Altcoin

Can Synthetix Perps v2 achievement save SNX from the bears

- SNX’s revenue and fees spiked in recent days, but metrics were bearish.

- Market indicators showed signs of recovery and suggested a price uptick.

Synthetix [SNX] continues to make news with its achievements, the latest being Perps V2. Synthetix revealed in a recent tweet that Perps V2’s cumulative volume reached nearly $2 billion, while its daily volume somewhat touched $115 million. This was a commendable achievement, as only a week ago, Perp V2’s daily volume touched $100 million.

Synthetix Perps nears $2B in cumulative volume and $115M in daily volume! This is a massive milestone for Synthetix and DeFi as a whole

Integrators have worked tirelessly to make this possible.

Cheers to them @Kwenta_io, @PolynomialFi, @DecentrexHQ, @dHedgeOrg

❤️ ⚔️ pic.twitter.com/AQpfDRKjlT

— Synthetix ⚔️ (@synthetix_io) March 16, 2023

Realistic or not, here’s SNX market cap in BTC‘s terms

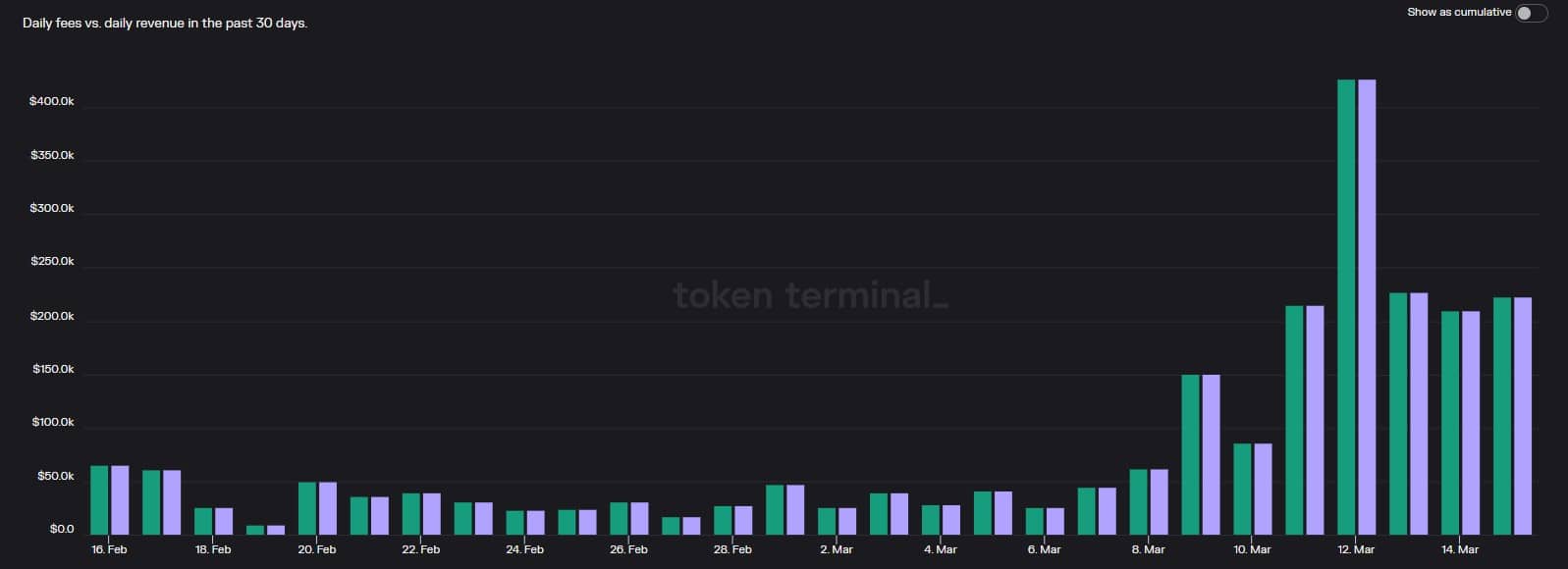

Thanks to the massive increase in volume, Synthetix’s fees and revenue also spiked over the last few days. As per Token Terminal, Synthetix’s fees and revenue gained upward momentum since 7 March and later spiked substantially on 12 March.

While these achievements suggested growth for the network, the same might not be true for its native token, SNX.

Here is the catch

SNX network’s growth seemed impressive, but the token’s state might be questionable, thanks to the whale which recently dumped SNX.

As per Lookonchain, an address transferred 2.66 million SNX to Binance, which was worth $7.5 million. The same account had earlier spent 15 million USDC to buy 5,436,960 SNX from Synthetix Treasury between 14 and 16 March.

The institution spent 15M $USDC to buy 5,436,960 $SNX from #Synthetix Treasury between Mar 14 and Mar 16, the average buying price is $2.76.

Then transferred 2.66M $SNX (7.5M) to #Binance 5 hrs ago.

Maybe he/she already sold $SNX on #Binance.https://t.co/rHJJjwwRdw pic.twitter.com/WUEZSQDPeh

— Lookonchain (@lookonchain) March 17, 2023

This looked bearish and can increase selling pressure, which can, in turn, push SNX’s price down.

Talking about price, SNX had already registered a daily decline of over 5%. At press time, it was trading

at $2.80 with a market capitalization of more than $710 million.SNX in trouble?

A look at SNX’s on-chain metrics gave more reasons to worry, as it suggested a further price drop in the following days.

Consider this– SNX’s Binance funding rate declined considerably, indicating less demand from the derivatives market. Exchange inflows have also spiked lately, which is typically a bearish signal.

In addition to that, SNX’s development activity declined over the last week, suggesting fewer efforts from the developers in improving the network.

Read Synthetix’s [SNX] Price Prediction 2023-24

Here is the good news

While the metrics supported the bears, SNX’s daily chart gave hope for a trend reversal. The Money Flow Index (MFI) bounced from the neutral mark and was headed northward, which looked optimistic.

The Chaikin Money Flow (CMF) also followed the same trend and moved upward. However, the MACD displayed a bearish advantage in the market, which can be troublesome for SNX.