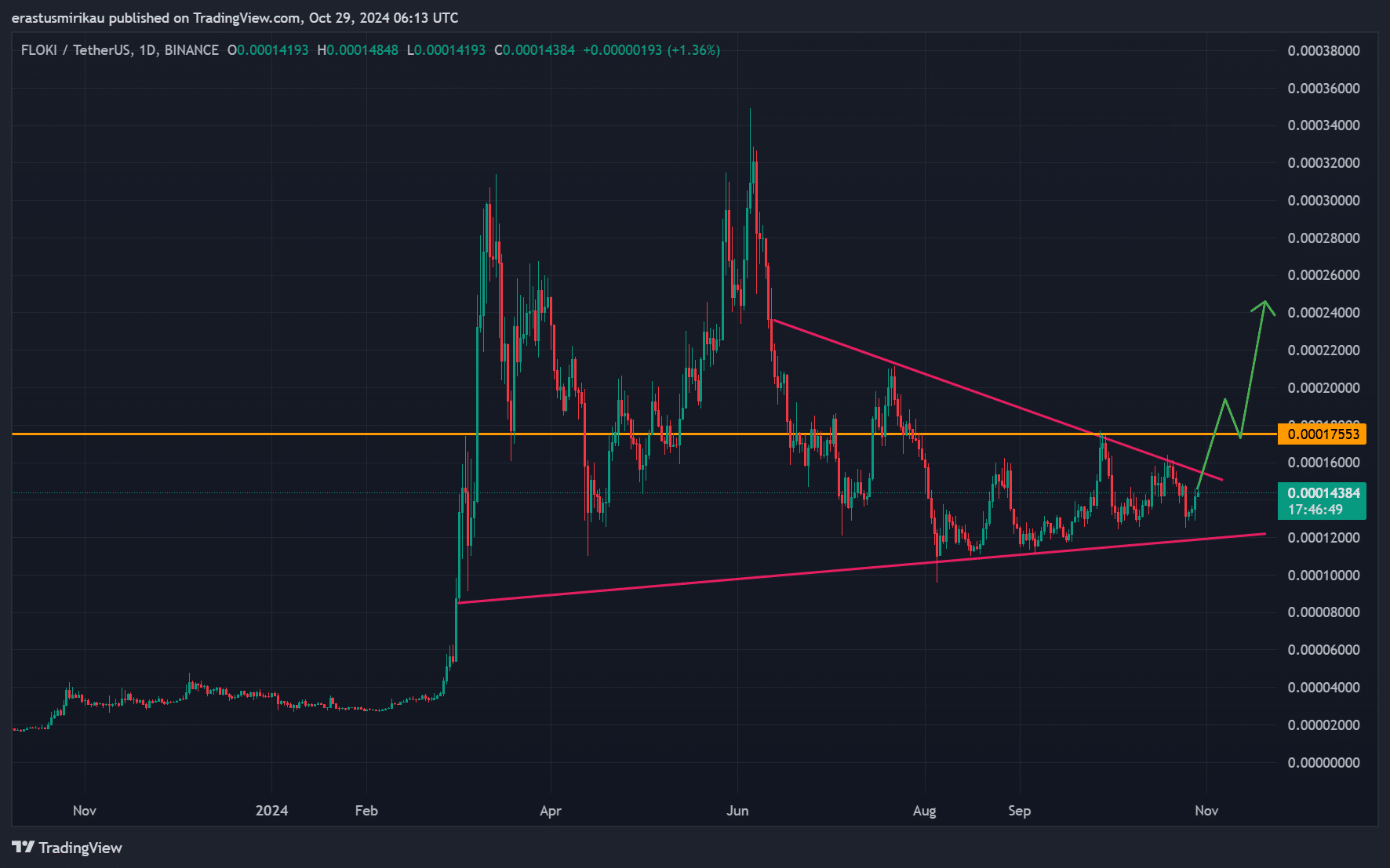

Floki [FLOKI] is consolidating within a tight range, forming a bullish pennant pattern as it approaches a key resistance level at $0.00017553. This crucial breakout point serves as a pivotal threshold for triggering a significant upward movement.

At press time, Floki was trading at $0.00014338, reflecting a notable 9.14% increase. Will the memecoin successfully breach this resistance and harness the bullish momentum to propel itself to new heights?

How does FLOKI technical analysis support a bullish outlook?

