Can Solana [SOL] compete in the big leagues aided by its DEXes? New data suggests…

- DEX volumes on the Solana network rises. Raydium and Saber lead growth.

- TVL on the network increased. SOL prices and volume continued to decline.

According to data published on 13 May, it was observed that the overall DEX volumes on the Solana [SOL] network increased substantially over the last week.

Is your portfolio green? Check out the Solana Profit Calculator

Solana makes a mark

The growth of Solana’s DEX volumes surpassed that of its competitors such as Ethereum [ETH], Arbitrum [ARB] and Polygon [MATIC].

Even though the protocol lagged behind its competitors in terms of daily activity, the rise in DEX volumes could suggest that Solana may be able to compete with other protocols in this sector soon.

$SOL DEX volume saw a spike in volume over the last week of 86%

This was led by @RaydiumProtocol which saw volume of $162M ( +202%) over the last week. pic.twitter.com/ZwrrxaIVrH

— Emperor Osmo? (@Flowslikeosmo) May 13, 2023

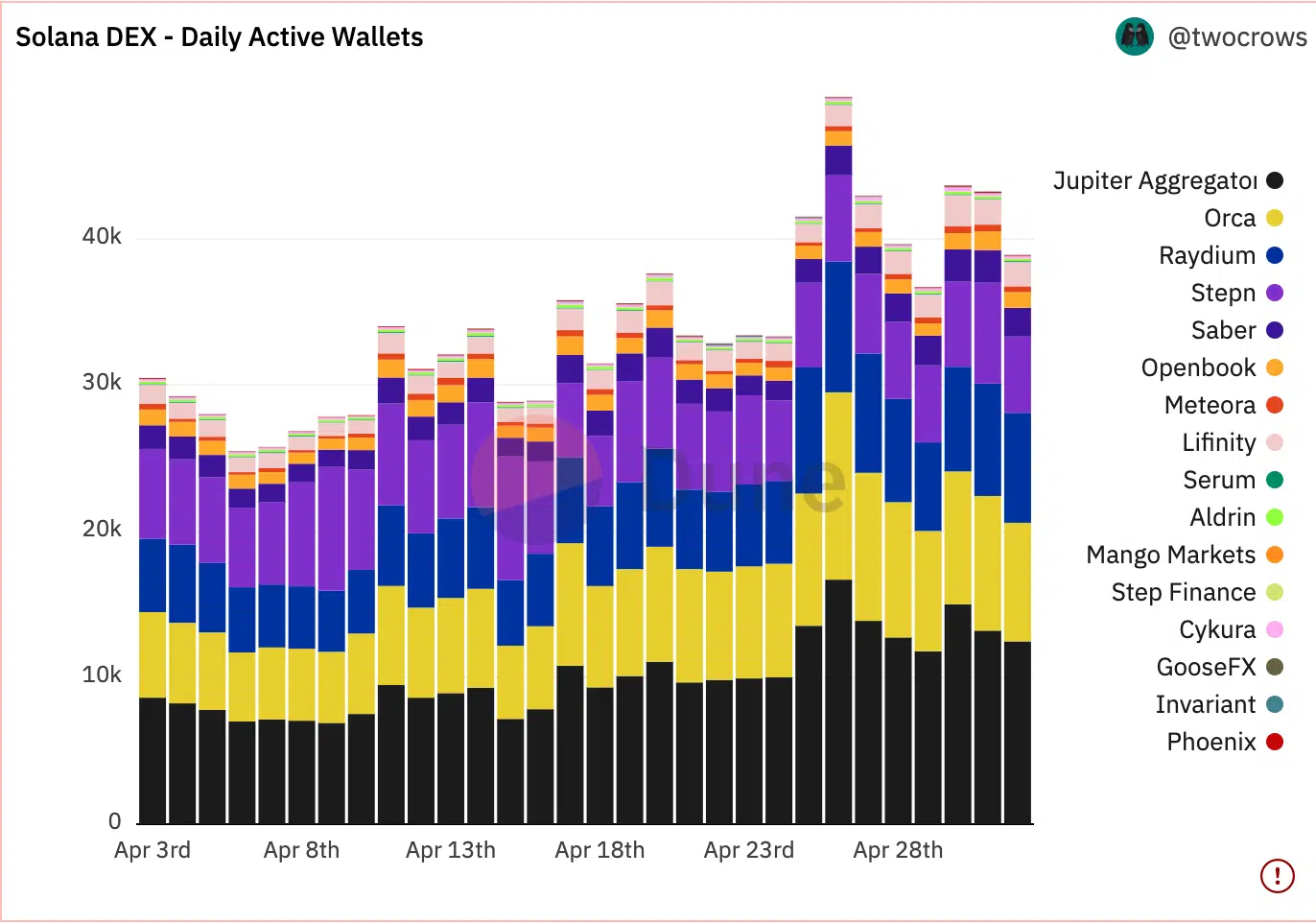

A large part of the spike in DEX volumes could be attributed to Raydium’s growth. Raydium is an onchain order book AMM.

