Can SOL, AVAX come to crypto-market’s rescue? These predictions say…

- Solana has a strong bullish bias even as prices soar above a key resistance level.

- Avalanche saw its bullish momentum slow down and could witness a minor pullback.

Solana [SOL] and Avalanche [AVAX] saw a slightly different trajectory on the price charts over the past two days. The former continued to surge higher even as the rest of the crypto market shed some gains, while the latter’s bullish momentum weakened.

Bitcoin [BTC] was a major factor in the performance of altcoins. The capital flow into ETFs has been monumental, but this did not mean the altcoin markets were forgotten. Here’s how traders could navigate the incoming volatility.

Avalanche could retest a key demand zone, while Solana continues the uptrend

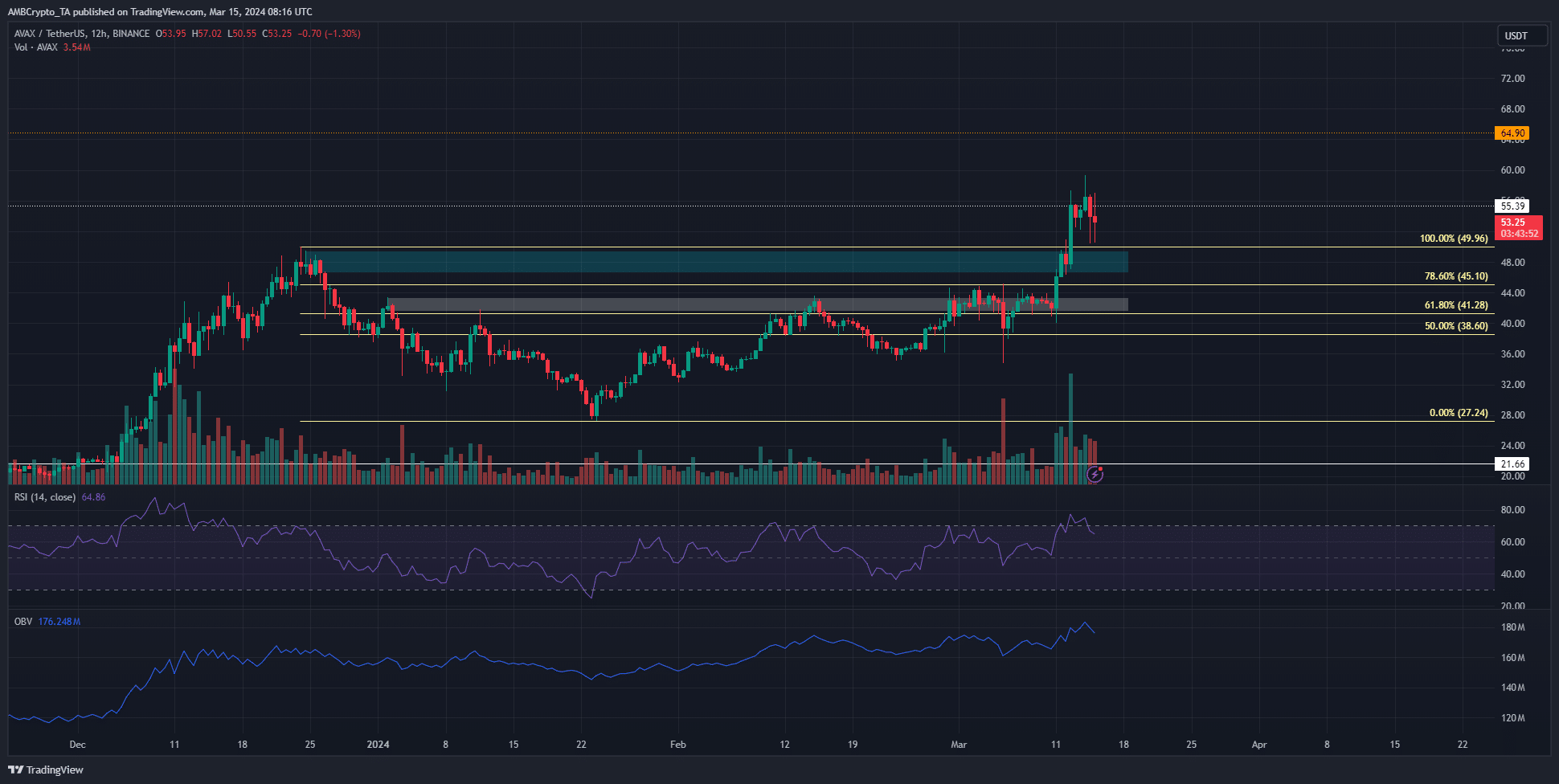

The AVAX chart showed two former bearish order blocks that have been turned into bullish breaker blocks over the past two weeks. These are highlighted by the white and cyan boxes.

