Can GMT repeat its 70% hike to cross $1?

- GMT broke out past the resistance zone that rejected the bulls earlier this month.

- Metrics reflected a healthy bullish bias, but sustained gains could hinge on Bitcoin breaking out.

Stepn [GMT] posted outsized gains in the past eight days. From 20th March’s low at $0.2506, GMT rallied to $0.445, a move that measured 77.57%. A few hours before press time, GMT prices fell to $0.406 and could dip lower.

Earlier in March, AMBCrypto reported that the on-chain metrics of GMT were healthy, and a bullish run of 70% or more could commence. However, Bitcoin [BTC] fell below $70k and nearly touched $60k just a few days later, dragging GMT prices down by 30%, from $0.3822.

Sentiment was firmly bullish once more

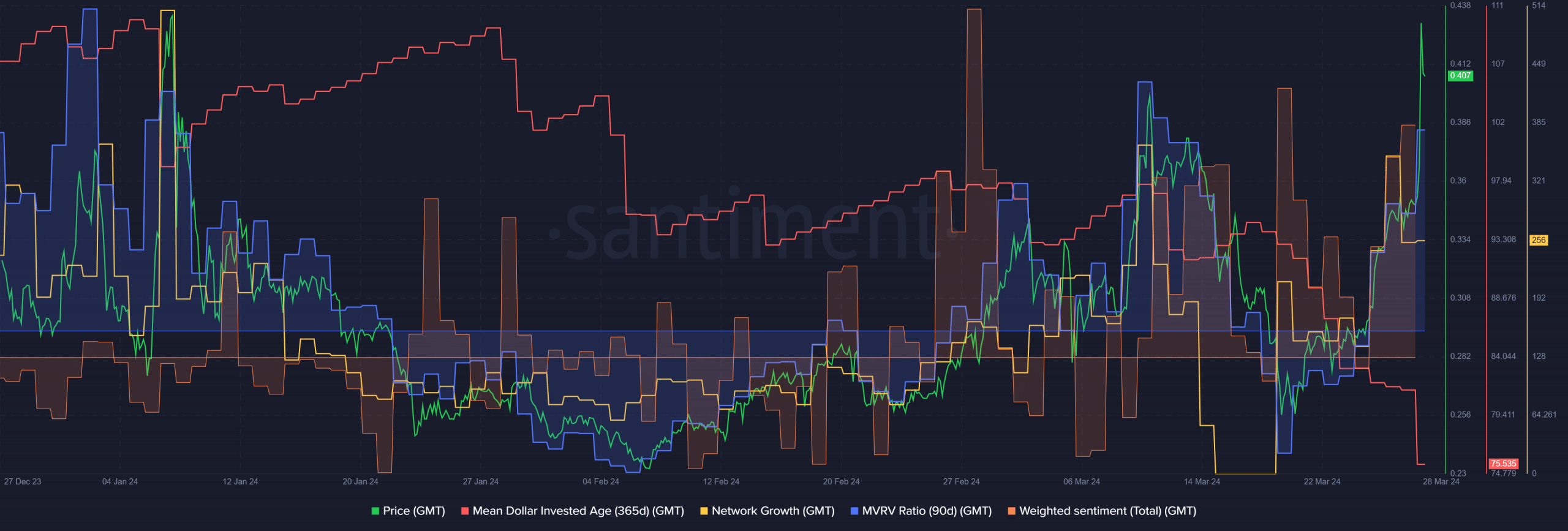

Source: Santiment

GMT did not rally as expected, but it did show strength during its resurgence. AMBCrypto looked closely at on-chain metrics to see if the token could maintain its bullish momentum.

The Mean Dollar Invested Age (MDIA) metric has been in a downtrend throughout January. This was a bullish sign and showed old coins re-entering circulation and rising demand.

The weighted sentiment was also strongly positive, reflective of the recent gains the token saw. The network growth also ticked higher in the second half of March.

The MVRV ratio shot higher alongside prices to reflect holders at a profit. While this was a positive outcome, it could lead to selling pressure in the form of profit-taking activity shortly.

Examining the supply distribution

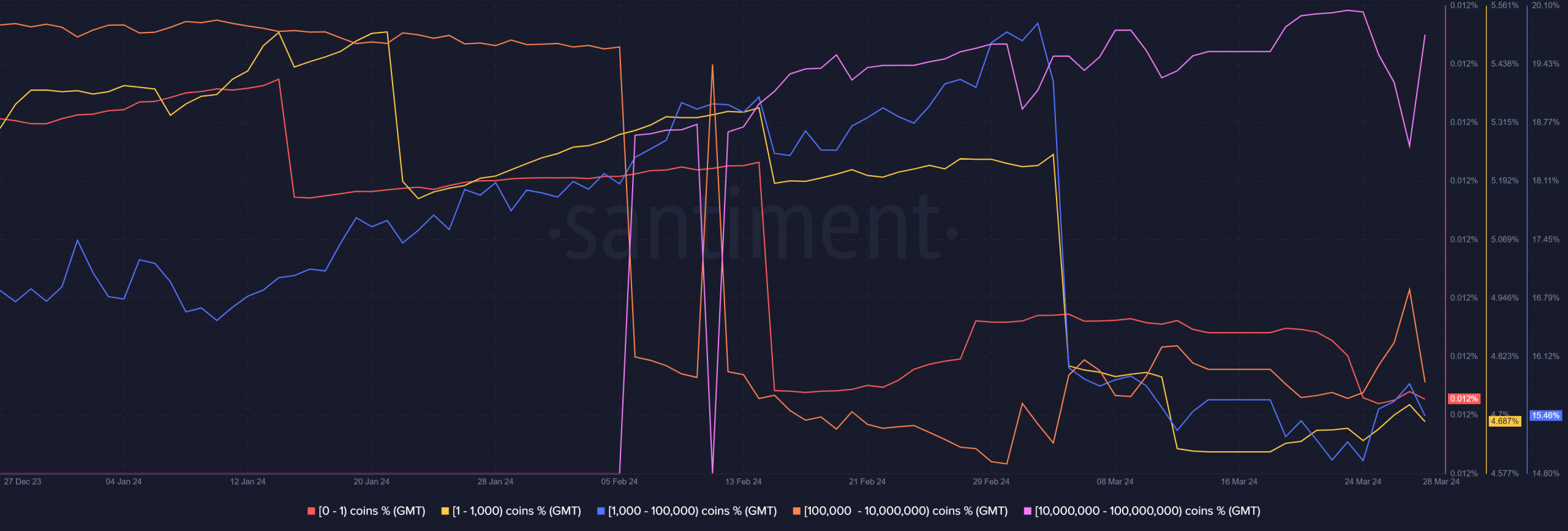

Source: Santiment

AMBCrypto analyzed the behavior of wallets holding different brackets of GMT tokens. The smaller holders, encompassing up to 100k GMT, saw a downtrend in March. This was especially pronounced in the 1k-100k GMT holders.

This suggested that holders were taking profits as prices rose.

On the other hand, wallets with 100k-10 million of the tokens made up a greater percentage of the supply distribution in the past three weeks. What it means is possible accumulation from whales.

Realistic or not, here’s GMT’s market cap in BTC’s terms

It is hard to be conclusive with this metric alone, but overall, the health of GMT remained bullish. The sharp BTC correction forced sentiment to sour across the altcoin market.

Perhaps this time favorable conditions will last longer for the bulls.