Can Optimism compete in the layer 2 race with these new developments?

- A new client program for the OP Stack ecosystem could prove to be beneficial for the Optimism protocol.

- The protocol falls behind other Layer 2 solutions in various areas such as activity and revenue.

Despite initially establishing a dominant presence in the Layer 2 (L2) sector upon entering the market, Optimism‘s performance has since been surpassed by other protocols such as Polygon and Arbitrum in various areas.

Read Optimism’s [OP] Price Prediction 2023-2024

Gift of the Magi

The addition of the Magi to the Optimism protocol could impact it positively. Magi is a recently developed client program designed to enhance the diversity and resilience of the OP Stack ecosystem.

Developed in Rust, Magi functions as a consensus client, commonly referred to as a rollup client, and complements execution clients like op-geth to synchronize transactions on the network. While OP Labs maintains the reference implementation called op-node, Magi performs the same functionality, albeit with the added benefit of being a novel solution.

It is worth noting that Magi is not yet a production-ready client and should not be considered as such. Nonetheless, it has already demonstrated its compatibility with both Optimism and Base testnets, making it suitable for experimental purposes.

Introducing Magi ?, our brand new OP Stack rollup client written in Rust.

We've been working on Magi to help improve the client diversity and resilience of the entire OP Stack ecosystem.

Lets dive in.

code: https://t.co/U8ER6v2SSe

blog: https://t.co/A4Tx8iaVOh pic.twitter.com/S5hDbx5Q4R— ncitron.eth (@NoahCitron) April 19, 2023

Back to the present

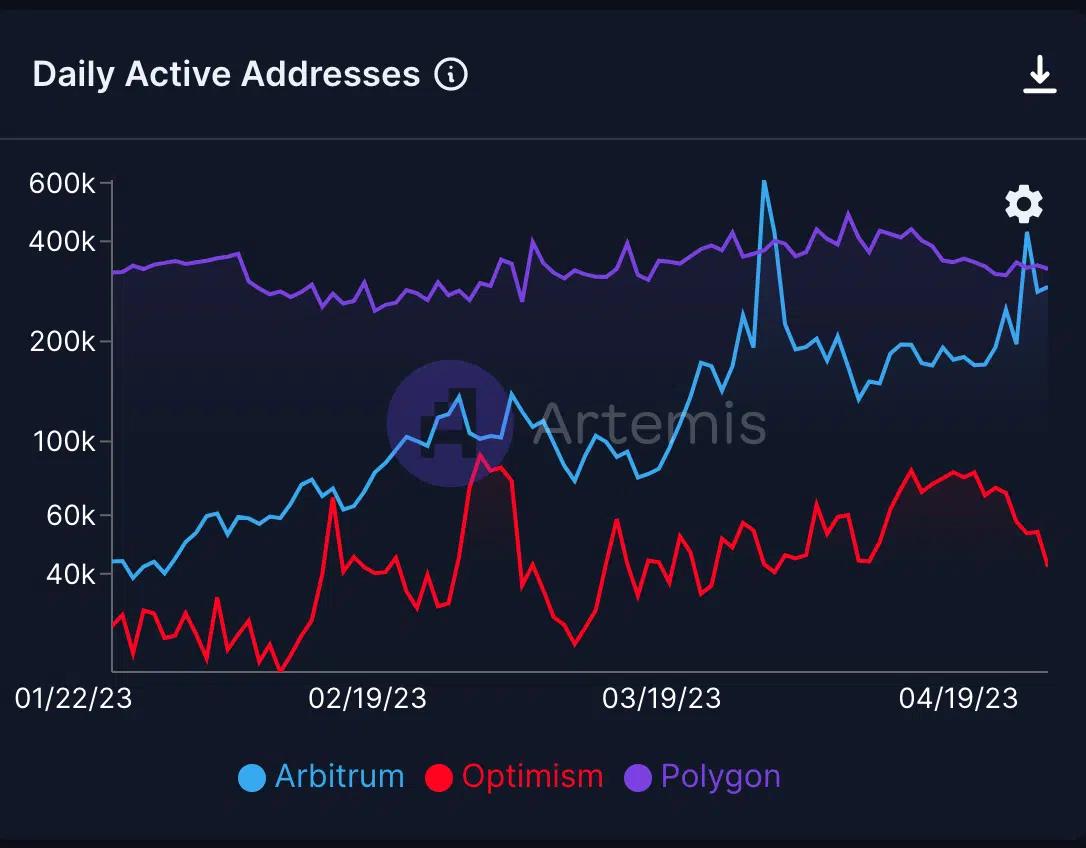

At press time, Optimism was still under attack due to a significant number of challenges. In terms of daily activity on the protocol, Optimism wasn’t able to compete with networks such as Polygon and Arbitrum.

Over the past few weeks, the number of daily active addresses on the Optimism network declined from 82,000 to 42,000.

