Can XRP sustain its momentum? A look at key indicators and price levels

- Ripple started the year strong but has dropped in the last 48 hours.

- Bullish sentiment remains despite the drop.

XRP was trading at almost $2.4 at press time, reflecting a modest pullback from recent highs.

The cryptocurrency was in a critical consolidation phase, with its future trajectory hinging on key technical indicators.

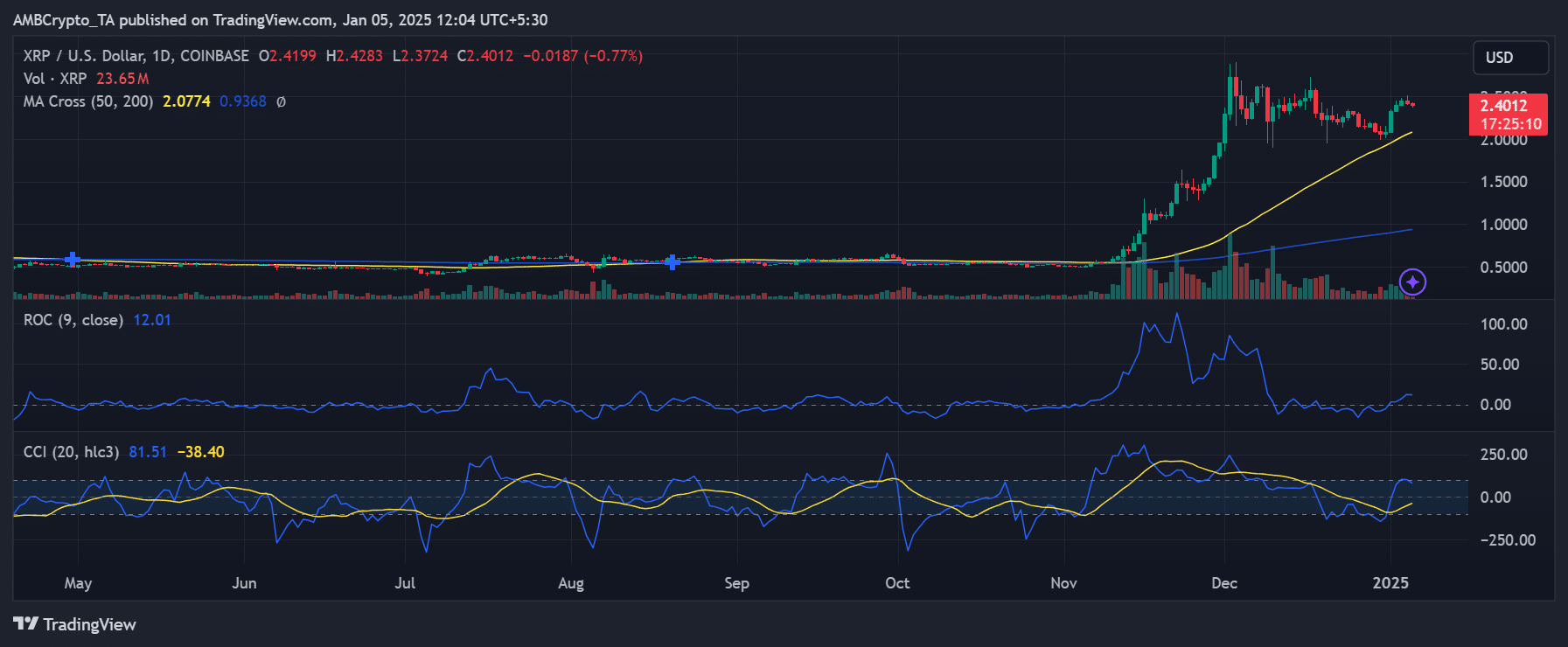

XRP overbought signals in play

The Commodity Channel Index (CCI) displayed on the charts is signaling overbought conditions, registering a value of 101.77. This suggested that XRP could face short-term selling pressure.

However, it’s worth noting that the overbought status does not always signal an imminent correction, particularly during a strong uptrend.

The Rate of Change (ROC), also present in the charts, highlighted an upward price momentum, affirming that buyers still hold a degree of control.

These indicators combined point to a phase where bulls must sustain momentum to avoid a reversal.

