Can Solana’s 51% NFT royalties boost demand for SOL?

- Solana now holds 51% of NFT royalties, surpassing Ethereum.

- Low fees and fast transactions are driving SOL demand and investor interest.

Solana [SOL] has recently surged to capture a 51% share of the NFT royalties market, surpassing Ethereum [ETH]. This growth highlights a strong preference for its high-speed, low-cost blockchain among NFT creators and collectors.

Beyond market dominance, Solana’s success in the NFT sector is likely to enhance demand for its native token and bolster investor confidence.

Is Solana becoming the go-to blockchain for NFTs?

Solana’s competitive edge in the NFT market stems from its faster transactions and lower fees compared to other blockchains, including Ethereum.

These advantages make it an attractive choice for NFT creators and collectors seeking efficiency and cost-effectiveness.

By lowering barriers to entry, Solana enables creators to mint and trade NFTs affordably, while collectors benefit from seamless transactions without high gas fees.

Increased NFT activity pushes demand for SOL

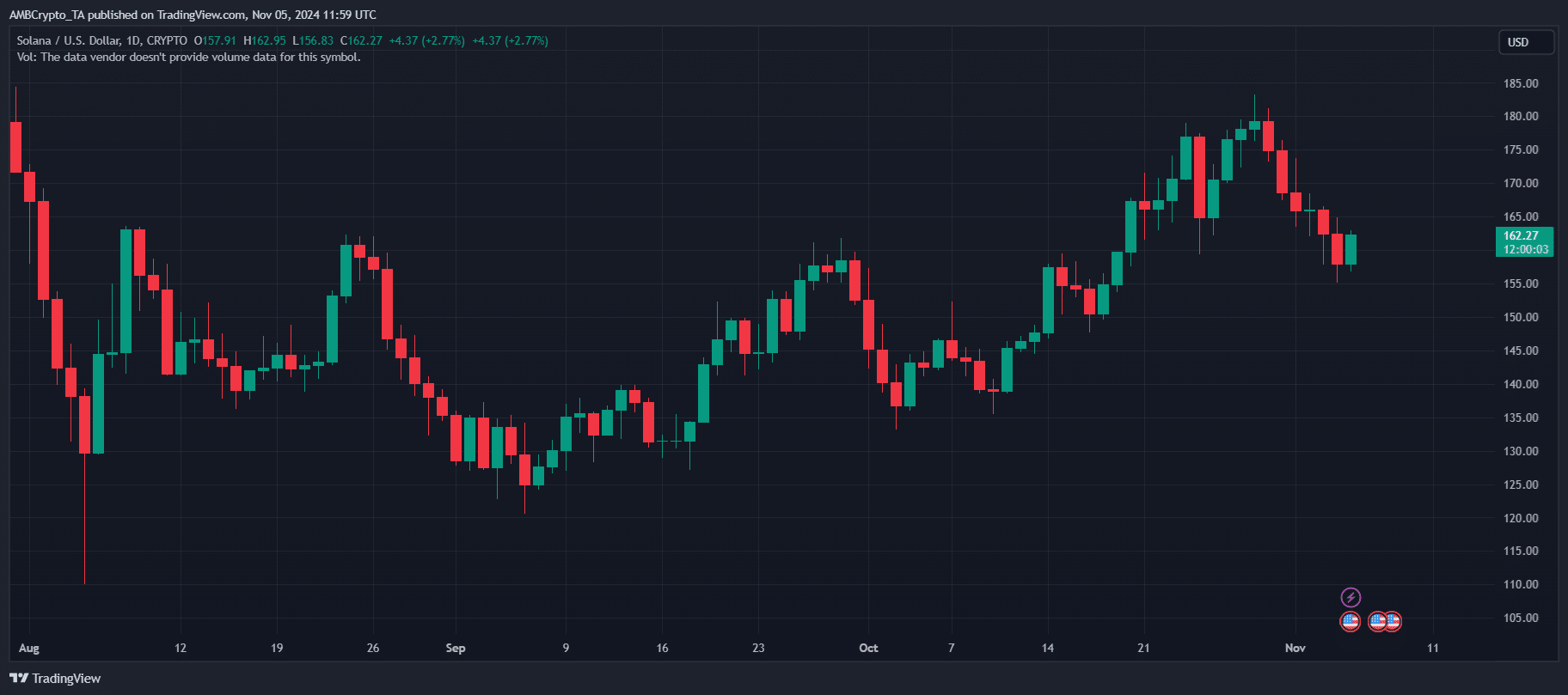

Over the past few weeks, Solana’s price has shown a series of higher lows, indicating a steady growth trend – peaking above $180 before a pullback to around $162.

Increased NFT activity, combined with low fees and efficiency, is boosting demand for SOL, pushing its price higher. This demand is not only practical but speculative, as investors eye Solana’s position as an NFT leader.

If this momentum continues, SOL could maintain its upward trend.

Solana’s strong performance in the NFT sector is enhancing investor confidence in its long-term potential. As it establishes itself as a leader in NFTs, both institutional and retail investors are increasingly viewing SOL as a viable asset.

High-profile collections on Solana-based marketplaces like Magic Eden, along with brand adoption of NFTs, demonstrate the platform’s expanding ecosystem.

Additionally, growing venture capital interest in Solana-linked projects further reflects confidence in its ability to attract mainstream engagement.

Can Solana sustain its NFT-driven price gains?

Solana’s rapid growth in the NFT market has generated optimism for SOL’s price, but several risks could hinder its momentum.

Increasing saturation in the NFT space, along with competition from Ethereum – now reducing gas fees – and newer blockchains like Polygon and Avalanche, poses challenges to its dominance.

Additionally, technical issues, including occasional network outages, raise concerns about its performance under pressure.

Is your portfolio green? Check out the Solana Profit Calculator

While Solana currently holds a strong position, maintaining its edge will require continuous network enhancements, strategic partnerships, and broader applications.

Its success in the NFT market has laid a solid foundation, but long-term value will hinge on adaptability in a competitive landscape.