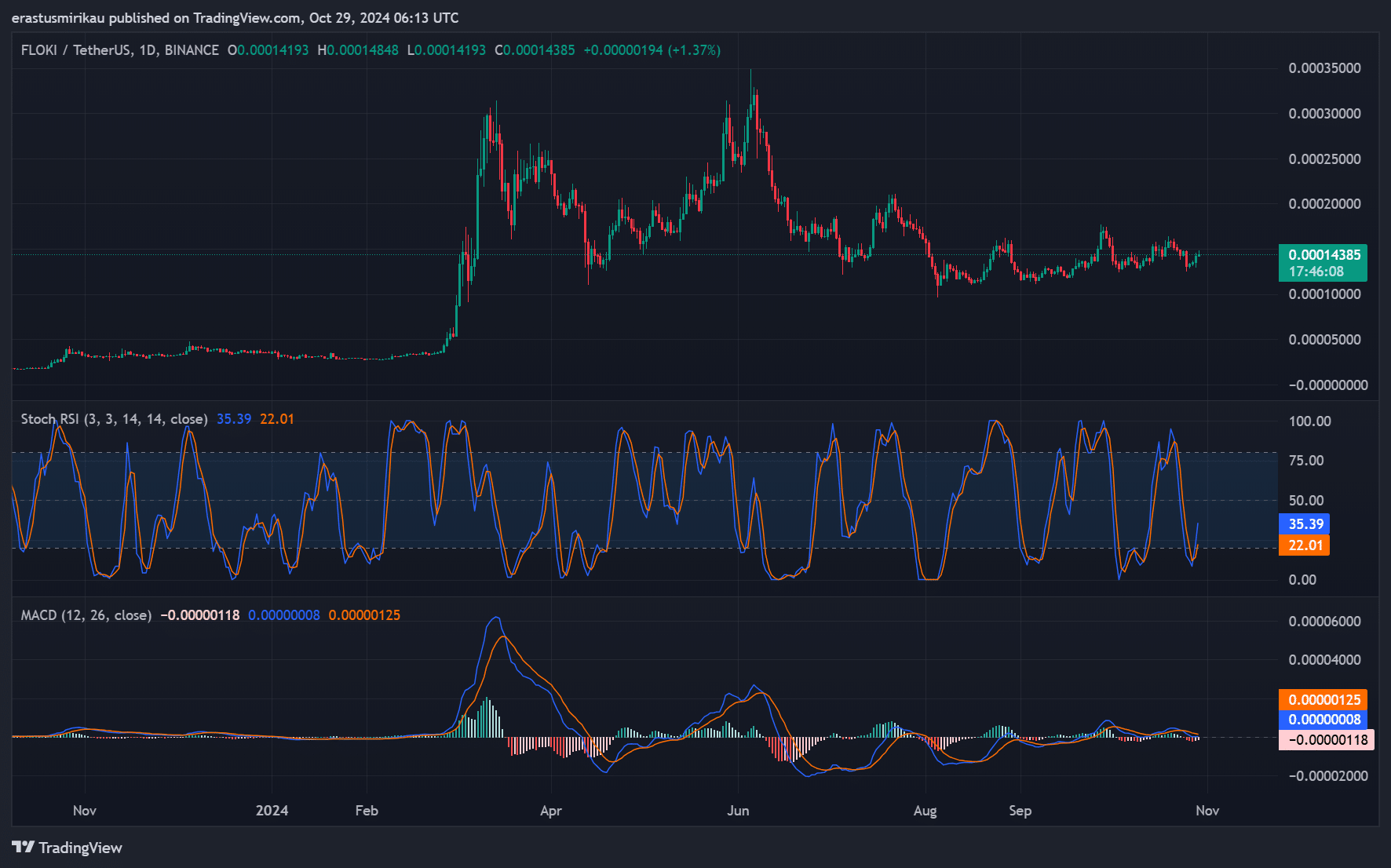

The technical indicators strongly support the case for a bullish breakout. The MACD (Moving Average Convergence Divergence) shows a bullish crossover, suggesting potential upward momentum.

Additionally, the Stochastic RSI sits at 22.01, indicating that Floki is approaching oversold territory. This positioning often precedes price rebounds, signaling that buyers may step in soon. Consequently, these technical signals suggest a growing likelihood of an upward breakout.

What does the MVRV ratio reveal about market sentiment?

