Can LINK rally to a new ATH on the back of Bitcoin’s halving?

- Bullish sentiment around Chainlink rose on the back of Bitcoin’s halving

- Buying pressure was high, hinting at a sustained price hike

Chainlink [LINK] recorded a solid comeback over the last few hours as its price gained bullish momentum on the charts. This happened on the back of Bitcoin [BTC] undergoing its fourth halving. Hence, it’s worth looking at LINK’s state to find out whether the uptrend was a result of the hype around the halving or if metrics lent it any support.

Chainlink turns bullish

Like most cryptos, LINK also bled last week as its value dropped by more than 9%. However, the scenario changed as Bitcoin halving happened, with the same sparking bullish sentiment across the market.

LINK was also affected by it, as the token’s value shot up by 4% in 24 hours. At the time of writing, Chainlink was trading at $13.98 with a market capitalization of over $8.2 billion.

Despite the price rise, however, over 43% of LINK investors were at a loss at press time, according to IntoTheBlock’s data. That being said, the stats might change soon as LINK seemed to be bouncing from a crucial support area.

World Of Charts, a popular crypto-analyst, recently shared a tweet highlighting the uptrend of the LINK/BTC pair. This hinted at a sustained hike in LINK’s value.

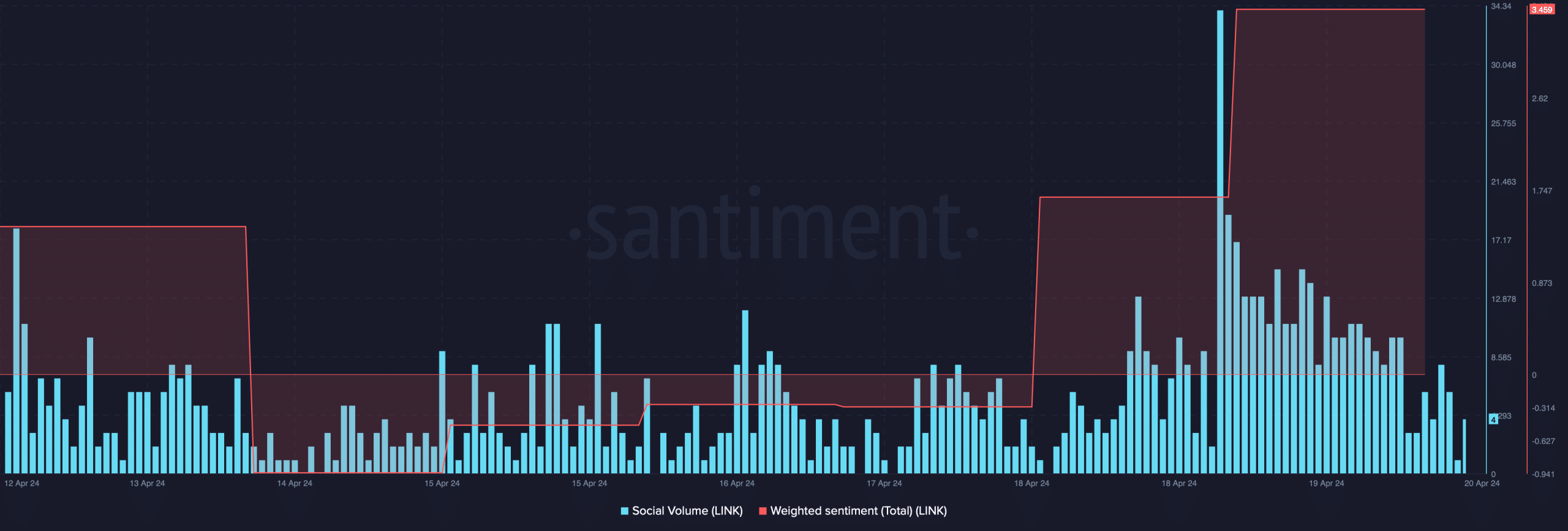

AMBCrypto’s analysis of Santiment’s data also revealed that investors’ confidence in LINK rose, with the same evidenced by the sharp rise in its weighted sentiment. The token’s social volume also spiked, reflecting its popularity in the crypto-space.