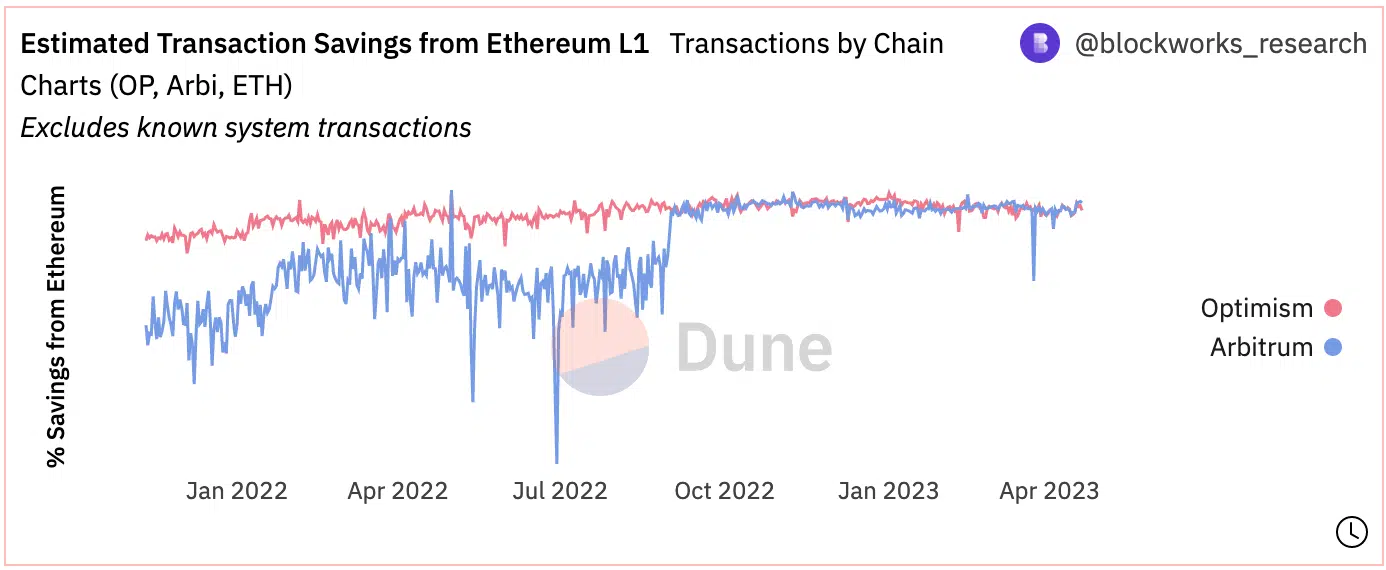

The protocol was also unable to compete with other solutions in terms of saving ETH for its users. According to Dune Analytics’ data, Arbitrum was outperforming Optimism by a large margin in this regard.

Should holders be ‘OP’timistic?

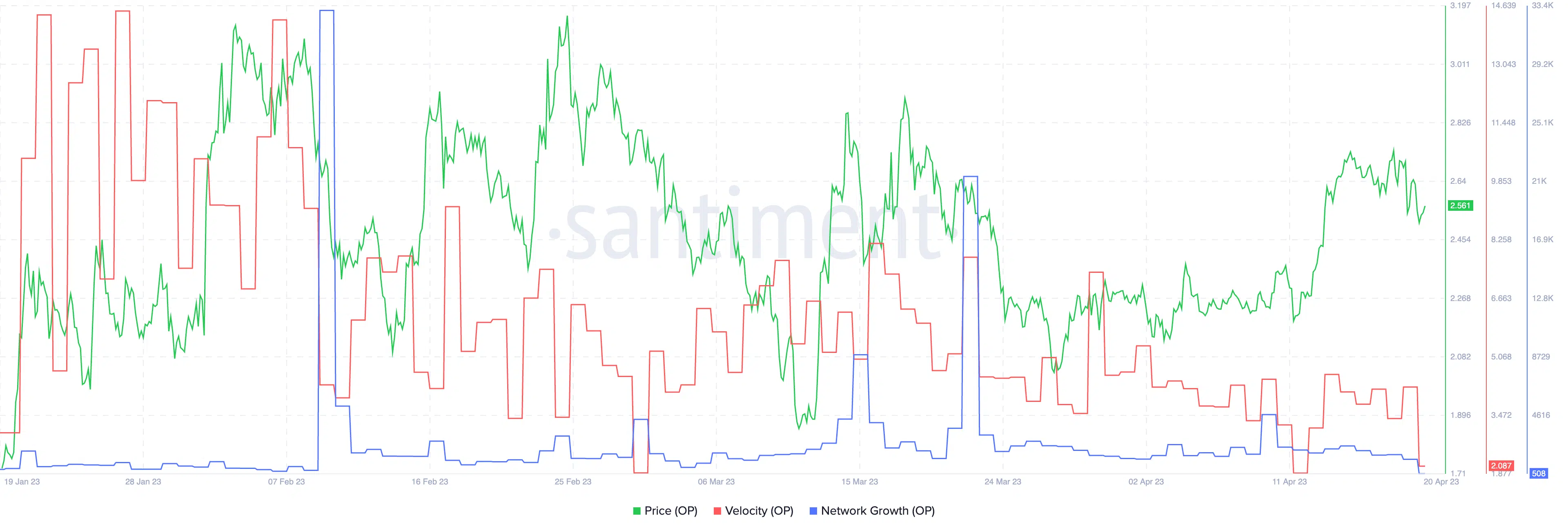

Optimism’s native token OP faced the consequences of the aforementioned information. The last few weeks saw a drastic fall in the velocity of the OP token. This indicated that OP’s trading frequency witnessed a decline.

Coupled with that, OP’s network growth started to fall. This further indicated a fall in the number of new addresses transferring OP for the first time.

Realistic or not, here’s OP’s market cap in BTC’s terms

Despite the declining price of OP, the MVRV ratio remained positive. This implied that there were still addresses left that were profitable that could have the incentive to sell their holdings for profits in the future.

Source: Santiment