Can Uniswap’s retail traders rescue UNI’s price from falling again?

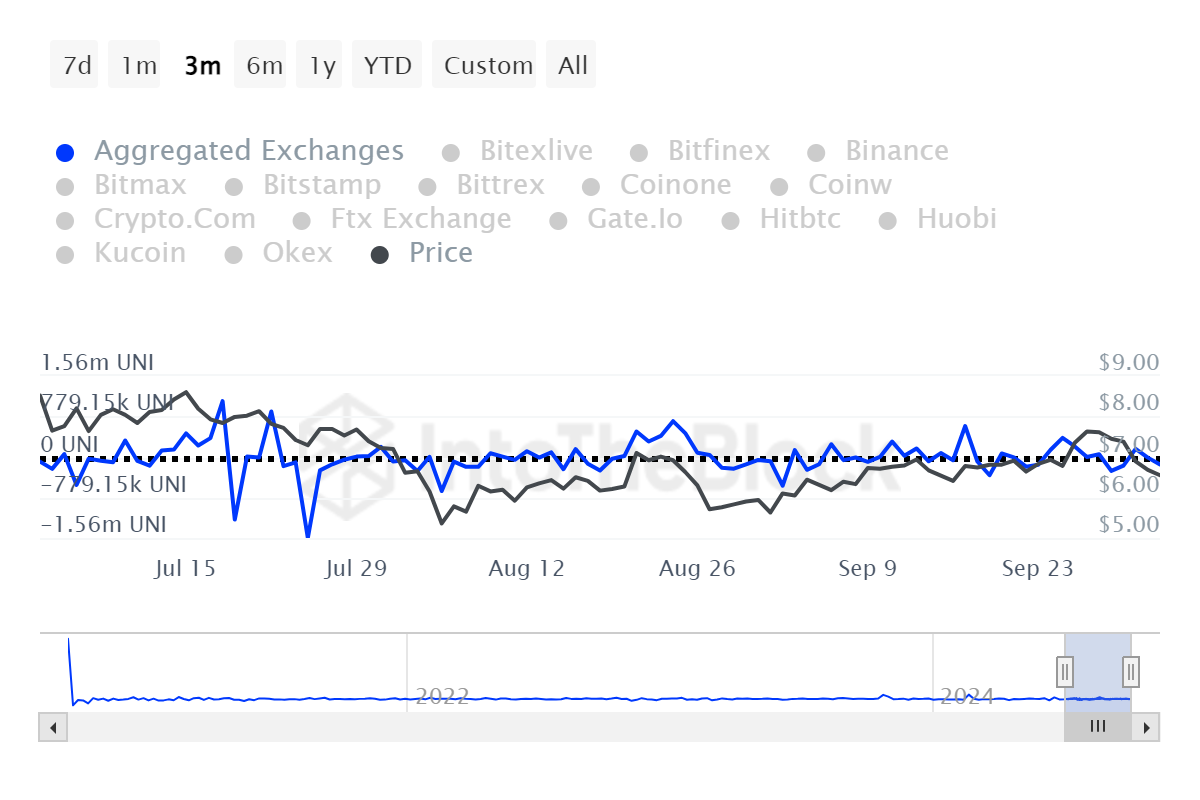

- Uniswap’s exchange netflow has surged by a massive 1195%, indicating higher trading activity

