Can Lido’s dominance help the struggling LDO

- The Liquid Staking Derivative (LSD) market, led by Lido protocol, dominates DeFi with significant TVL growth.

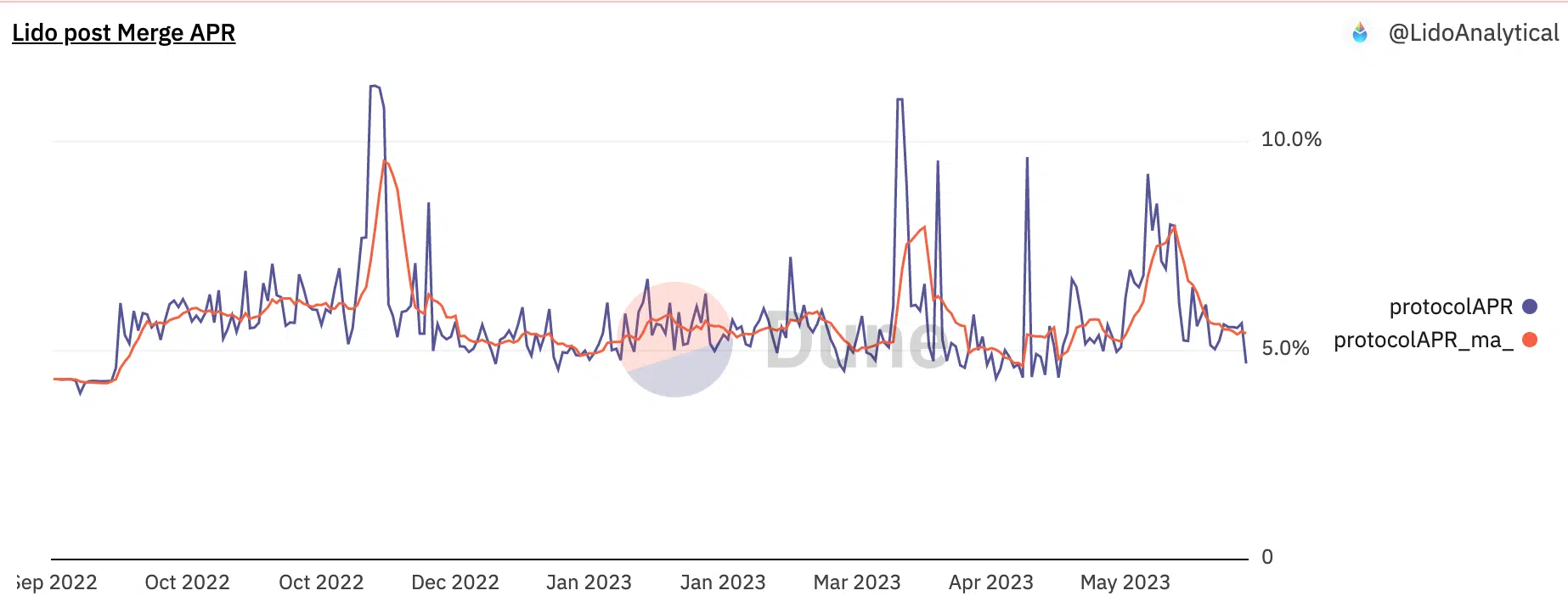

- Lido faces challenges with declining APR and LDO token performance.

The Liquid Staking Derivative (LSD) market has emerged as the dominant force in the decentralized finance (DeFi) sector, spearheaded by the Lido [LDO] protocol. As the sector experienced exponential growth, questions arose regarding the future trajectory of Lido.

The impact of Lido

Since the beginning of the year, LSD witnessed a staggering $10 billion increase in Total Value Locked (TVL), and Lido protocol has played a pivotal role in driving this growth. Particularly, the interest in stETH, the protocol’s offering, has significantly contributed to the surge in TVL.