LINK’s rally to last longer

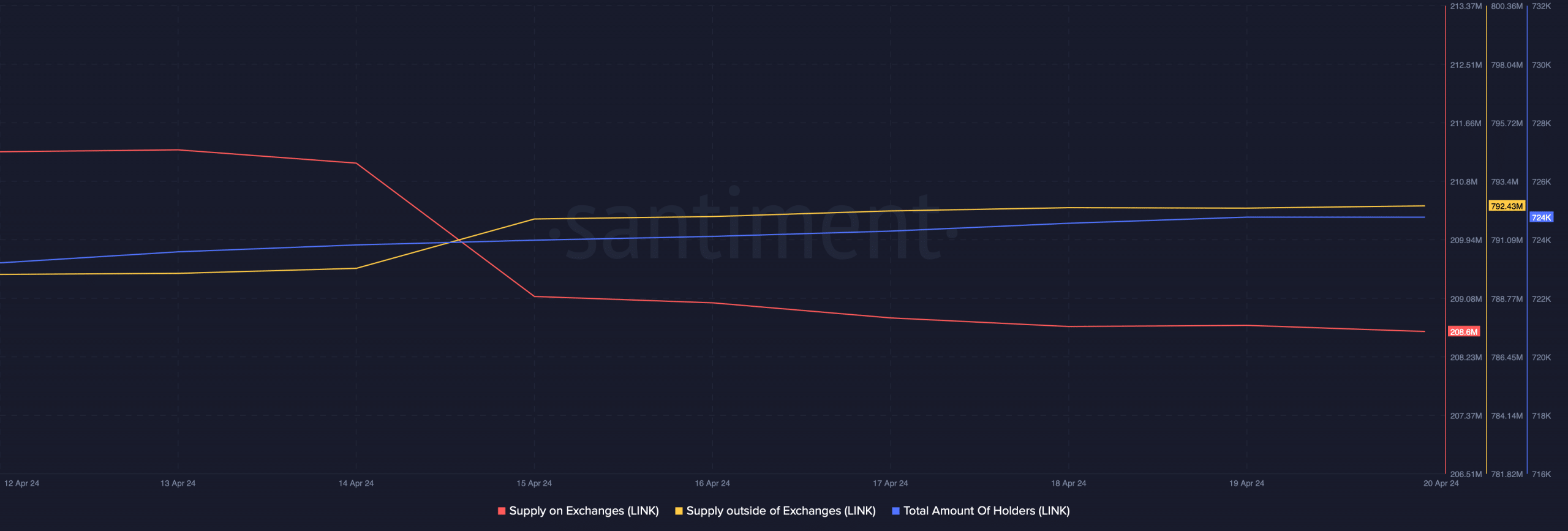

AMBCrypto then analyzed LINK’s metrics to see whether this price uptick would continue. We found that buying pressure on the token increased, which is a bullish signal.

Chainlink’s supply on exchanges declined while its supply outside of exchanges rose, indicating that investors have been accumulating LINK. Additionally, its total amount of holders also hiked over the past week.

As per our analysis of Hyblock Capital’s data, it’s crucial for Chainlink to go above the $14.7-mark in order to sustain a bull rally. The token’s liquidation would rise sharply at that level, which can cause trouble in its path north.

A successful breakout above $14.7 could easily result in LINK reclaiming the $15-level.

Read Chainlink’s [LINK] Price Prediction 2024-25

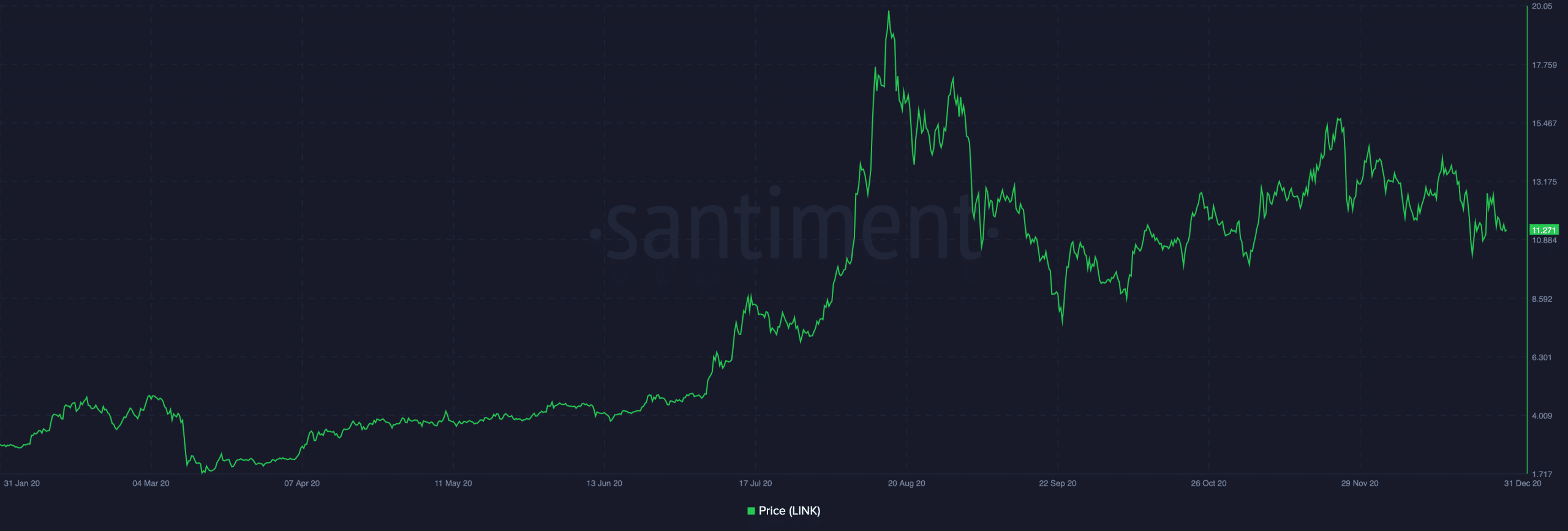

Here, it’s worth looking at historical references too.

During the previous Bitcoin halving in 2020, LINK’s reaction was similar to the one right now. LINK’s price gained bullish momentum, allowing the token to hit an all-time high in just 2 months’ time. Therefore, investors might want to keep a close eye on the altcoin’s performance over the coming weeks.