The Fibonacci levels showed that a bullish trend was established once the white box resistance at the $43.35 mark was broken.

The $55.4 and $64.9 levels were higher timeframe resistance levels that traders need to watch out for. The OBV and the RSI were trending higher in recent weeks, showing bullish domination. More gains are expected to come after a pullback.

A retest of the $49 and $43 demand zones could occur, and would present a buying opportunity upon a retest.

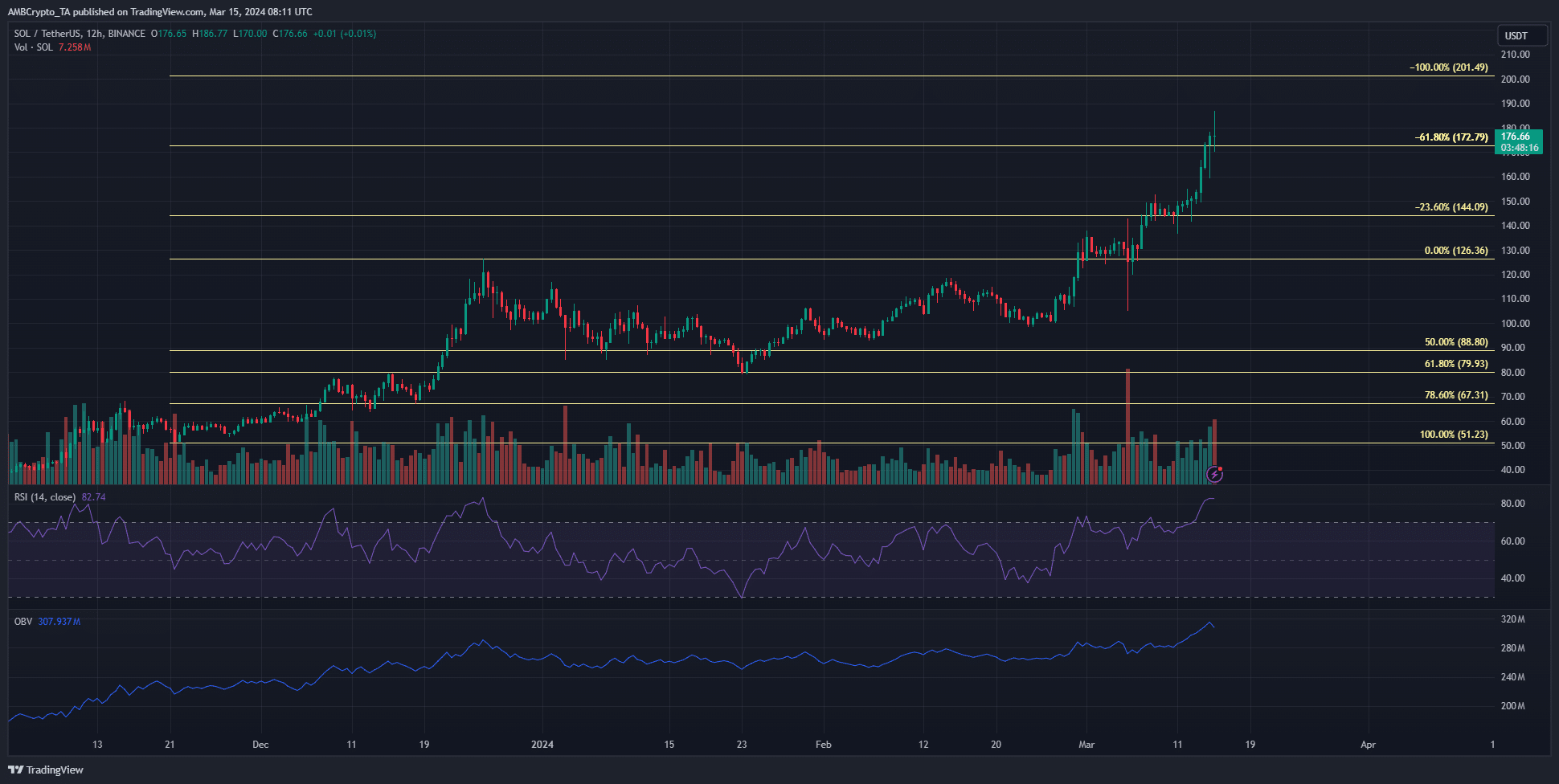

While Avalanche saw a pullback from the $56 resistance due to the Bitcoin price drop, Solana did not slow down its bullish march. Its RSI on the 12-hour chart was at 82 to indicate strong bullish momentum.

The OBV also climbed higher to signal an inflow of buyers into the market. Conversely, whales have taken profit, as AMBCrypto reported.