The increased popularity of Lido has led to a substantial rise in daily active users on the network. Data from Token Terminal revealed a notable 23.8% increase in users over the past 30 days. Correspondingly, Lido’s revenue has also witnessed an impressive surge of 53.2%.

However, despite its ongoing success, Lido may face challenges in the future. One potential hurdle is the declining Annual Percentage Rate (APR) offered by Lido, which could impact the protocol’s growth and appeal.

Will interest in the token rise?

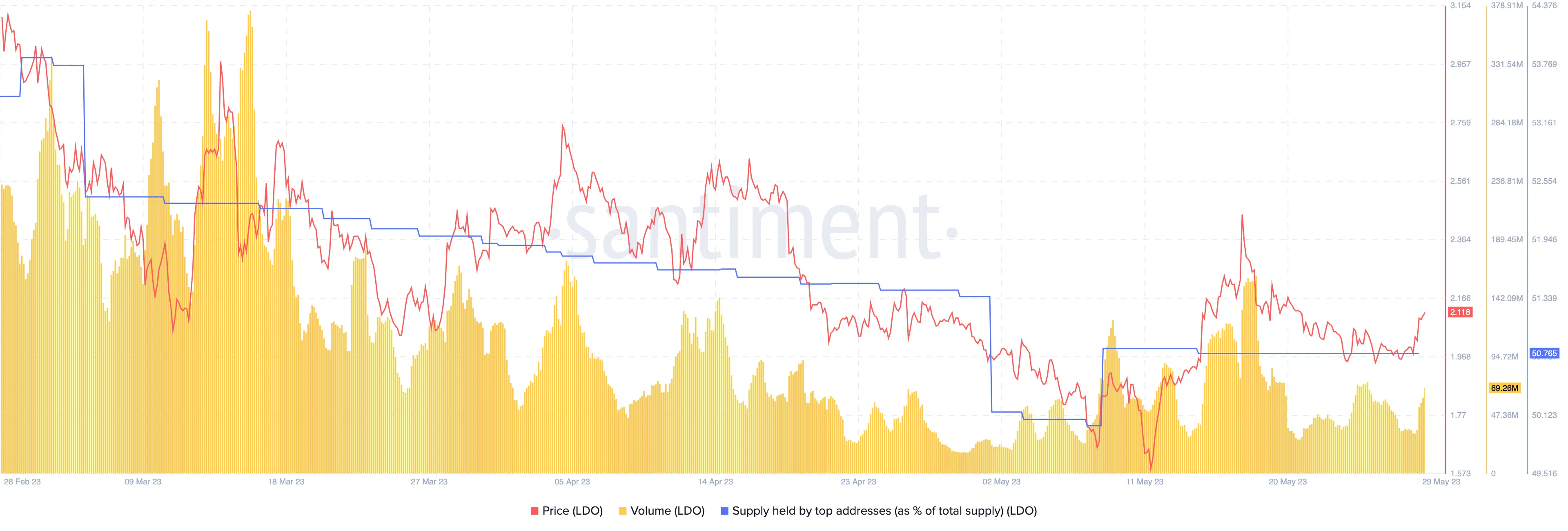

The LDO token, which is integral to Lido’s ecosystem, has experienced a significant decline in price and trading volume over the past three months. Additionally, there has been a decline in whale interest in the token. Nevertheless, Lido aims to revive interest in the LDO token through a new proposal.

The latest proposal introduces the LDO staking module and a buyback program. This initiative enables token holders to stake LDO in exchange for a proportion of Lido DAO revenue through an LDO buyback and distribution program.

Realistic or not, here’s LDO’s market cap in BTC’s terms

This innovative approach aims to increase the utility of the LDO token by involving LDO stakers as insurance providers of last resort.

As Lido continues to refine its offerings and adapt to market dynamics, the future holds both opportunities and challenges. The protocol’s success in maintaining its leading position within the LSD market will depend on its ability to address declining APR concerns and rejuvenate interest in the LDO token through its proposed staking and buyback program.