Can Solana’s booming NFT sector lure in more users

- Solana’s NFT ecosystem experienced impressive growth, with record-breaking minting activity and a surge in compressed NFT.

- Despite challenges, Solana’s development activity remained strong.

Despite the roller-coaster ride of the Solana [SOL] protocol in recent years, its NFT ecosystem remains a captivating domain. Solana’s NFT landscape was marked by significant developments, offering both excitement and challenges.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Record-breaking mint activity

In August, Solana experienced an NFT minting frenzy, with its ultra-low-cost Compressed NFTs leading the way. These compressed NFTs achieved an astonishing minting volume exceeding 15.6 million, all while incurring a mere 82 SOL in fees. This remarkable feat set a new record, emphasizing the protocol’s prowess in handling NFTs efficiently.

The numbers tell a compelling story. Solana at press time boasted nearly 78 million compressed NFTs, surpassing their non-compressed counterparts. These constitute a substantial 55.62% of the total NFT count and contribute significantly, accounting for 21.5% of Solana NFTs’ monthly sales volume in August. This surge in minting activity points to a thriving NFT community on Solana.

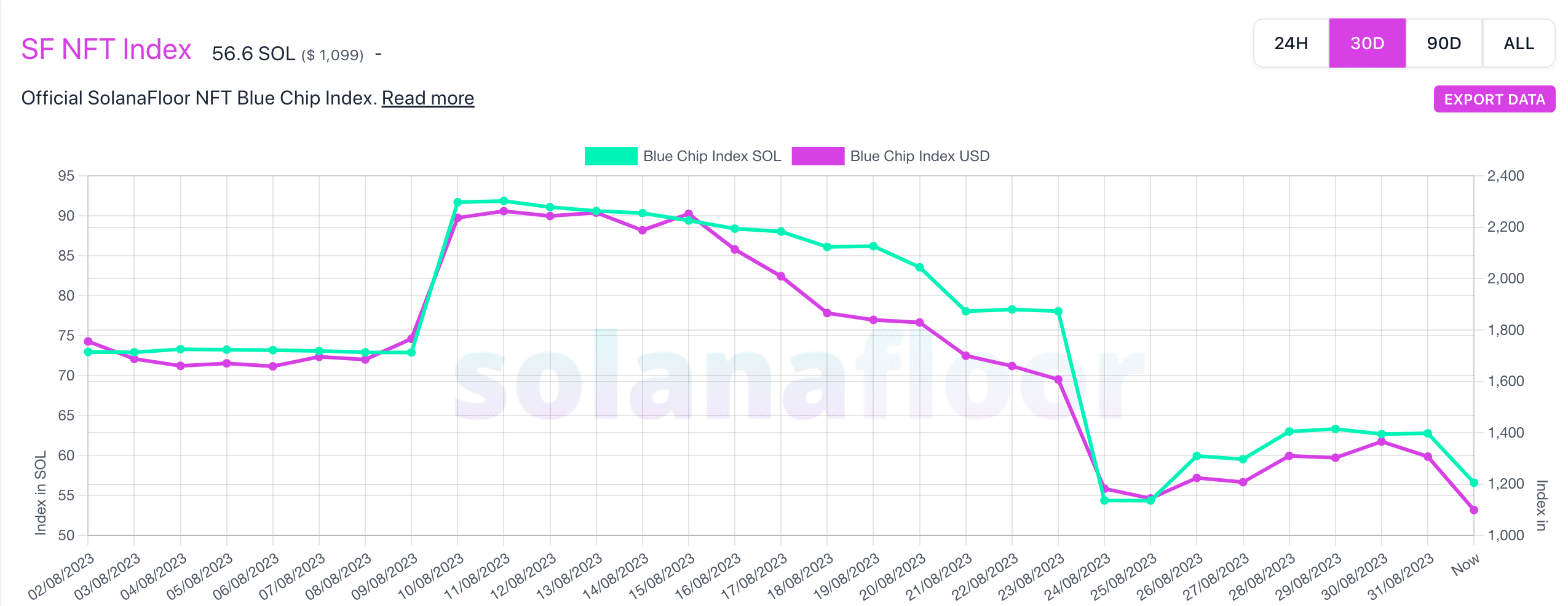

However, while the overall NFT ecosystem on the protocol was flourishing, the story was not the same for blue-chip NFTs. Solana’s floor data revealed a noticeable decline in the blue-chip NFT index over the past month. This dip indicated that despite the minting boom, blue-chip NFTs on Solana faced headwinds.

