Can Shiba Inu’s aggressive token burns reverse SHIB’s price trend?

- SHIB burn rate surges by 459% in the last 24 hours.

- The Deflationary pressure fails to change the market trend as SHIB continues to decline.

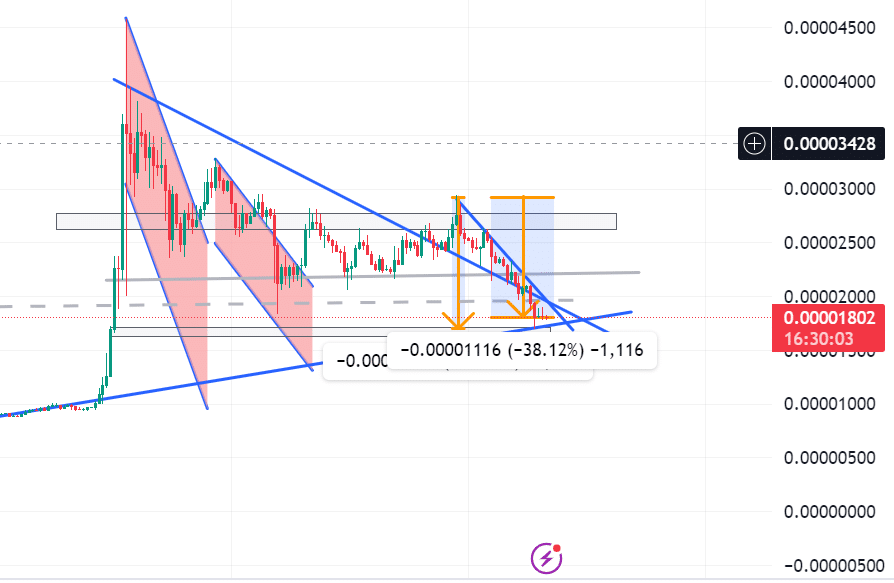

Shiba Inu has been on the downside since 30th May, recording a 41% decline till 21st June. The sudden decline after hitting a record high of $0.0004558 on 5th May has captured various crypto players’ attention.

Crypto analysts and enthusiasts have come out blazing to share developing news regarding SHIB.

Innovatekmobile shared on X, that

“Dogecoin killer Shiba Inu’s burn rate soars by 459%, large transactions witness a twofold jump. However, the deflationary pressure failed to push its prices upward”.

He posited that although there have been high transactions, SHIB prices are continuing to decline.

Crypto Crown shared similar insights on X, stating that,

“Shibu Inu’s burn rate skyrockets by 459%, torching 33.29 million tokens. Despite the hype, SHIB/USD fails to rally”.

According to Shibburn, holders eliminated over 33.29 million of SHIB tokens in circulation.

Notably, in financial markets, especially cryptocurrency, the burn rate implies a considerable amount of tokens are transferred to an unusable wallet.

The move usually aims to reduce supply by removing it from circulation and increasing prices through increased demand resulting from scarcity.

How did SHIB react?

Despite the attempts to increase demand or generate a positive impact, AMBCrypto’s analysis indicated that the deflationary pressure did not positively affect prices.

At press time, SHIB was trading at $0.00001799 and experiencing a 3.19% decline in 24 hours.

Further, AMBCrypto’s analysis showed that SHIB has declined by 30% this month, with a 29% decline in the last 30 days. Declining prices result from excessive selling pressure, leaving the market struggling to hold an upswing.

