Can Lido sustain its position amidst rising competition

- Lido’s market cap continued to grow despite increasing competition in the Liquid Staking Derivative space.

- New proposals, including onboarding Ethereum operators, aimed to bolster Lido’s decentralization and resilience.

In the rapidly evolving Liquid Staking Derivative (LSD) space, Lido has been a significant player, capitalizing on the growing interest in this sector over the past year. However, as the LSD field becomes more competitive, questions arise about whether Lido [LDO] can maintain its ascent.

Is your portfolio green? Check out the Lido Profit Calculator

Lido continues to outshine competitors

Despite the increasing competition, Lido’s market cap continued to grow steadily. According to Token Terminal’s data, its market share on 1 January stood at 73.8%, and at the time of writing, it slightly increased to 74.1%.

This sustained market cap growth suggested that Lido was able to hold its ground and even expand its presence despite heightened competition.

Total liquidity in liquid staking over time?

Interestingly, Lido market share:

Jan 1st: 73.8%

Today: 74.1%Despite increased competition, @LidoFinance continues to be the market leader by miles? pic.twitter.com/Z33JsdNf5B

— Thor⚡️Hartvigsen (@ThorHartvigsen) September 2, 2023

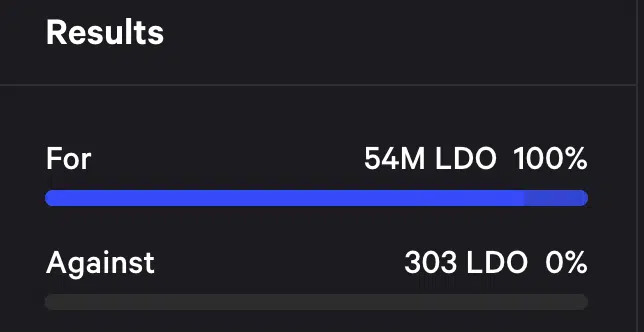

The protocol’s future prospects seem promising, with new proposals aiming to strengthen its position. One recent proposal suggested that the Lido DAO should add two shortlisted Ethereum operators to Lido’s Ethereum operator set.

The primary goal of onboarding these new node operators is to enhance the decentralization and resilience of the protocol. It also aims to bring in organizations that align with its values and possess strong skill sets.

The onboarding process would be divided into two stages. In Stage 1, the Lido Node Operator Sub-Governance Group (LNOSG) reviewed and assessed 14 onboarding applications, resulting in the selection of two applicants for the Stage 1 shortlist.

The Stage 2 evaluation, along with the subsequent shortlist proposal, is planned for the end of August or early September, when additional candidates for inclusion will be proposed.

Importantly, the LNOSG’s shortlisted candidates align with Lido’s onboarding goals, emphasizing the protocol’s commitment to thoughtful expansion.

State of the protocol

Currently, Lido is experiencing both growth and challenges. Over the past month, its activity has grown by a notable 20.4%. However, there has been a 6.0% decline in the overall revenue generated during this same period, indicating potential challenges that may need to be addressed for sustained success.

Realistic or not, here’s LDO’s market cap in BTC’s terms

At the time of writing, LDO was trading at $1.535, reflecting a significant decline in its price over the past month. While whale interest in the LDO token has decreased, the trading volume of LDO tokens has seen a substantial increase.

This shifting dynamic in trading activity could have implications for Lido’s market performance in the coming days.