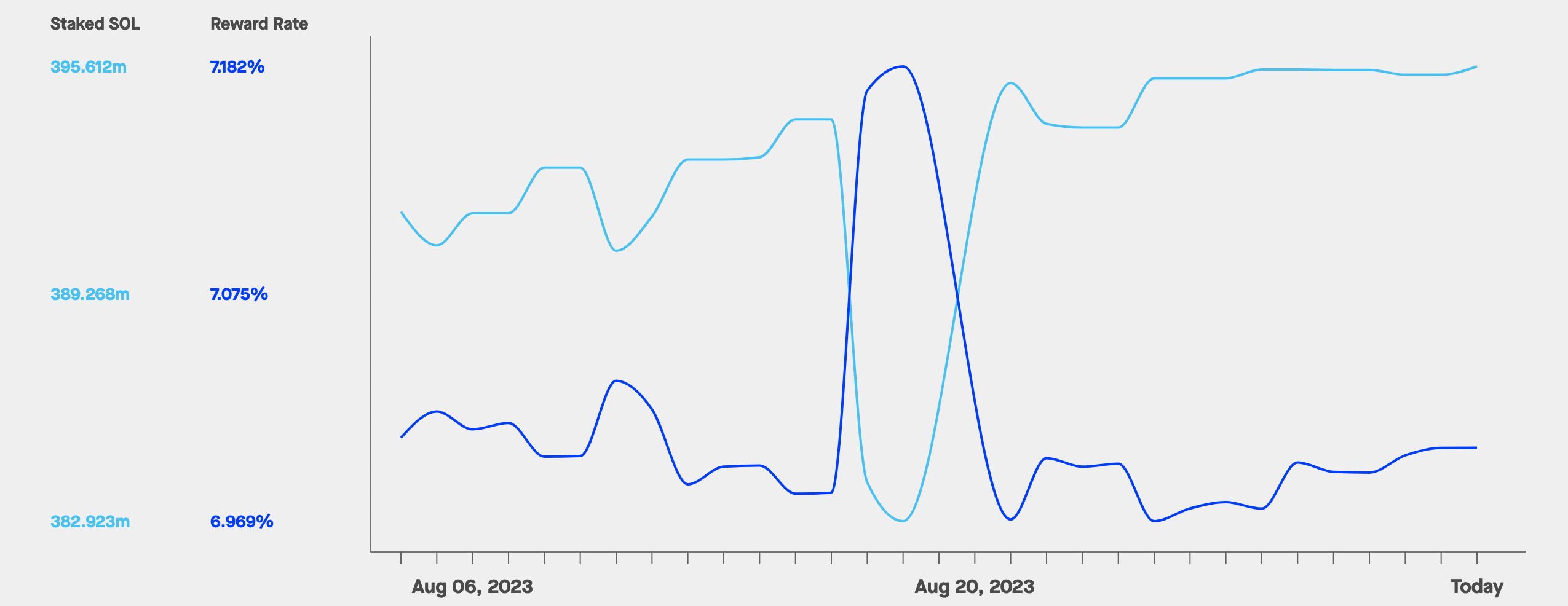

Shifting the focus to staking, Solana witnessed a substantial increase in the number of staked SOL over the last month. The growing interest in staking SOL aligned with the broader trend of crypto enthusiasts seeking to earn rewards through token staking.

However, this surge in staked SOL comes with a caveat—the reward rate for staking SOL significantly fell during the same period. This decrease may impact the attractiveness of staking SOL in the short term.

However, a potential game-changer for Solana looms on the horizon. The contemplation of forking MakerDAO onto Solana, expressed by the founder, raises intriguing prospects. Such a move could draw further attention to the network and its capabilities, potentially attracting developers and projects to the ecosystem.

Protocol activity and future outlook

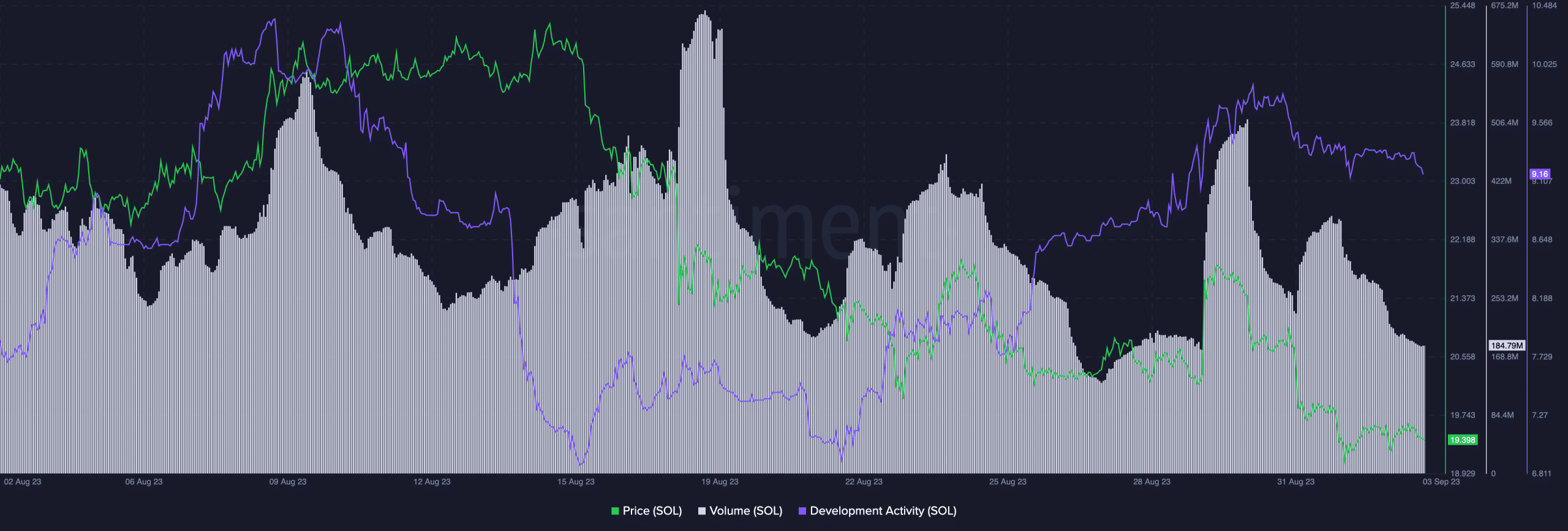

Examining the overall state of the protocol, activity experienced a decline of 27.3% over the last month. Simultaneously, revenue also fell by 1.3%.

Is your portfolio green? Check out the Solana Profit Calculator

Despite these challenges, the network’s development activity remains robust. This indicated ongoing upgrades and improvements within the protocol, which could shape its future course.

Solana’s recent performance in terms of price and trading volume was less than stellar, with the price dipping to $19.38. While this may concern some investors, the heightened development activity suggests a dynamic ecosystem with potential surprises in store.

![Ethereum [ETH] targets $1,810 – Will THIS crucial level ignite a breakout?](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-59-400x240.jpg)