Can Uniswap cross $10 this weekend? What we know so far!

- Uniswap surged by over 8% after retesting a key support level.

- 520% surge in active addresses suggests growing network adoption

Uniswap [UNI] has demonstrated significant strength after successfully defending the $8.75 support level and subsequently posted an impressive 8% gain.

The altcoin’s recent price action suggests that bulls are regaining control of the market momentum.

Technical breakout signals bullish momentum

Uniswap has broken out from an ascending triangle pattern, a trading pattern that historically precedes a bullish run.

Since its breakout from the consolidation phase, UNI has tested the $8.75 support level several times in the past week. This reinforces the support level as a significant demand zone for the altcoin.

The successful defense of this level indicates Uniswap’s strong buyer presence.

Uniswap metrics flash positive signals

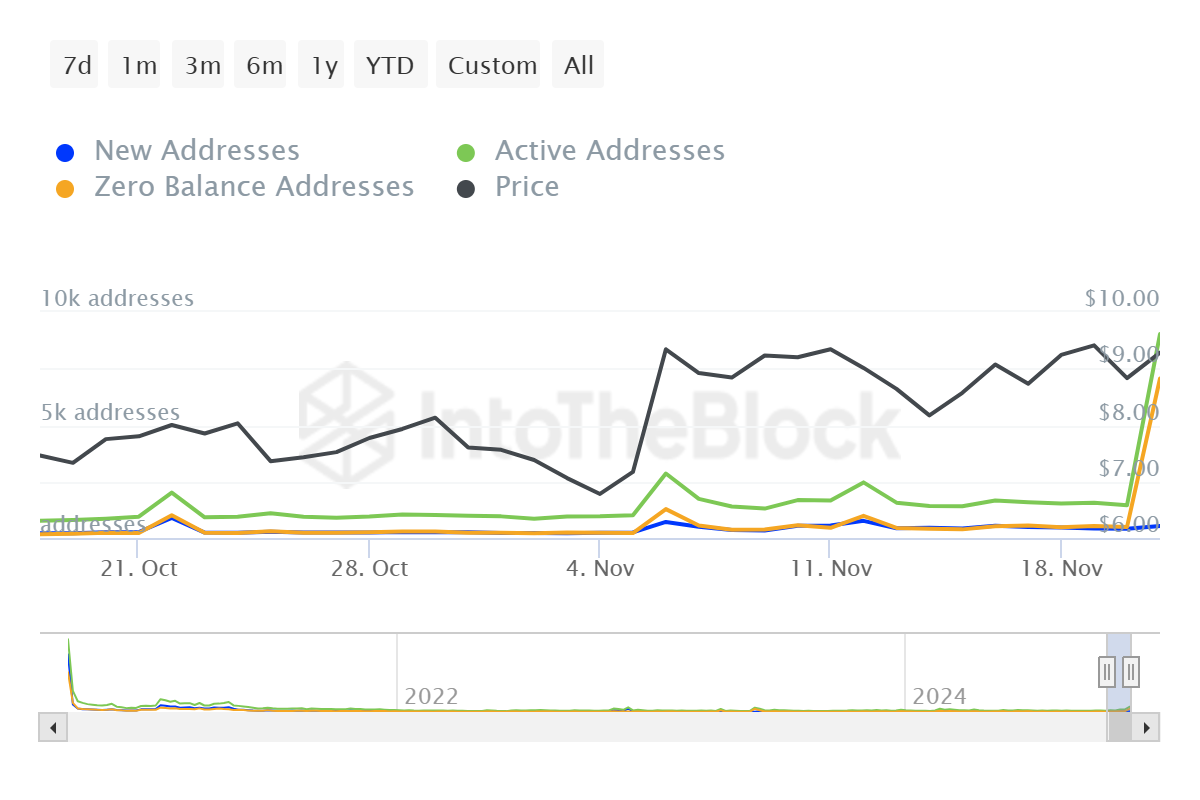

AMBCrypto analysis on the on-chain data reveals a substantial increase in network activity. Uniswap active addresses have exploded by 520% over the last 24 hours alone, suggesting a significant uptick in user engagement.

