Analysis

Can Polkadot bulls defend the $5.15 support

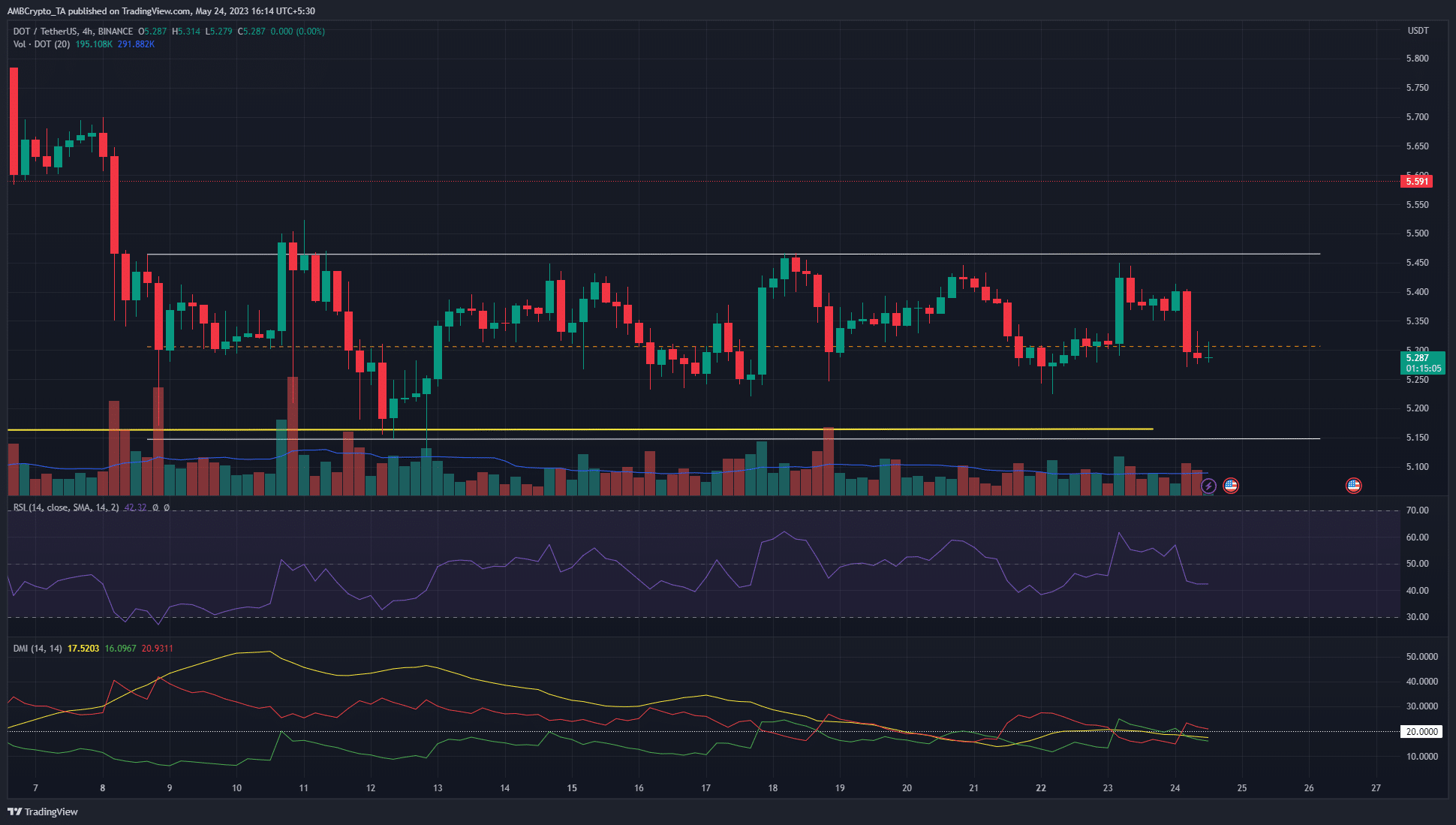

The price action of Polkadot showed a lack of initiative from the buyers, while the indicators showed a strong trend in either direction was not in progress

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The formation of the short-term range at support hinted at bearish strength.

- Bullish speculators have lost steam in recent days as well, pointing toward further losses for DOT.

Polkadot [DOT] traded within a range that extended from $5.15 to $7 since March. On 19 April, when Bitcoin fell from $30.4k to $28.8k, the 1-day market structure of Polkadot also flipped bearish. This was due to a session close beneath the $6.55 mark.

Read Polkadot’s [DOT] Price Prediction 2023-24

Over the past month, the bias of DOT was bearish on the higher timeframes. Moreover, the price formed yet another short-term range within a zone of support in the $5.4 region. This was indicative of weak bulls. Will Polkadot prices slump further and lose the $5.15 support?

The lack of reaction from support was a concern for buyers

An analysis of the 12-hour chart showed that the $5.15-$5.45 area represented a bullish order block. Moreover, they coincided with the two-month range (yellow) lows. This demarcated the $5.15 territory as strong support.

Yet, when this order block was tested as support on 8 May, it saw a lukewarm response from the buyers. The price bounced to $5.53 before facing heavy selling pressure. The bears were successful in keeping DOT prices beneath $5.5 in the past two weeks.

The RSI oscillated above and below the neutral 50 mark without showing a clear trend in progress. This finding was corroborated by the Directional Movement Index. The ADX (yellow) was below zero, showing the absence of a significant trend. Both these findings support the idea of a two-week range formation around $5.2.

Therefore, DOT traders can look to enter short positions in the $5.4-$5.5 area. They can also look to short Polkadot in the event the prices dived below $5 and retest the region as resistance.

Is your portfolio green? Check the Polkadot Profit Calculator

The past 48 hours highlight discouraged bulls

Source: Coinalyze

In the past week, the price has oscillated between $5.25 and the $5.44 levels. The Open Interest was flat during this period, with upticks corresponding to a minor bounce in prices and a decline alongside a fall in prices.

Yet in the past two days, the OI has dived by close to $8 million, even though DOT prices hovered just above $5.25. This suggested that sentiment was strongly bearish in the short term. Putting the price action and sentiment together, it was clear that the sellers had the upper hand recently.