Can XRP weather the harsh market with a surge? Key indicators show…

- XRP has seen a slight recovery from the lass in its previous trading session.

- More traders are now taking short positions against it.

The market recently experienced a general downturn, but Ripple [XRP] appeared to fare better than many other assets. Despite this relative resilience, indicators revealed that market sentiment was moving in the opposite direction of XRP’s price.

Ripple sees slower declines

According to data from CoinMarketCap, Ripple [XRP] experienced a relatively smaller decline over the past week compared to other top ten cryptocurrencies.

As of now, XRP’s decline was approximately 5% over the last seven days. In comparison, Bitcoin saw a larger drop of over 9% during the same period.

Ethereum also experienced a significant decline, falling by over 8%, while Solana faced a sharp decrease of over 17%.

Ripple in the last few days

Recent analysis of Ripple (XRP) on a daily time frame by AMBCrypto revealed a pattern of declines, with the most significant occurring on August 2nd—a drop of 6.13%.

This decline saw XRP’s price fall from approximately $0.59 to around $0.56, marking the largest decrease in the last three days. However, despite this downturn, Ripple’s price support held strong.

The analysis highlighted that the long-moving average (often depicted as a blue line on charts) acted as a strong support level at around the $0.54 price range.

This support helped prevent further declines and has been instrumental in stabilizing XRP’s price amidst volatility.

As of the latest data, XRP has shown signs of recovery, rebounding by almost 2% and currently trading at around $0.57.

Additionally, its Relative Strength Index (RSI) has returned to the neutral line, suggesting a stabilization in market sentiment and potential balancing of buying and selling pressures.

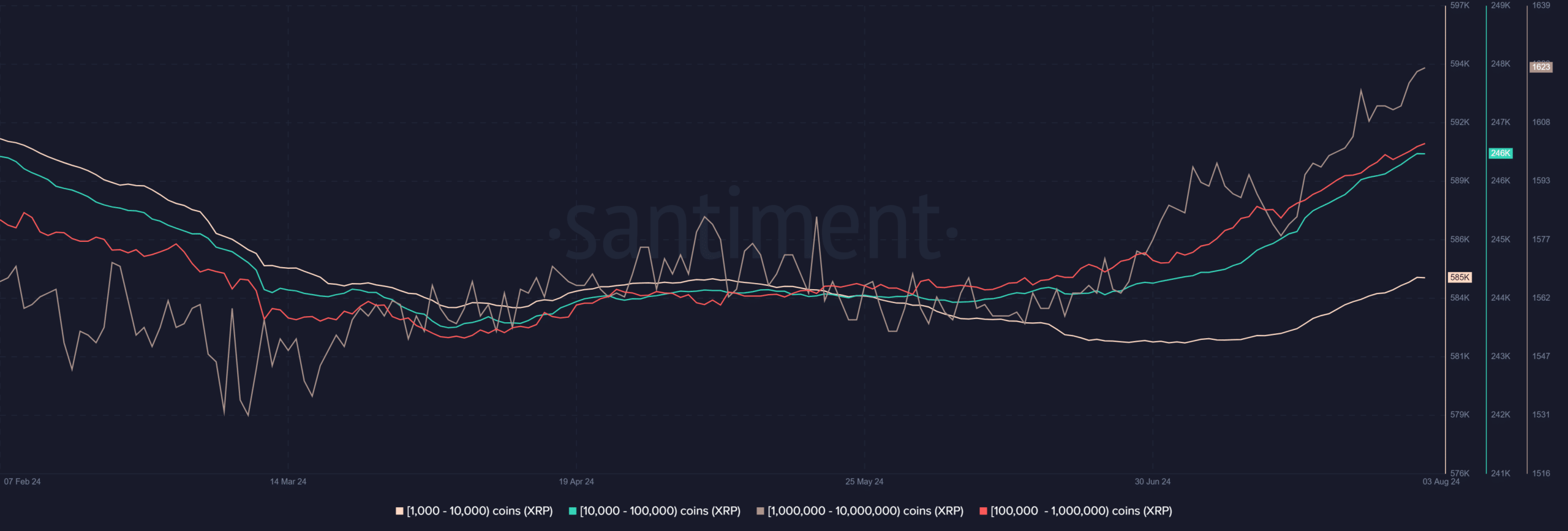

Large wallets continue accumulation

The recent analysis of Ripple’s supply distribution has revealed that despite the market’s volatility, large wallets have continued their pattern of accumulation.