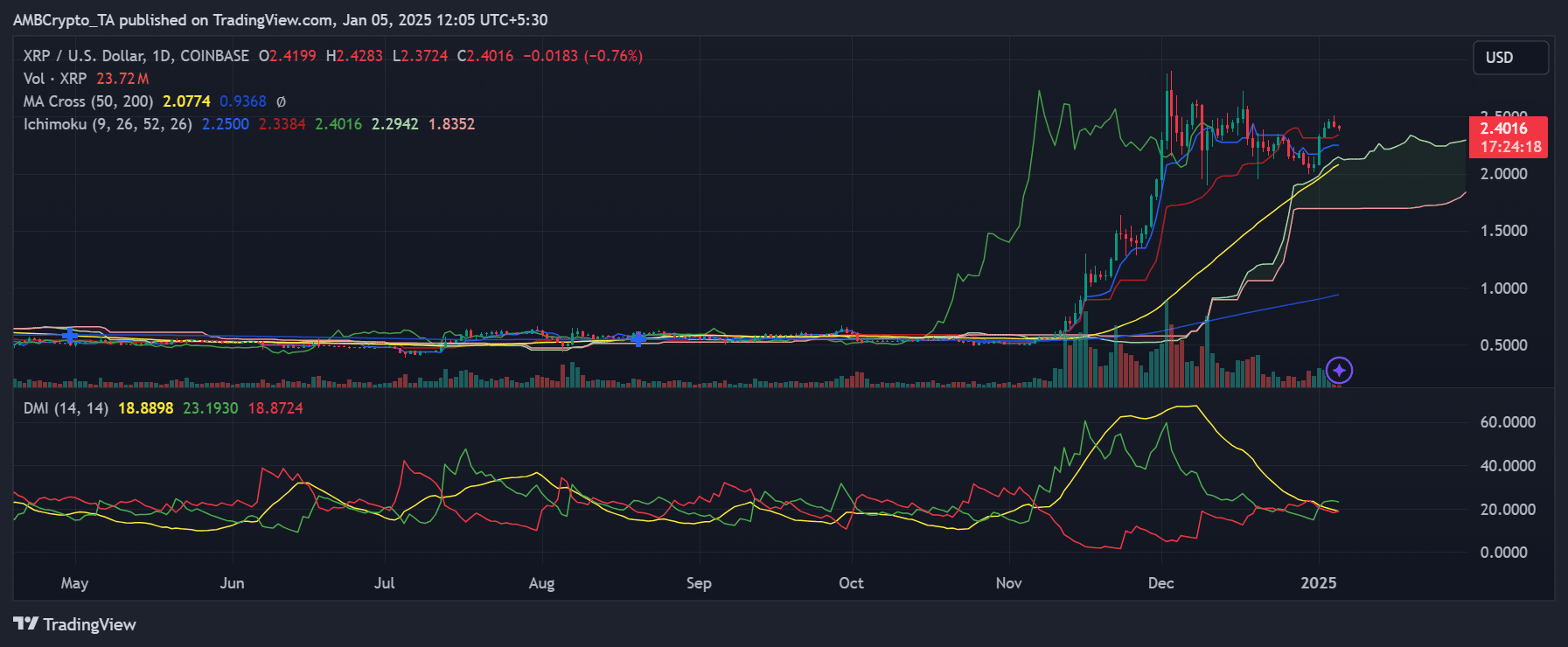

Trend strength and long-term optimism

XRP’s trend indicators were providing crucial context. The charts showed that the 50-day Simple Moving Average (SMA) remained above the 200-day SMA, indicating a continued bullish trend in the long term.

The Ichimoku Cloud further supported this perspective, with XRP trading above the cloud. This positioning confirmed the token’s bullish momentum, with the leading spans indicating strong support at the $2.00 level.

Despite these positive signs, the Directional Movement Index (DMI) revealed that while the +DI (bullish directional index) was ahead of the -DI (bearish directional index), the Average Directional Index (ADX) was at a moderate level of 19.55, suggesting the trend is not yet at full strength.