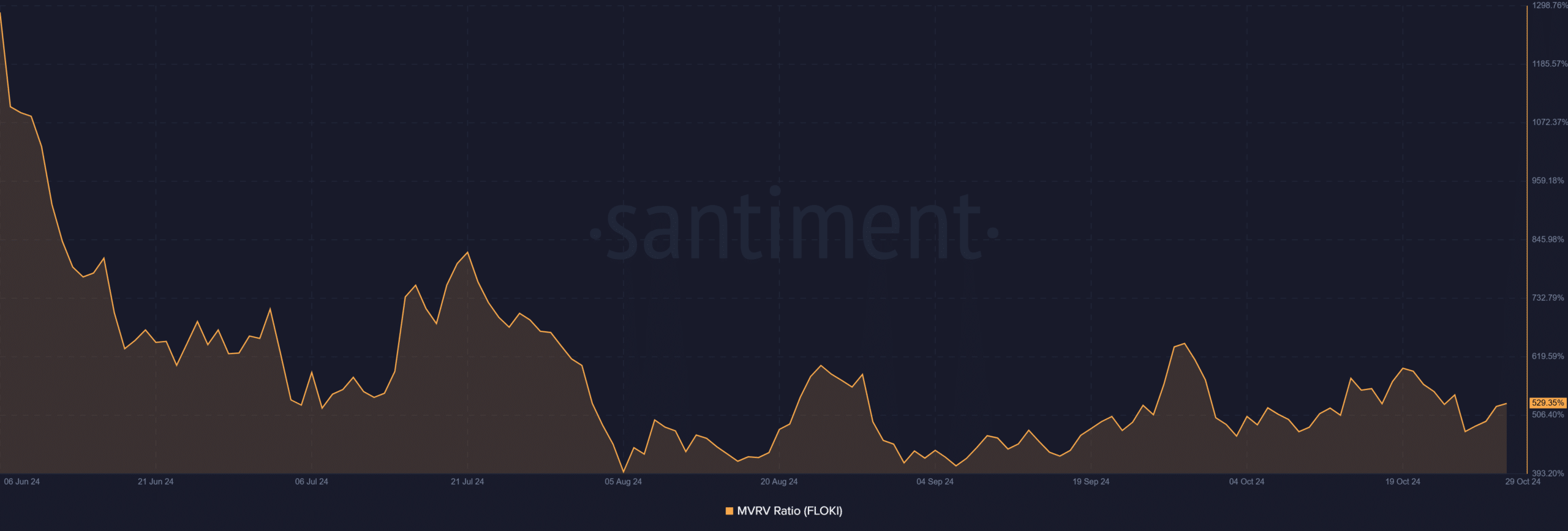

The MVRV (Market Value to Realized Value) ratio currently stands at an impressive 529.35%. This elevated ratio indicates that investors hold significant unrealized gains. High MVRV ratios typically signal profit-taking, suggesting a cautious market.

However, the strong bullish pennant formation may mitigate this selling pressure as traders anticipate a breakout. Therefore, the positive market sentiment could incentivize more investors to hold their positions, maintaining upward pressure on the price.

How does FLOKI open interest impact trading sentiment?

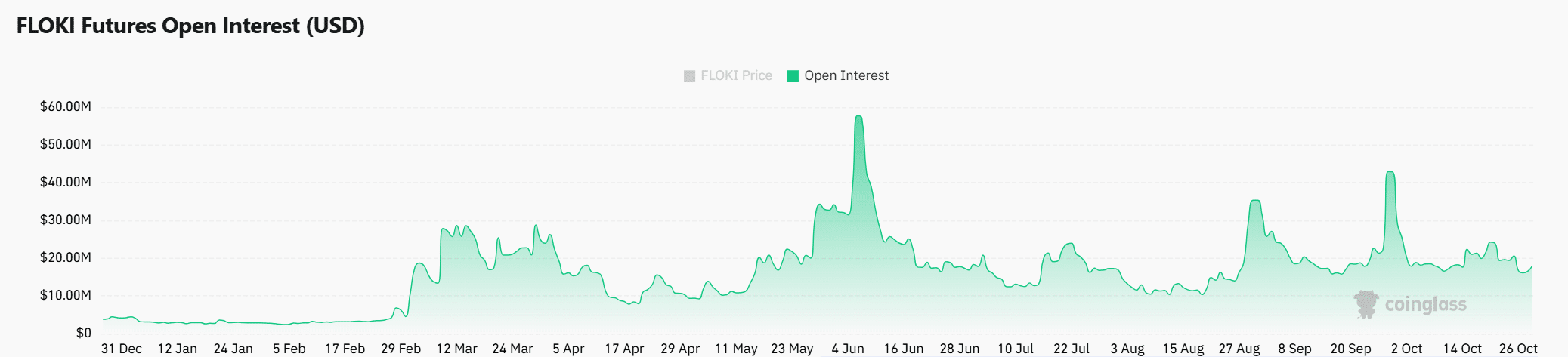

The open interest recently surged by 15.53%, reaching $18.84 million. This increase signals growing trader confidence in Floki’s upcoming price movement. Rising open interest typically suggests that more money flows into the market, often leading to significant price shifts.

Furthermore, with more participants betting on a breakout, traders appear optimistic about Floki’s future price action.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

Is a breakout imminent?

Floki’s current consolidation within a bullish pennant pattern indicates a potential breakout at the key resistance level of $0.00017553. Technical indicators, including the MACD and Stochastic RSI, support this bullish outlook.

Moreover, a high MVRV ratio and increasing open interest underscore positive market sentiment. Therefore, if Floki successfully breaches the resistance, it could unleash substantial bullish momentum.

![Aptos [APT]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-12-1-400x240.webp)