Can WIF’s sentiment save the day after memecoin’s 28% weekly fall?

- WIF’s price has dropped by over 28% in the past week alone

- Some technical indicators pointed to the possibility of a further decline

According to AMBCrypto’s findings, Solana-based memecoin dogwifhat [WIF] appears poised to extend its seven-day loss, despite the uptick in demand for the token.

WIF was valued at $3.31 at press time, logging a 28% value decline over the past week. The double-digit drop in WIF’s price mirrors the waning hype associated with memecoins and the general decline in the cryptocurrency market over the past seven days. In fact, according to CoinGecko’s data, global cryptocurrency market capitalization has cratered by 4% over this period.

Demand barks, but bearish sentiments roar louder

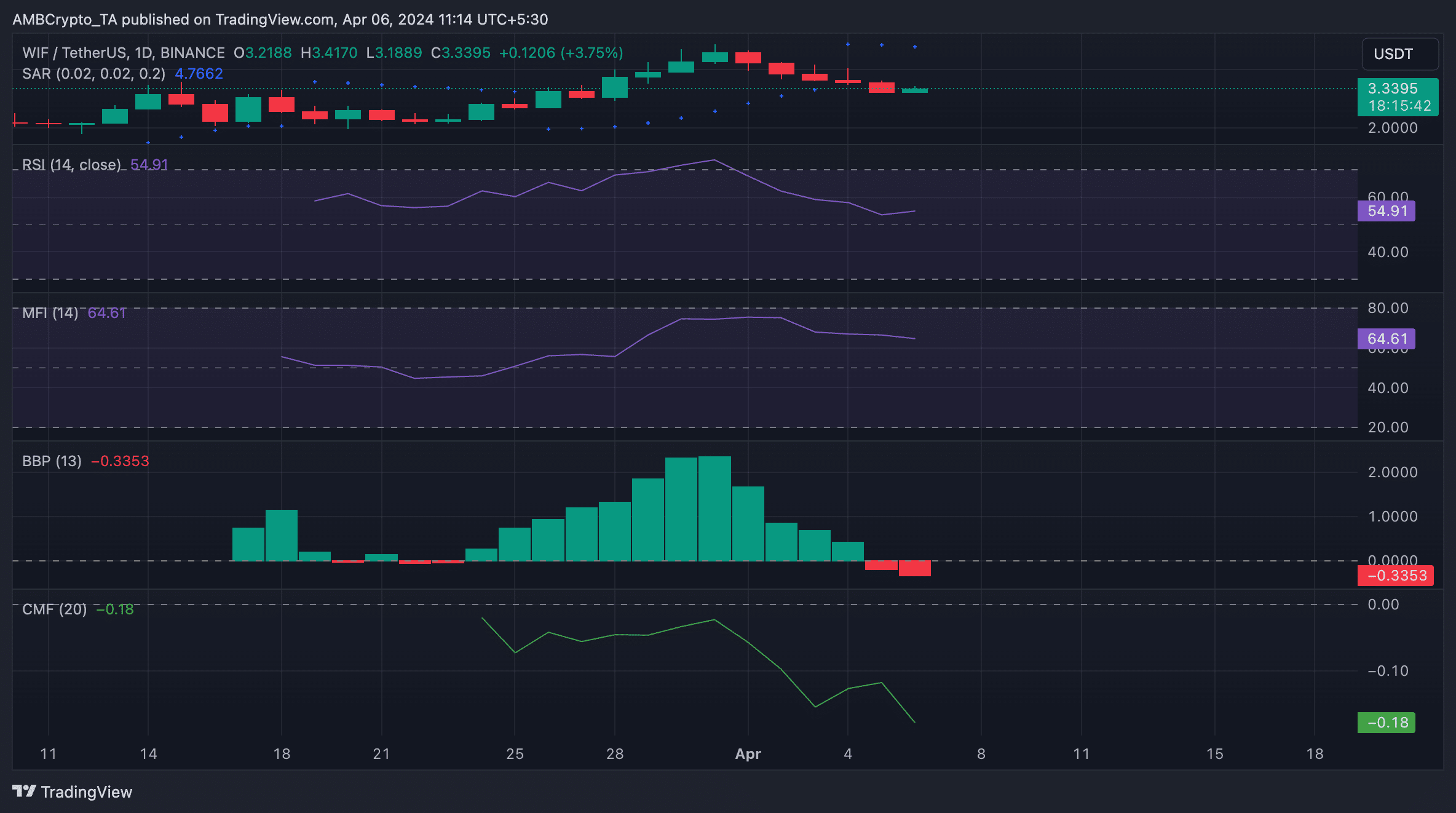

An assessment of WIF’s key momentum indicators on a daily chart showed that market participants have continued to buy WIF.

At the time of writing, the token’s Relative Strength Index (RSI) and Money Flow Index (MFI) returned values of 54.91 and 64.61, respectively, resting above their respective center lines. The values of these indicators showed that market participants favoured WIF accumulation over its sell-offs.

However, the general market’s bearish trend has made it so that WIF’s current demand might not be enough to initiate the desired uptrend.

WIF’s Parabolic SAR rested above its price at press time, suggesting that the altcoin is geared to extend its losses in the short term. This indicator measures the potential reversal points in an asset’s price direction.

When the dotted lines that make up the indicator rest above an asset’s price, it is a bearish signal. It confirms that an asset’s price will experience further decline. Traders interpret this as a sign to exit long positions and take short ones.

Realistic or not, here’s WIF’s market cap in BTC’s terms

Furthermore, AMBCrypto found that WIF’s Elder-Ray Index was negative at press time and has been so since 5 April. This indicator estimates the relationship between the strength of buyers and sellers in the market. When its value is negative, it means that bear power is dominant in the market.

WIF’s negative Elder-Ray Index showed that despite the steady demand for the altcoin, its price had closed below the exponential moving average since 5 April, implying weakness in the market.

Finally, WIF’s negative Chaikin Money Flow (CMF) confirmed that the buying volume cannot initiate an uptrend. This was supported by the CMF revealing that outflows were peaking.