Canary Capital files for new ‘battle-tested’ Solana ETF

- Canary files for a Solana ETF.

- SOL’s price mirrored BTC’s decline below $70K.

Canary Capital has submitted an S-1 filing with the U.S. Securities and Exchange Commission (SEC) for a spot Solana [SOL] exchange-traded fund (ETF).

As per the form, the ETF’s Net Asset Value (NAV) would be calculated based on the Chicago Mercantile Exchange (CME) CF Solana-Dollar Reference Rate.

This latest move comes on the heels of the asset manager’s recent applications for spot Ripple [XRP] and Litecoin [LTC] ETFs.

Although Canary has no live ETFs yet, its three recent filings underscore an ambitious move into the crypto investment space.

Canary’s support for Solana

Following the news, James Seyffart, ETF analyst at Bloomberg, highlighted Canary’s ambitions for a SOL ETF in a post on X (formerly Twitter).

Reflecting on Solana’s strong standing within the blockchain ecosystem, Canary stated:

“Despite the hyper-competitive L1 and EVM landscape, Solana has emerged as a battle-tested frontrunner for decentralized applications.”

The statement also emphasized Solana’s strong DeFi ecosystem, citing sustained metrics like daily transactions, active addresses, and new addresses, all within a low-fee structure.

Additionally, the firm expressed optimism that the ongoing growth in stablecoin deployment would further solidify Solana’s lead over its competitors.

Solana’s ETF filings

Canary’s filing marks the latest attempt to introduce a Solana ETF in the U.S., though it isn’t the first.

Earlier this year, asset management firms VanEck and 21Shares filed for spot SOL ETFs, submitting their S-1 applications in June.

Worth noting, that outside of the U.S., Brazil has been the first country to approve SOL ETFs in August.

SOL’s market performance

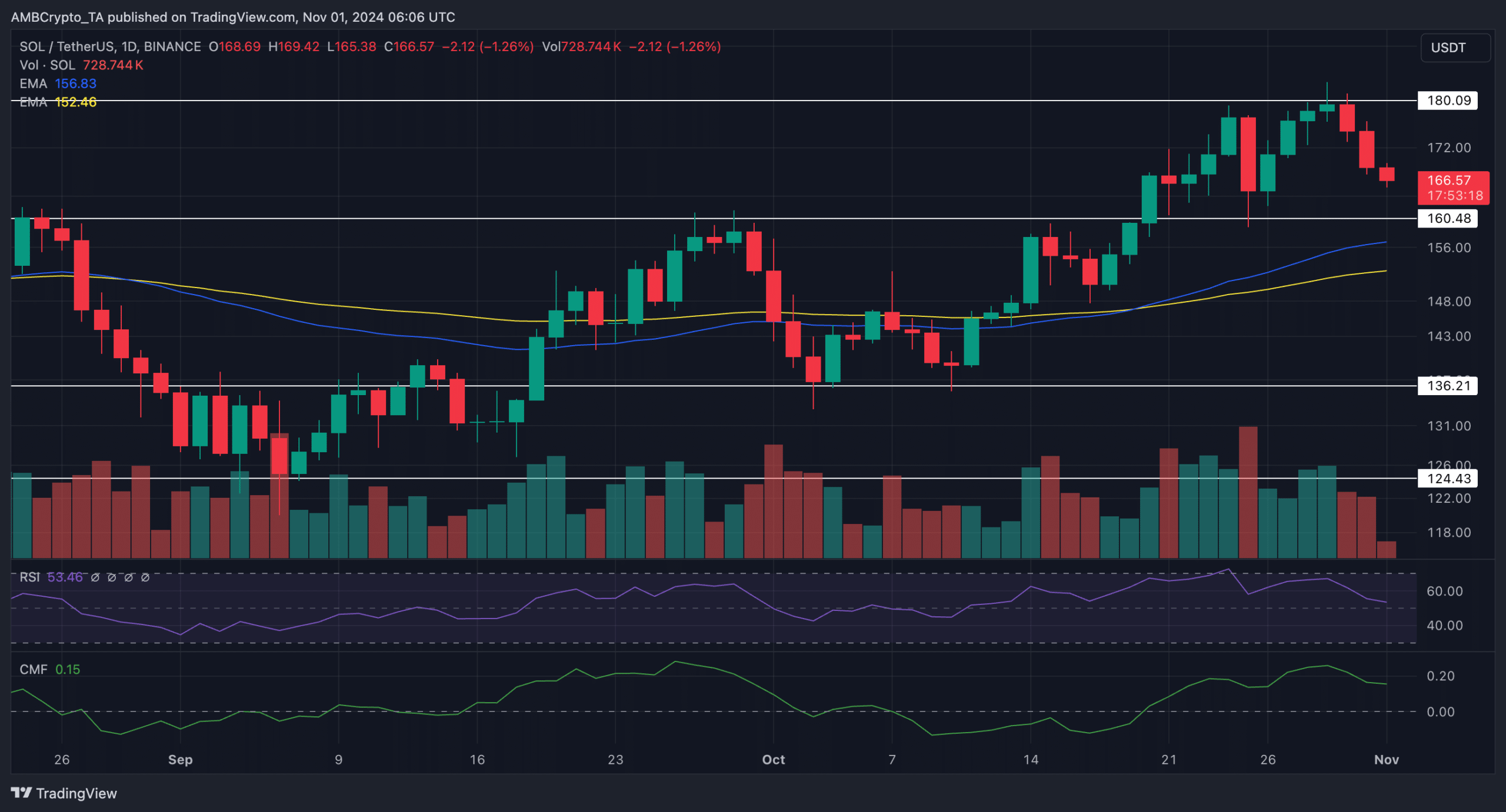

Despite the filing, things weren’t looking so good on the price front. After facing rejection at the critical $180 mark, SOL’s chart was painted red.

At the time of writing, the altcoin was trading at $166, down by 4.90% in the past day.

Notably, the downturn in SOL’s price aligned with sector-wide losses, as Bitcoin [BTC] dropped below the $70,000 mark.

Technical indicators mirrored this trend, with both the RSI and CMF showing weakening bullish strength. At press time, they stood at 53.46 and 0.15, respectively.

This downtrend has put SOL at risk of testing the $160 support level. If breached, the decline could deepen.

Furthermore, if the 100-day (yellow) EMA is lost to sellers, the trend would decisively tilt in bearish favor.

The potential upside for SOL ETFs

Meanwhile, all is not bad for SOL in the crypto sphere.

On the 14th of October, AMBCrypto reported that Grayscale applied to convert its Digital Large Cap Fund (GDLC) into a multi-crypto ETF, which included Solana among other assets.

On the 29th of October, the SEC officially acknowledged Grayscale’s application. This marks a significant step toward launching the first multi-asset crypto ETF in the U.S.

A decision on the application is expected within 45 to 90 days.

As the ETF race continues, Canary Capital’s recent filing underscores the increasing demand for Solana-based investment vehicles.

However, will this momentum translate into regulatory approval? That remains to be seen.