Can VELO surge 81%? What key indicators suggest

- VELO could see an 81% surge, supported by solid market sentiment and whale accumulation.

- Oversold RSI and narrowing Bollinger Bands suggested a potential price breakout for VELO.

Velo [VELO] has been drawing attention in the market recently, with some analysts suggesting that the token could see significant upward momentum.

An analysis shared by a crypto analyst named Javon Marks on the X (formerly Twitter) claimed that VELO could make an 81% move toward $0.028876, driven by bullish market conditions.

But does the data support this optimistic outlook?

At press time, VELO was trading at $0.01611, an 8.94% daily increase. This reflected rising interest and positive sentiment surrounding the token.

Additionally, the token has maintained a healthy market cap of $119M with strong trading volumes of $21.69M over the last 24 hours.

These figures indicated solid market interest, but does this translate into sustainable growth?

Is whale accumulation fueling VELO’s growth?

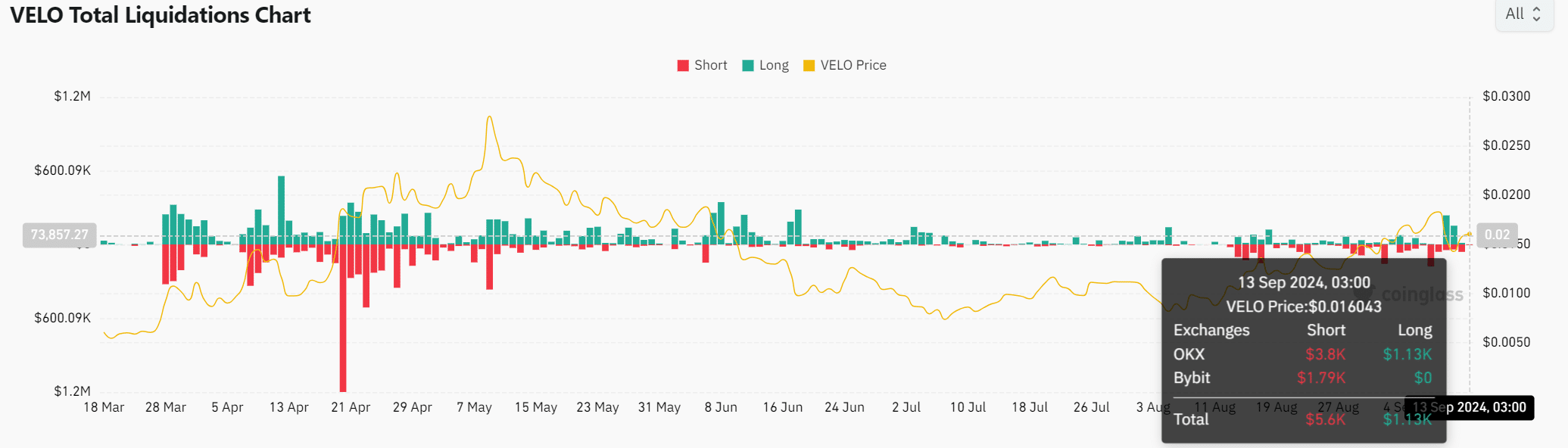

Whale activity has been a key driver for many bullish moves in cryptocurrency markets. On-chain data revealed that VELO has seen significant whale accumulation, evident in the total liquidations chart.

The balanced mix of $5.6K in shorts and an increasing volume of $1.13K in long positions suggested whales and larger investors were confident in VELO’s upward potential.

Additionally, despite recent liquidations, there has been no sharp drop in VELO’s price.

This stability often hints that whales are accumulating tokens without causing price shocks, signaling confidence in its potential for future growth.

Can technical indicators support a breakout?