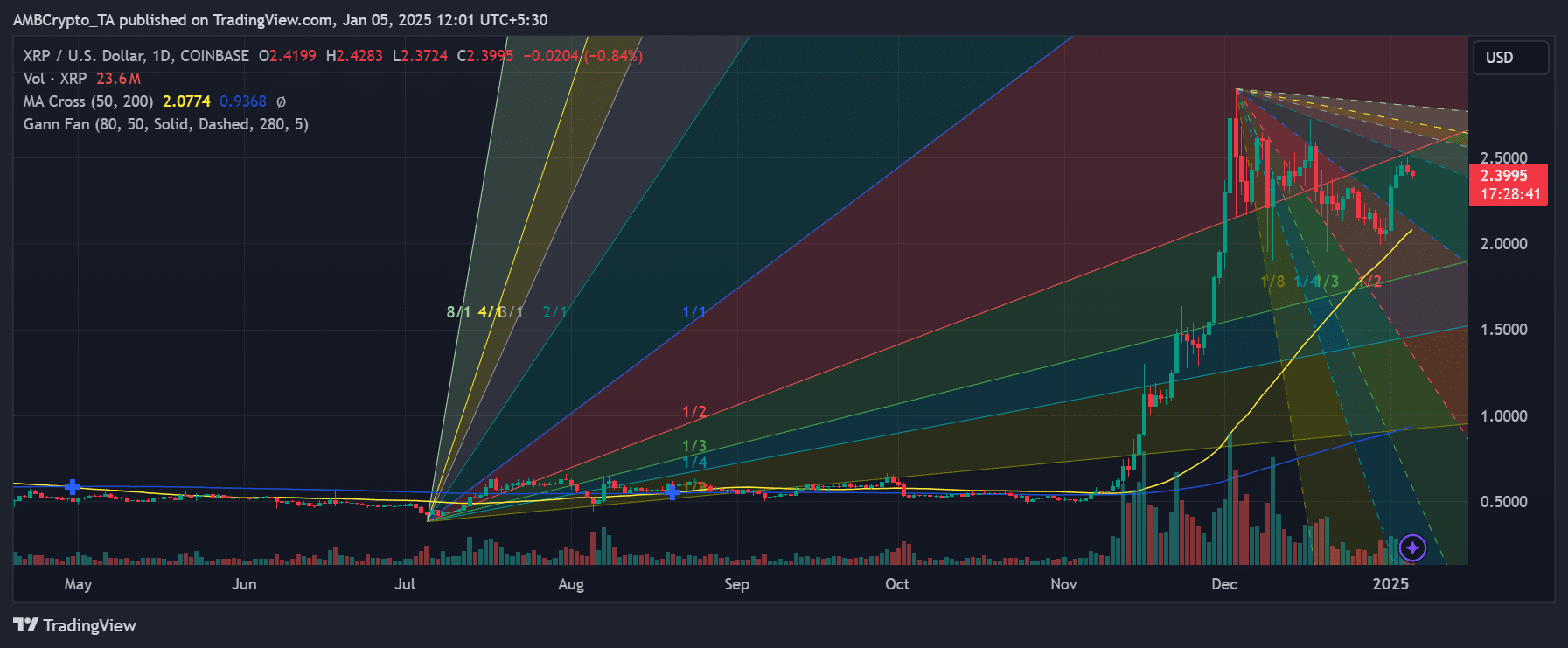

Defining the battle zones

The Gann Fan analysis from the charts is particularly noteworthy. XRP was testing a significant support angle, emphasizing the importance of holding above the $2.00 mark.

This level serves as a critical base for maintaining the current trend.

On the resistance side, the Gann Fan and Fibonacci projections pointed to $2.50 as a key hurdle.

A breakout above this level could pave the way for XRP to target the $3.00 zone, while failure to hold the $2.00 support might lead to a deeper correction.

Narrowing volatility and imminent breakout potential

Volatility indicators from the charts suggested that XRP’s price action was tightening. The Bollinger Bands were contracting, indicating reduced volatility and the likelihood of a breakout.

Whether this move favors the bulls or the bears remains to be seen, but it shows the need for traders to remain vigilant as the price approaches critical thresholds.

XRP at a crossroads

XRP’s current consolidation phase is a defining moment for its near-term outlook. The $2.00 and $2.50 levels are the key battle zones to watch, as they will dictate the token’s next significant move.

Indicators like the Ichimoku Cloud, Gann Fan, and CCI provide mixed but actionable signals for traders.

Realistic or not, here’s XRP market cap in BTC’s terms

A breakout above $2.50 could ignite a rally toward $3.00 while losing support at $2.00 might invite additional selling pressure.

For now, XRP remains at a crossroads, with both bulls and bears gearing up for a decisive move.