An on-chain order book AMM facilitates trading by matching buy and sell orders on the network without the need for an off-chain order book.

According to Dapp Radar’s data, the number of unique active wallets on Raydium increased by 84.9% over the last week. Additionally, the number of transactions being made on the network surged by 147.9%.

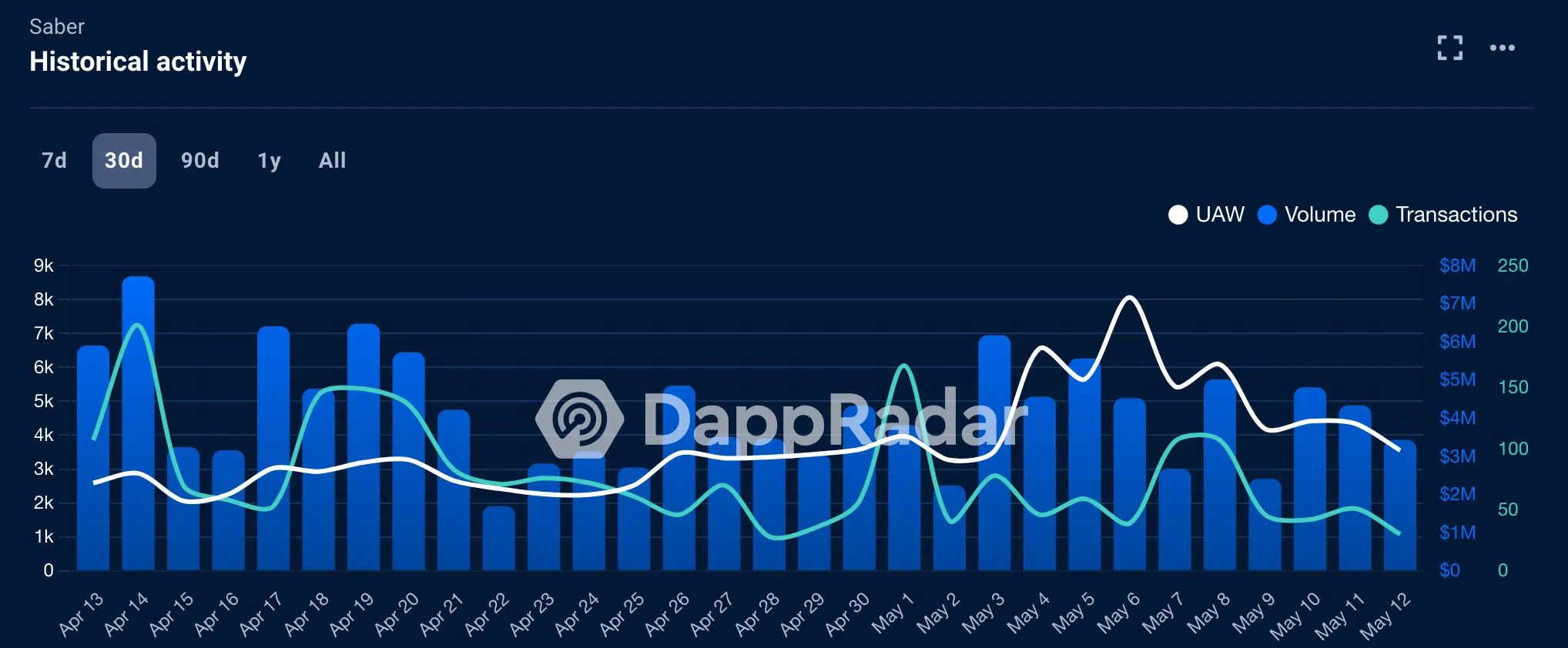

Other dApps on the Solana network, such as Saber also showed improvements. Dapp Radar’s data indicated that volume and activity on the protocol soared materially on the network over the past month.

Due to the performance of these DEXes, the overall number of unique DEX wallets across all Solana platforms increased.

DEXes make an impact

The high DEX volumes impacted Solana’s state in the DeFi sector as well. DeFi Llama’s data indicated that the TVL on smart contracts increased steadily over the last few months.

Coupled with that, the overall fees generated also increased as a result of high activity on the network.

Realistic or not, here’s SOL’s market cap in BTC terms

A high TVL for Solana indicates a strong demand for its DeFi protocols and services, which can lead to increased adoption and growth of the Solana ecosystem.

However, despite the performance showcased by Solana in the DeFi sector, SOL’s price continued to decline over the past month. Its volume suffered the same fate as it fell from 1.36 billion to 366 million during the same period.