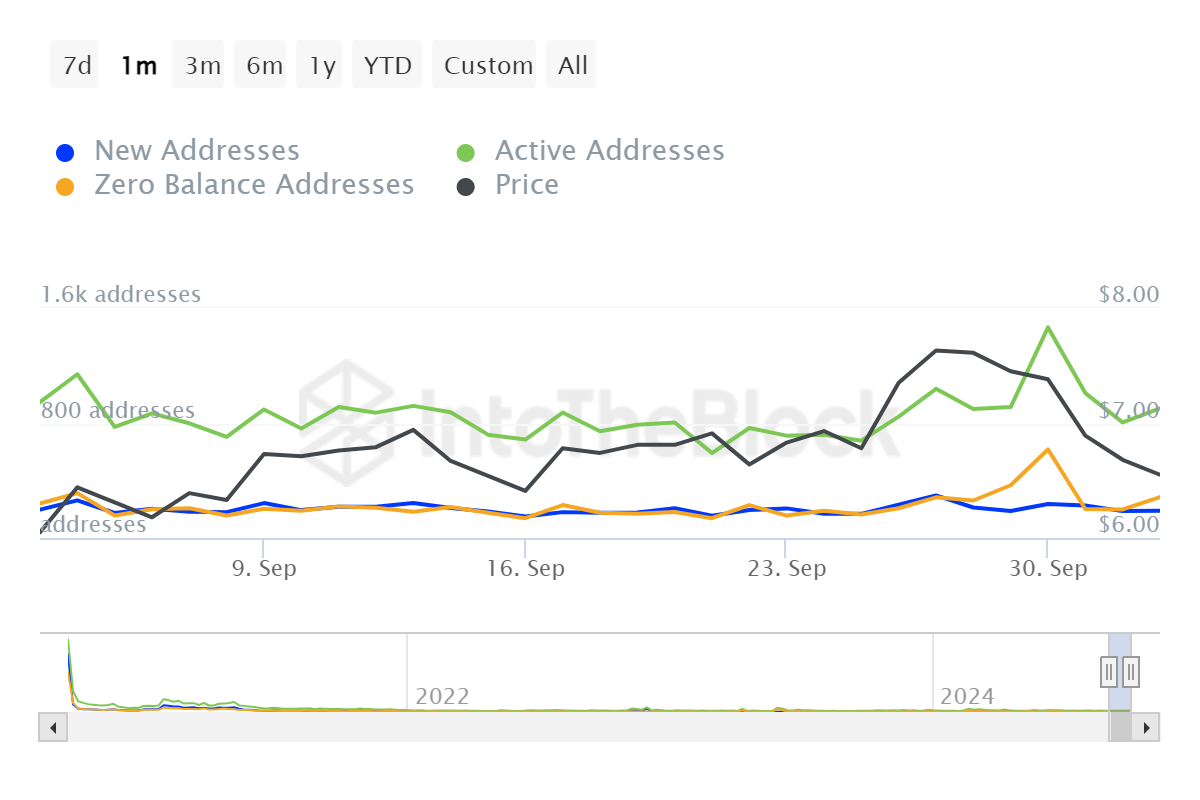

- Despite surging active addresses, a sharp 63% drop in large transactions raises concerns

Uniswap (UNI) has scaled by 1195% in exchange netflows, indicating increasing activity on the platform. This has triggered debates as to whether this could point to a price bounce in the wake of active addresses recording a hike of 11.9% too.

However, large transactions have fallen by 63%, leaving some doubts about institutional interest.

What does exchange netflow surge mean for Uniswap?

The recent spike in Uniswap’s netflow implies more money flows into the market, possibly a rush to capitalize on highly volatile price movements.

This usually means higher trading volumes as retail traders become more active.

A heavy upsurge of activities often leads to short-term volatility in an asset’s price. In the case of Uniswap, it could mean greater buying and selling pressure, setting the stage for a possible rebound in UNI’s price in the short run.

Are retail traders stepping up?

An 11.9% incline in active addresses means that retail traders are coming on board. More users interacting with the platform could also mean more demand for Uniswap.

Here, it is worth noting that retail traders are often crucial for sustaining momentum when institutional interest is especially soft.

On the contrary, the 63% drop in large transactions did point to a significant drop in whale activity. This trend suggests that major investors have been on the sidelines, watching the market dynamics.

Without the big players, the long-term movement of a retail-driven rebound may face some resistance.

Will Uniswap rebound?

The answer probably lies in how long retail traders can keep this activity going and push the price upwards. If retail activity keeps increasing, we might witness a short-term price bounce.

However, without large transaction volumes returning, the price of UNI might not be able to sustain such rallies.

Retail traders can probably keep UNI afloat, but sustained interest by institutional players will be key to any long-term recovery.

![Pudgy Penguins [PENGU] memecoin rose just 1% on the 5th of August.](https://ambcrypto.com/wp-content/uploads/2025/08/Lennox-400x240.jpg)