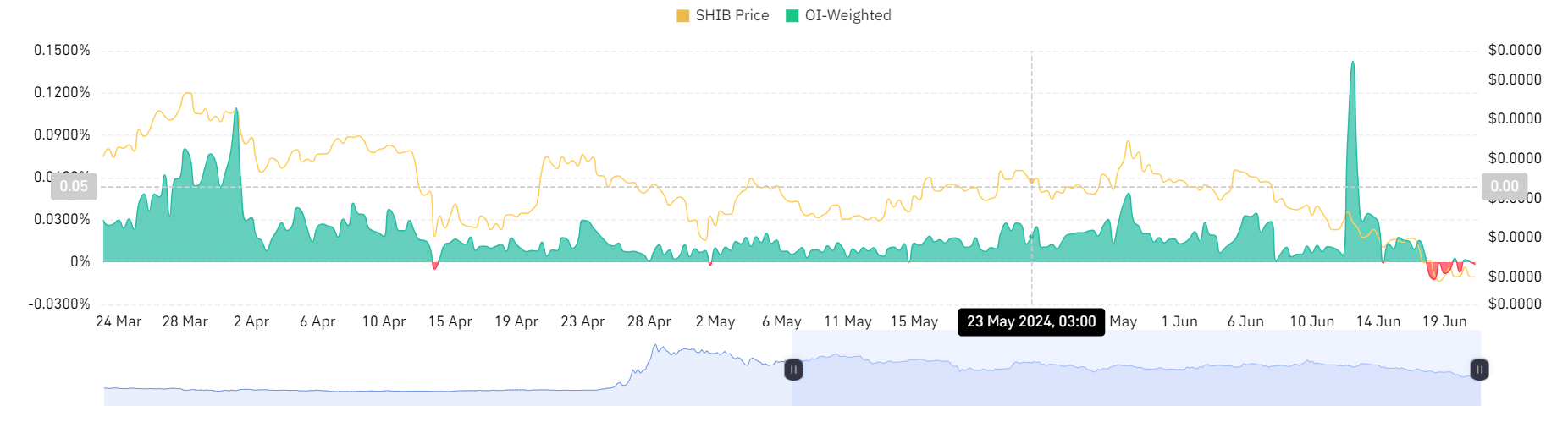

AMBCrypto analysis of data from Coinglass shows that the massive burn has had no impact on market sentiment. At press time, SHIB’s weighted funding rate was -0.0015%, meaning investors were closing their positions without opening new ones.

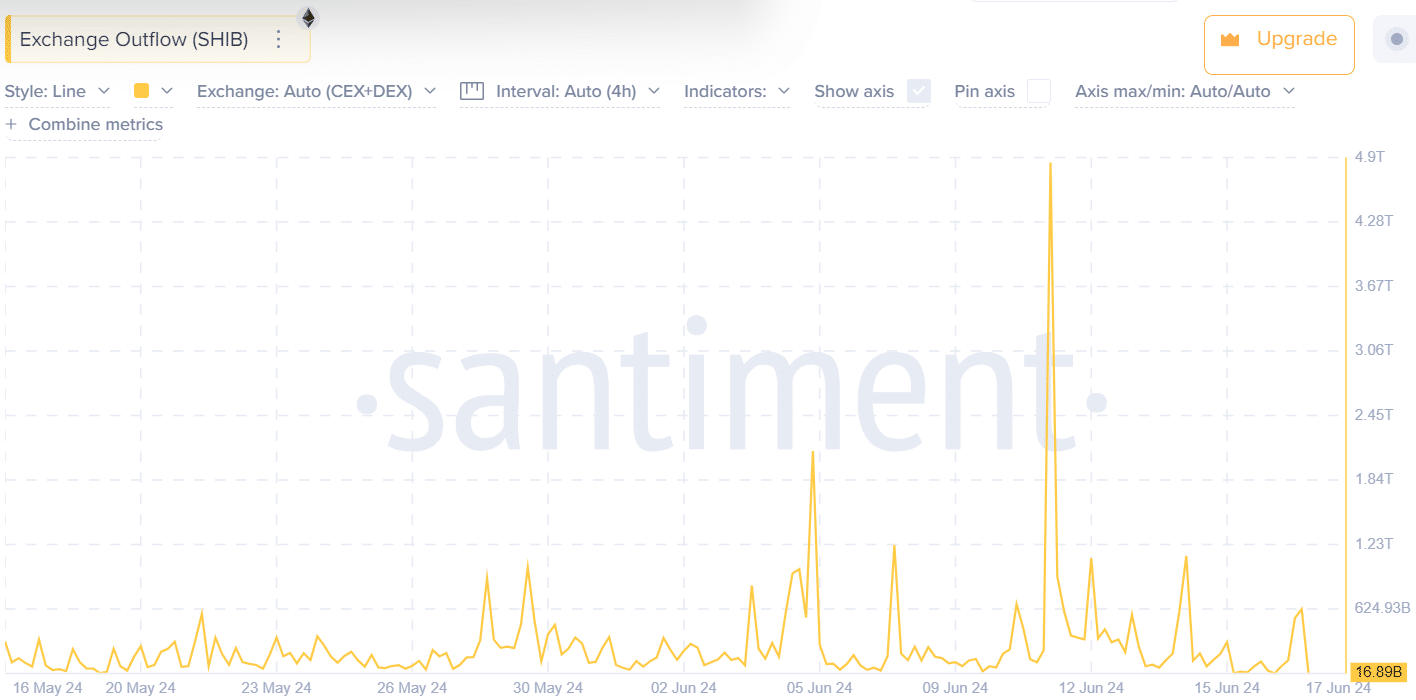

Equally, Data from Santiment shows declining exchange outflow. Low exchange outflow implies that investors are preparing to sell their assets, resulting in higher selling pressure and lower prices.

Is your portfolio green? Check out the Shiba Inu Profit Calculator

Implications of the recent burn

The surge in burn rates arises amidst increased selling pressure and lower prices.

Selling pressure rises because many tokens are in circulation that are ready for trade. At press time, SHIB prices were still declining; thus, higher burn rates failed to achieve their targeted goal, leaving whales with gains.