A specific examination of wallets holding between 1,000 to 10 million XRP indicates a notable uptrend in holdings, suggesting sustained interest from these investors.

Though the increase in the number of such wallets might not be substantial, the trend is significant. It illustrates that larger wallets are opting to hold onto their assets rather than sell them off during the recent price declines.

For instance, the segment of wallets holding between 1 million to 10 million XRP experienced an increase from 1st August to press time. This increment, albeit small, underscores a cautious but definite confidence among substantial holders.

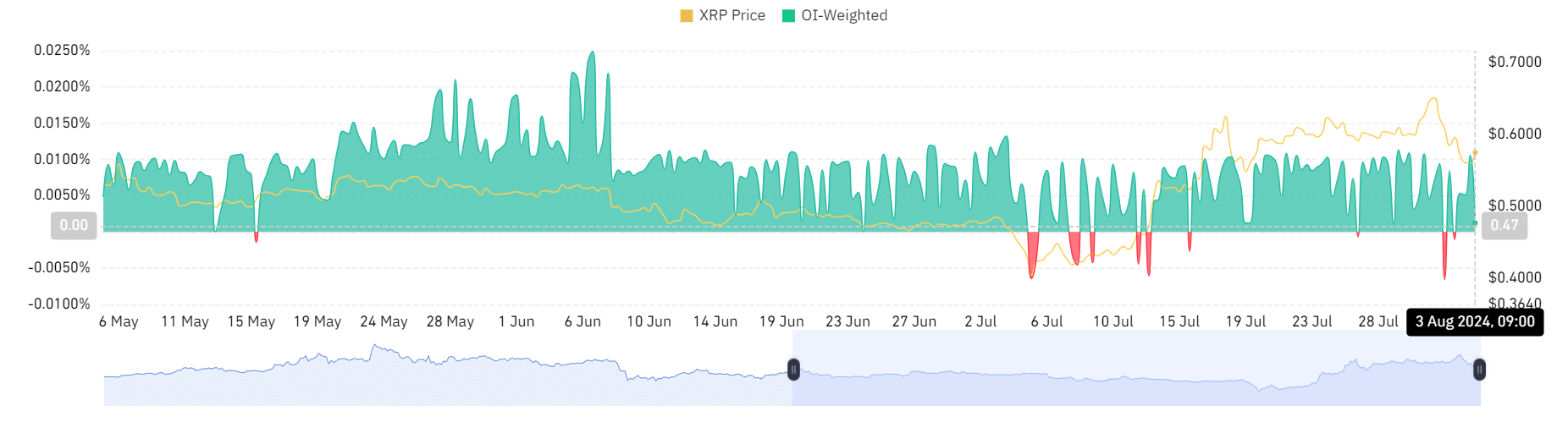

Ripple’s sentiment wanes

The analysis of the Ripple (XRP) funding rate on Coinglass highlighted a notable spike earlier, reaching 0.0106% despite a preceding decline in its price during the previous trading session.

This spike in the funding rate often indicates that traders were optimistic or expecting a price recovery, hence the willingness to pay a premium to hold long positions.

However, the situation has since adjusted along with changes in XRP’s price dynamics.

Realistic or not, here’s XRP market cap in BTC’s terms

As the price of XRP began to recover, the funding rate experienced a sharp decrease, currently standing at around 0.0012%.

This reduction suggests that the initial bullish sentiment that caused the spike may have cooled off. It means traders might be less inclined to pay higher premiums for holding long positions.

![DEX Token Jupiter [JUP] promises volatility in the short-term despite steady network activity, sentiment](https://ambcrypto.com/wp-content/uploads/2025/08/Jupiter-Featured-400x240.webp)