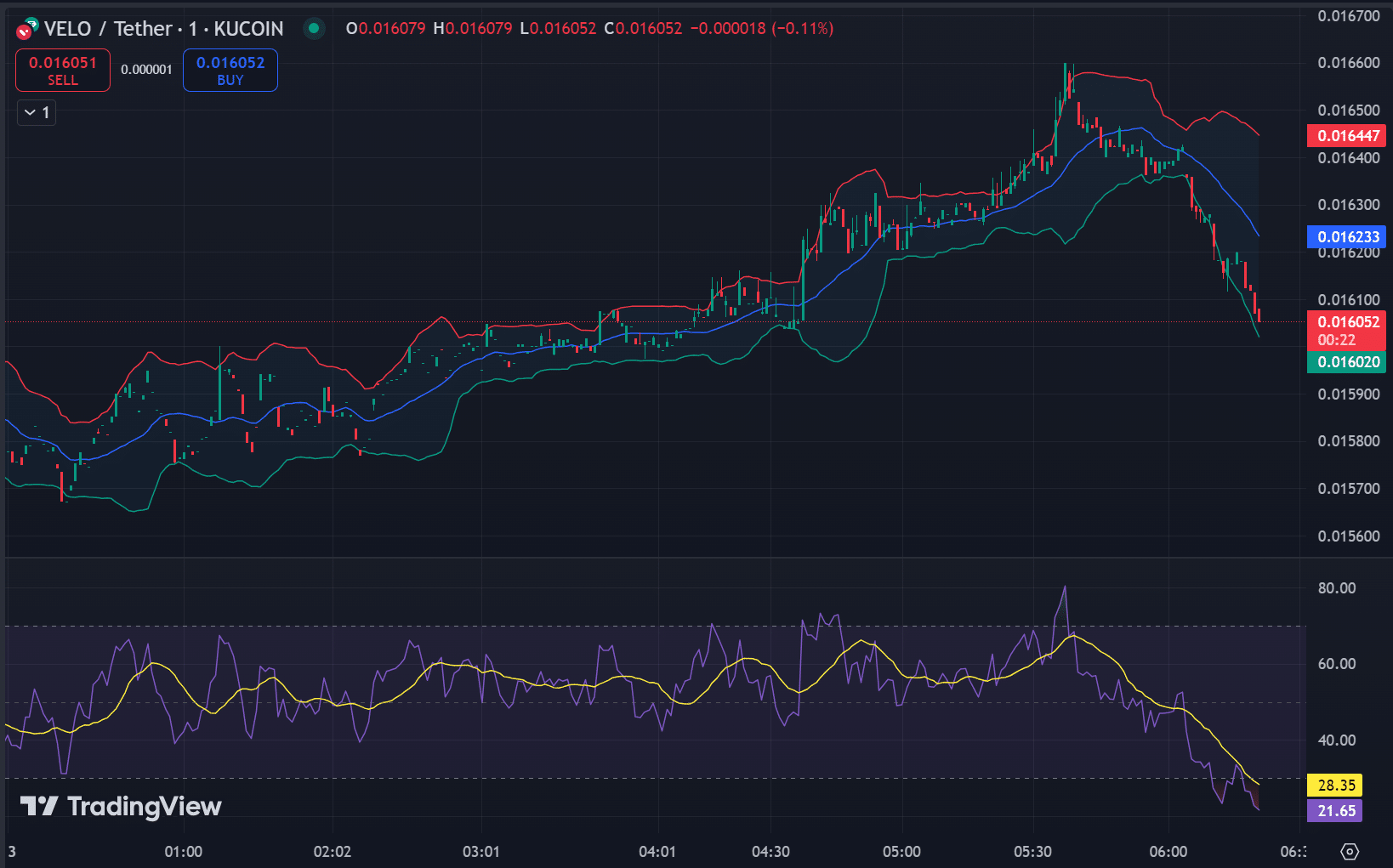

The RSI (Relative Strength Index) was 28.35 at press time, indicating that VELO was in an oversold zone. This typically suggested that selling pressure was weakening, and a reversal may be on the horizon as buyers begin to step in.

Similarly, per the Bollinger Bands, VELO was nearing the lower band, at $0.01602 at press time, while the upper band was at $0.01644. This tightening suggested low volatility, and approaching the lower band often signaled a potential price bounce.

These indicators together suggested that VELO may soon experience a rebound, but a break above key resistance levels will be essential for sustained upward momentum.

What is the likely outcome?

Although analysts suggested an 81% increase, the actual technical setup presents a more cautious outlook.

Read Velo’s [VELO] Price Prediction 2024–2025

For VELO to achieve such a significant move, it must first break above the current resistance at $0.016 and sustain momentum.

The market sentiment, whale accumulation, and oversold conditions support a potential short-term rise, but traders should watch for confirmation of a breakout before expecting an 81% rally.

![Ripple [XRP]’s subtle rebound – Will strong derivatives bets trump weak on-chain signals?](https://ambcrypto.com/wp-content/uploads/2025/04/E3CB2045-31A3-4BD4-B5BC-2142FF334BE1-400x240.webp)

![Shiba Inu [SHIB] price prediction - A 70% rally next after 300%+ burn rate hike?](https://ambcrypto.com/wp-content/uploads/2025/04/Erastus-2025-04-12T132907.604-min-400x240.png)