Source: IntoTheBlock

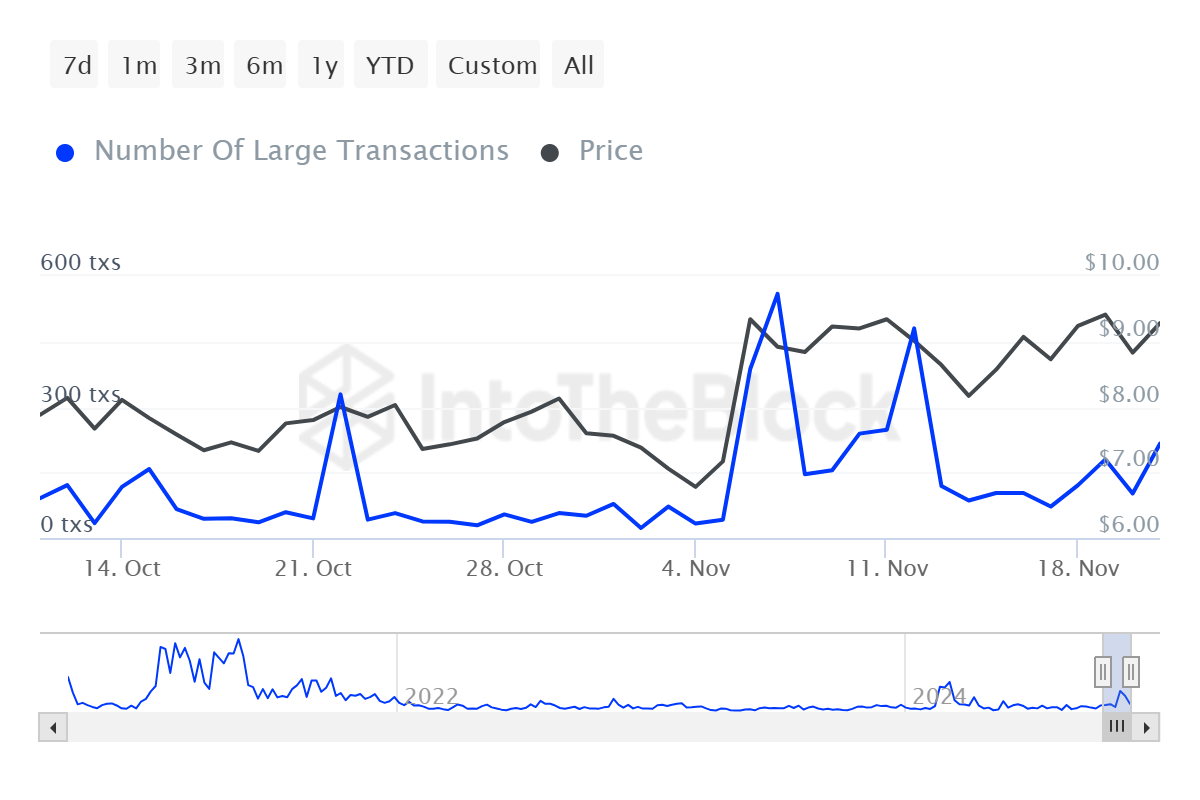

This rapid surge in large transactions coincides with a 143% increase in large transactions, indicating growing whale interest in UNI.

The significant surge in both active addresses and large transaction volume suggests growing institutional interest.

This surge in network participation often precedes sustained price movements, as increased trading activity typically leads to higher price discovery.

Critical liquidation level ahead

Coinglass’s report on liquidation heat map data reveals a significant cluster of positions around the $9.73 price level, with approximately 430K UNI worth of liquidations.

The liquidation pool may act as a price magnet to push UNI prices higher in favor of the long position takers. This further adds to the likelihood of a Uniswap potential bullish run.

Source: Coinglass

Realistic or not, here’s UNI’s market cap in BTC’s terms

Both Uniswap technical and on-chain metrics paint a bullish picture. However, the $9.73 resistance level remains crucial.

A successful breach above this level could trigger a cascade of liquidations, potentially fueling further upside momentum.