Can Solana’s $5B DeFi milestone help rescue SOL’s price action?

- Solana locked in DeFi, including liquid staking, hit an ATH

- Several metrics hinted at a price correction for SOL

Solana [SOL] has been fairly popular lately, with its ecosystem continuing to expand. In fact, the rise in adoption has also allowed the blockchain to hit new highs on multiple fronts recently.

Hence, it’s worth investigating whether these developments will have any impact on the token’s price action or not.

Solana’s new milestones

According to Solana Floor’s latest tweet, Solana locked in DeFi, including liquid staking, has now soared to a record-breaking 36 million SOL. This is a major development as the aforementioned number is an ATH for the network. At the time of writing, the locked SOL was worth more than $5 billion.

In the context of Solana’s expanding ecosystem, AMBCrypto had previously reported that Coinbase listed one of Solana’s DePIN tokens – io.net. That’s not all though as according to another tweet, Solana’s Spot DEX volumes exploded to $480 billion year-to-date (YTD) in 2024.

These figures surpassed the annual volumes of 2022 and 2023 – Another sign of how popular SOL is among investors.

Will this help SOL?

Amidst all this, SOL bulls gained control of the market as the token recorded an over 3% price hike. At the time of writing, SOL was trading at $146.45 on the charts.

AMBCrypto then planned to have a closer look at the token’s state to find out whether the aforementioned achievements will have a positive impact on SOL’s price.

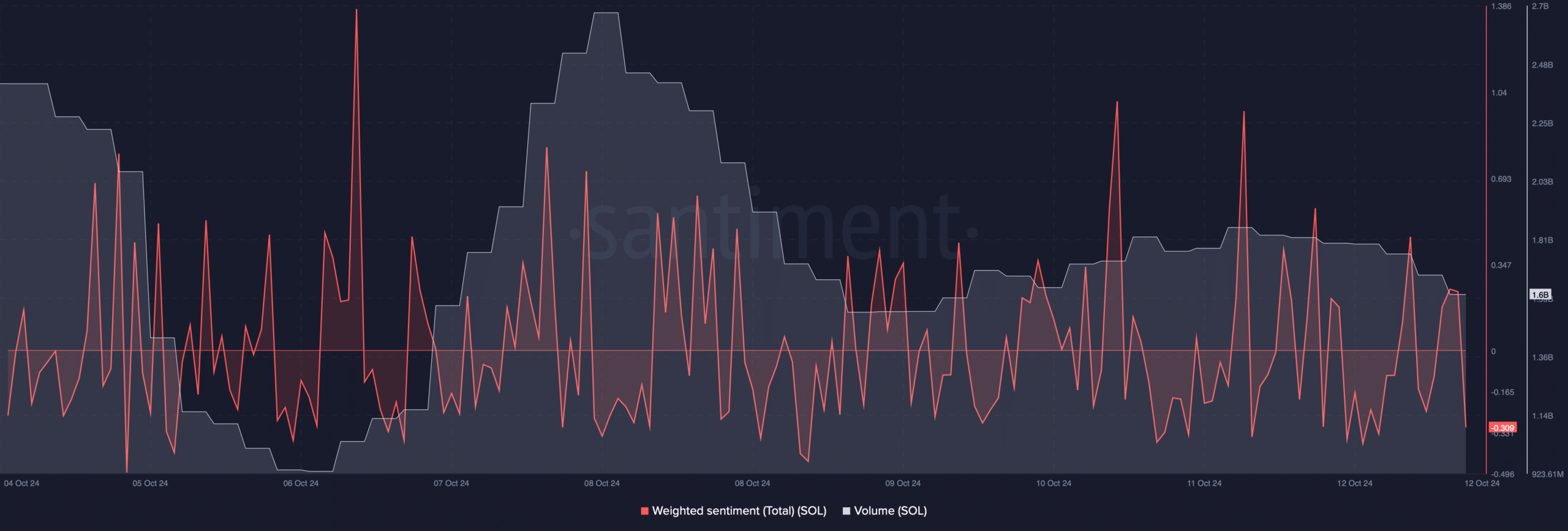

As per our analysis, the token’s trading volume dropped while its price rose. Such incidents suggest that a bull run might not last. Solana’s weighted sentiment also fell, indicating an uptick in bearish sentiment around the token.

Additionally, at the time of writing, SOL’s fear and greed index was sitting in the “greed” position. When this metrics hit that level, it means that the chances of a price correction may be high.

Read Solana’s [SOL] Price Prediction 2024–2025

However, the good news is that as per DeFiLlama’s data, SOL’s netflows turned negative too. Whenever figures for the same fall into the negative zone, it means that buying pressure is high.

A hike in buying pressure could be inferred as a bullish signal as it often results in price hikes.