Analysis

Can Lido continue defending $1.5?

Lido bulls have continuously defended the $1.5 level in September. Will the trend repeat and front a short-term reversal?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Lido fluctuated above $1.5 in early September.

- Funding rates were increasingly negative at press time.

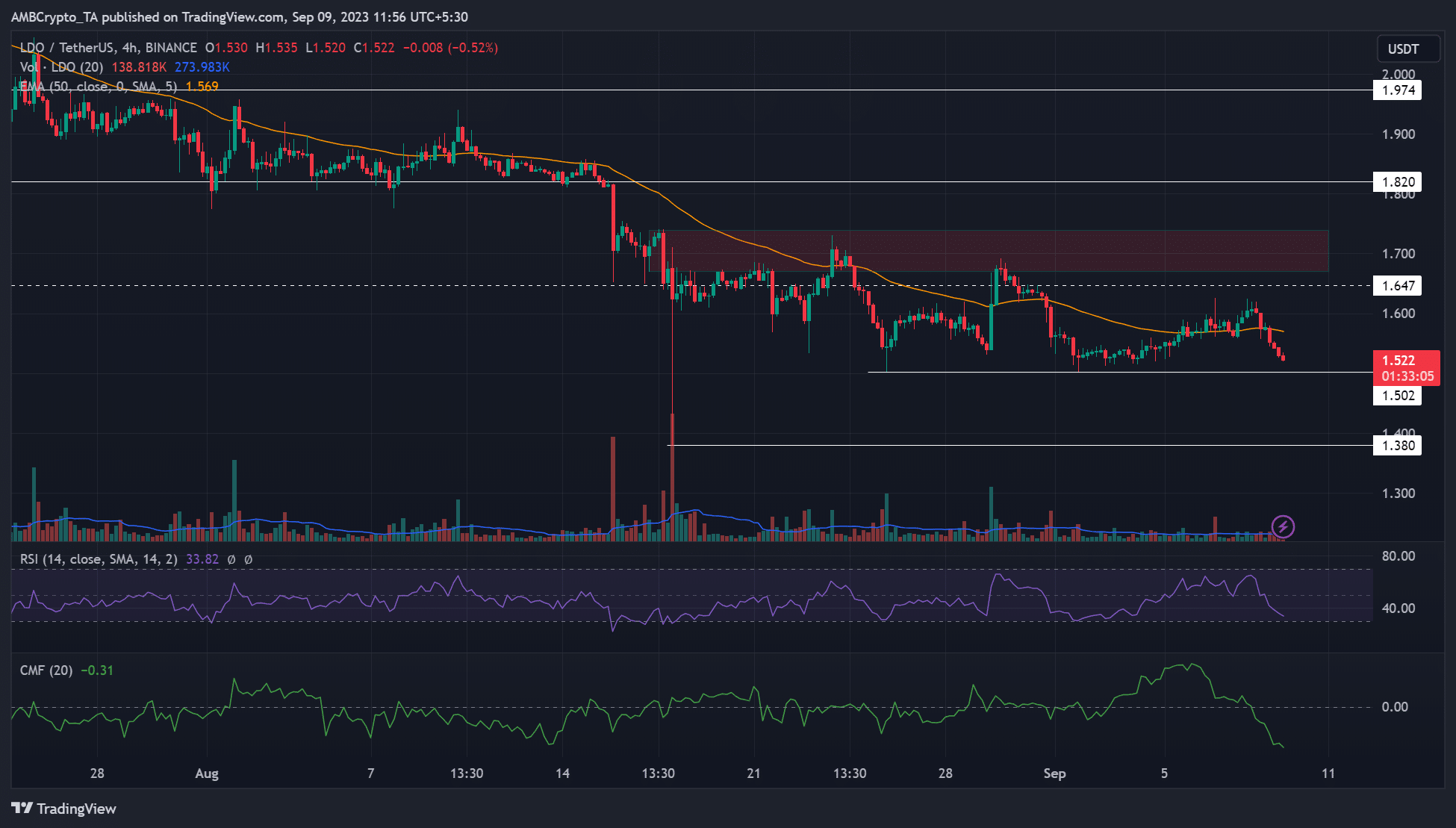

Lido [LDO] price performance remained muted in September as the market recorded low volatility. It fluctuated above $1.5 over the same period, underscoring the level as a key short-term support.

Is your portfolio green? Check out the LDO Profit Calculator

But an elevated sell pressure on Saturday, 9 September, threatened to crack the support.

In the meantime, Bitcoin [BTC] hovered near the range-low of $25.7k and could set LDO to extend the price consolidation above $1.5 in the short term.

Will $1.5 support stop the sell pressure?

Between mid-August and early September, Lido fluctuated within the $1.7 – $1.5 range. The range-high near $1.7 had a confluence with an H12 bearish order block (OB) of $1.67 – $1.74 (red).

At press time, the sharp price rejection at $1.6 dropped LDO lower towards the key short-term support of $1.5. If the previous trend continues, the $1.5 could ease the weekend sell pressure.

Such a move could set LDO to rebound towards 50-EMA (Exponential Moving Average) or the bearish OB of $1.67 – $1.74. However, LDO could head lower to $1.380 if an extreme short-term sell pressure cracks the $1.5 support.

Meanwhile, the RSI and CMF retreated deeper into the lower ranges, reinforcing elevated selling pressure and capital outflows from the LDO market.

Lido had negative funding rates

From Coinalyze’s 1-hour chart, Lido chalked negative funding rates in the past few days, underscoring a bearish bias.

How much are 1,10,100 LDOs worth today?

However, the Open Interest rates improved over the same period and only eased from 8 September. It shows demand for Lido in the derivatives market improved but waned from 8 September.

The CVD (Cumulative Volume Delta) also rose in early September but eased from 8 September. It demonstrates that sellers gain more market control from 8 September. However, if bulls defend it, sellers could exit the market at $1.5 support.