At press time, the 61.8% extension level at $172.8 has been flipped to support. The $200 level is the next target, as laid out in a recent report.

Is your portfolio green? Check the SOL Profit Calculator

Assessing the slide in Open Interest

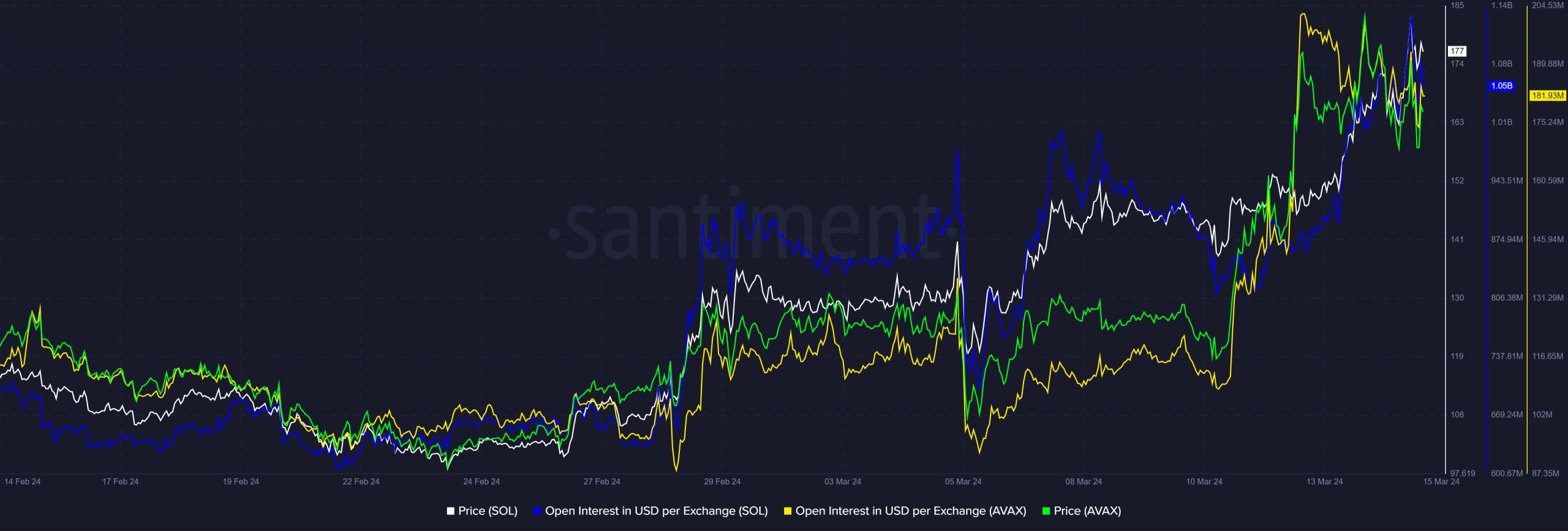

Source: Santiment

The OI of AVAX has slid lower over the past three weeks. It fell from $202 million to $181 million at press time while prices stagnated around the $55 mark. This indicated bearish expectations toward the token.

On the other hand, the Open Interest behind Solana rose from $880 million to $1.05 billion as prices went from $146 to $177. This was a signal that short-term conviction continued to be biased in favor of the bulls.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.