Can GOAT extend its 788% monthly surge? Everything you should know!

- If the recent resistance-turned-support level holds, GOAT could build on its bullish momentum.

- Technical indicators and on-chain metrics both point to continued strength for GOAT.

Over the past month, Goatseus Maximus [GOAT] has surged by an impressive 788.99%, while in the past seven days alone, it has added another 66.12%.

With a press time incremental gain of 2.12%, the key question now is whether GOAT can keep up its upward trajectory.

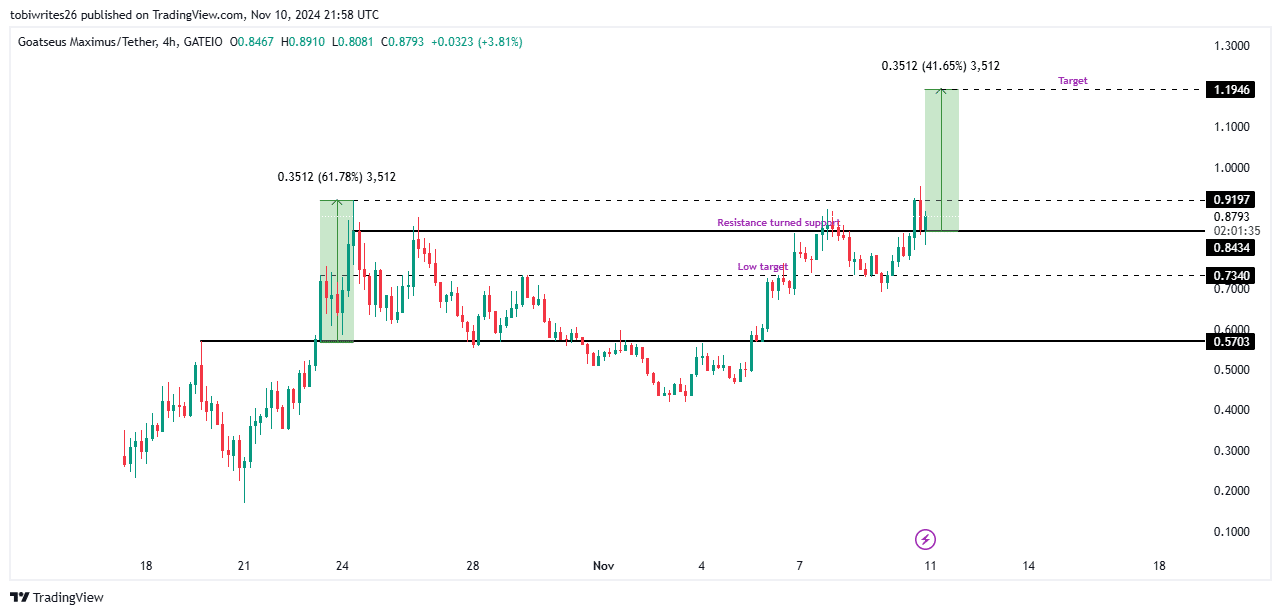

GOAT eyes potential 41.65% rally, pending key resistance break

GOAT is at a critical juncture after recently establishing a new high. For the asset to continue its rally, it must break through a major resistance zone at $0.8434, a level that has previously triggered pullbacks.

If this resistance is successfully flipped to support, GOAT could gain another 41.65%, reaching $1.1946—similar to a move it pulled last September.

A move to this target would likely push GOAT’s market capitalization above $1 billion, surpassing its all-time high of approximately $930 million.

However, if the resistance holds and forces a price drop, GOAT may retreat to $0.7340, where it could find support for a potential rebound.

Upward momentum stays strong as technical indicators turn bullish

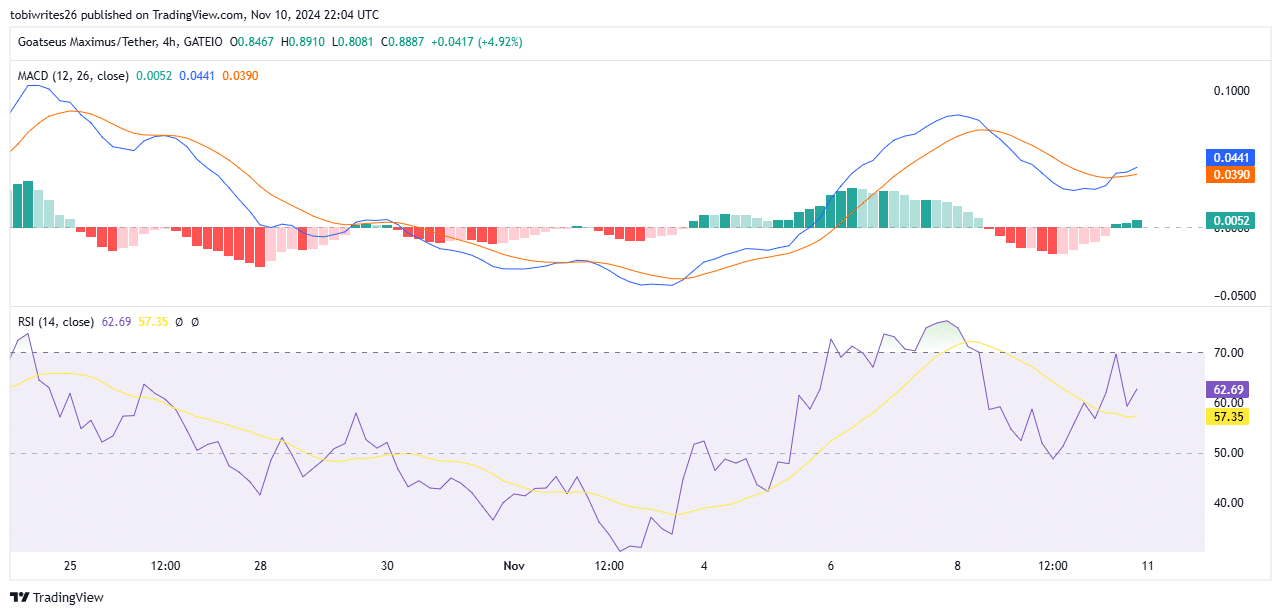

To gauge the market’s technical outlook, AMBCrypto analyzed the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), both signaling a bullish trend.

The RSI, which measures price momentum and potential trend direction, indicates a positive outlook. Currently at 62.69, the RSI suggests strong buying activity and potential for continued upward movement.

Similarly, the MACD shows a bullish precursor with the formation of a Golden Cross, where the blue MACD line crosses above the orange signal line. This crossover typically signals upward momentum, supported by increasing volume and gains.

While the technical indicators reflect a strengthening rally, on-chain metrics provide additional insights into market sentiment.

Additional pressure on GOAT’s market trend

Further analysis using data from Coinglass reveals that open interest in GOAT has declined by 3.87% in the past 24 hours, indicating increased market sell-offs and a rise in short positions.

Is your portfolio green? Check out the GOAT Profit Calculator

The Long/Short ratio, currently at 0.9448, suggests bearish sentiment, with more bears than bulls in the market. Additionally, a significant long liquidation of $2.57 million signals a potential downward trend for the asset.

If these metrics persist, GOAT may continue to decline, potentially seeking the lower support level at 0.7340.