Can Sonic’s DeFi outpace Solana, Ethereum as addresses hit ATHs?

- Sonic’s unique addresses hit an all-time high as its TVL skyrocketed to almost $1 billion

- Sonic’s stablecoins and DeFi ecosystem are thriving, with high-volume trading across multiple DEXs

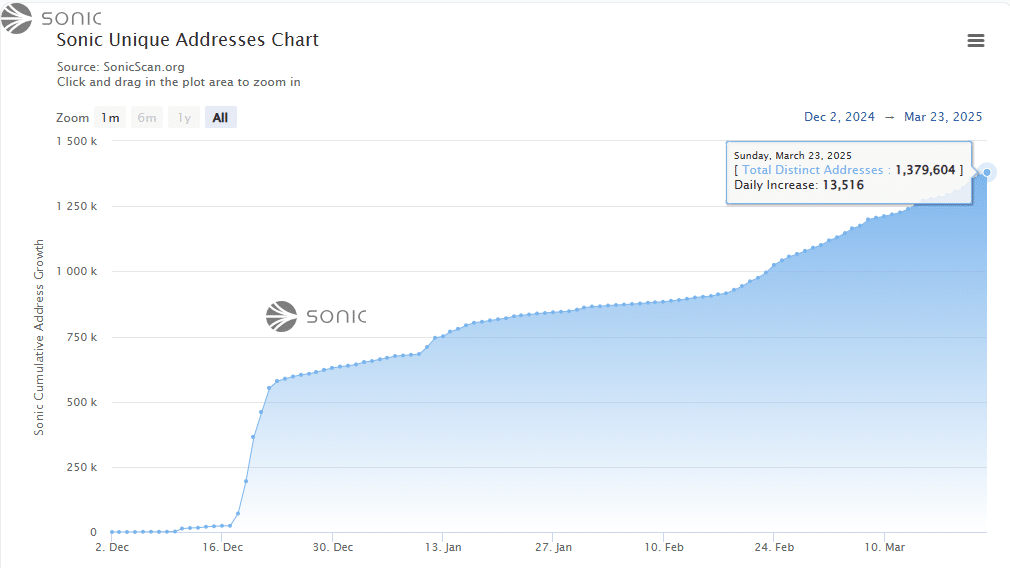

An analysis of Sonic (S), formerly Fantom, and its unique addresses chart established a maximum total of 1,379,604 addresses, with the same growing by 13,516 each day. In fact, from mid-December 2024, Sonic Unique Addresses have demonstrated a speedy expansion for almost a week.

This was followed by a stabilization period from mid-December through mid-January, before the start of constant growth that spiked towards the end of February 2025. This eventually led to the recent spate of ATHs.

Sonic’s market expansion achieved its growth through network acceptance and DeFi growth – Bringing more users into its ecosystem.

The Sonic network strengthened its user base through incentive offers and distributed free assets to users for new wallet account setups. This, combined with the implementation of cross-chain features, has really helped improve asset transfer functionality.

New addresses developed on the network reflected rising on-chain activity that enhanced user transactions and liquidity. This, while also attracting more users to participate in staking. This also led to Sonic’s market demand growth strengthening its long-term potential, especially after its upgrade.

Why is Sonic’s DeFi thriving?

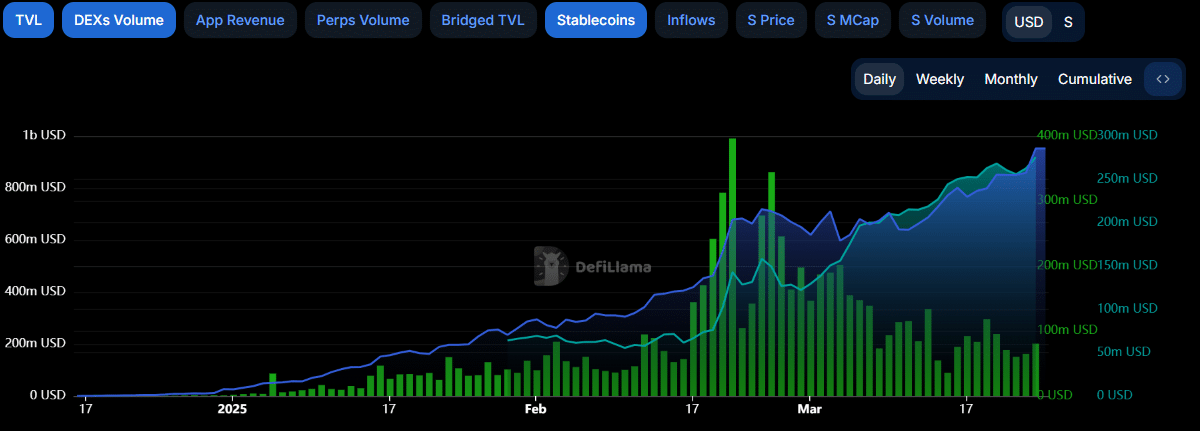

This on-chain spike led to strong growth across Sonic’s DeFi ecosystem because of high trading activity in its leading decentralized exchanges, total value locked (TVL), and stablecoin supply growth, together with important platform partnerships.

The DEX trading volumes were led by ShadowOnSonic, which stood at $38.6M, while SwapXfi reached $10.3M, and WagmiCom brought in $7.4M.

Major projects that joined Sonic included AAVE, Beets.fi, and Pendle Finance in 2025. These will contribute to an even greater surge of liquidity. Circle will also be releasing native USDC with CCTP V2.

Sonic’s TVL grew by 87% over the past month and stood at $951.96 million at press time – A sign of strong community adoption. The Market Cap/TVL ratio stood at 2.2x for S, while Solana held a higher ratio of 12.7x – A sign that S has substantial market potential that is yet to be unlocked.

The expansion of Sonic’s DeFi capabilities also depends on stablecoins, with the same now exceeding $250 million in market value. The native USDC integration through Circle’s CCTP V2 offers to transform the cross-chain liquidity market by replacing bridged USDC.e.

The chain upgrade brought instant USDC minting abilities between chains, which eliminated troublesome bridges alongside their associated delays.

The expanding metrics have created optimal conditions for Sonic’s price discovery, while solidifying its role as a top DeFi blockchain. The introduction of non-custodial lending via SiloFinance and advanced DeFi tools via ChainGPT have positioned Sonic to provide stiff competition to chains like Solana and Ethereum, before dominating the next market cycle.