Cardano – 8% price drop may be incoming thanks to THIS bearish pattern

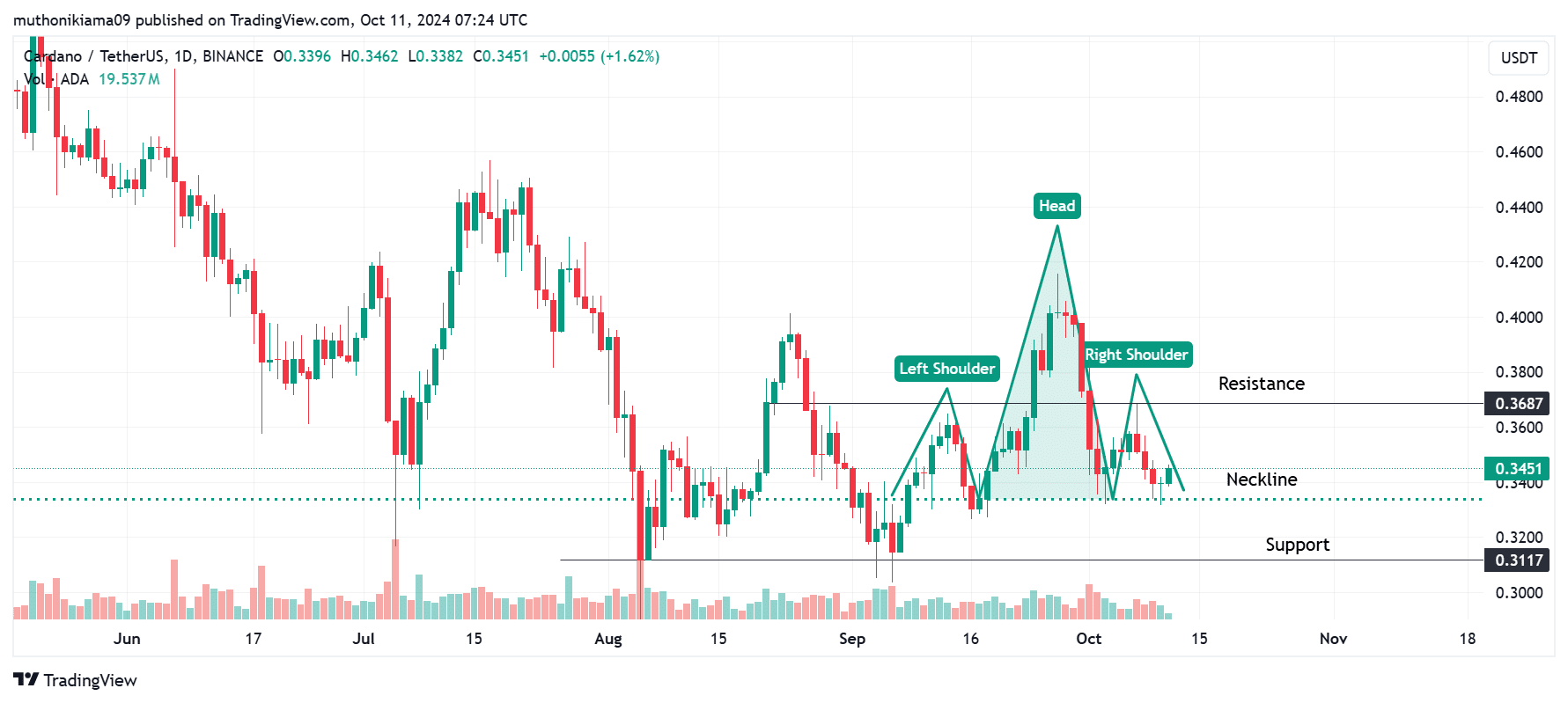

- Cardano formed a bearish head-and-shoulders pattern on the one-day chart

- Lack of buyer support amid rising selling activity could result in an 8% drop in the short term

Cardano (ADA) was trading at $0.344, at press time, after a 1.5% drop in 24 hours. In fact, ADA has been on a bearish streak lately, given that its price has dropped by 16% in the last 14 days alone.

Now, a look at the one-day chart revealed that this bearish trend could persist. This, after Cardano formed a head-and-shoulders pattern, one suggesting that the token could enter a downtrend. This chart pattern showed that the rally that saw ADA gain by more than 26% in late September has weakened. And, market bears could start selling, pulling the prices lower on the charts.

Such a bearish trend will be confirmed if ADA breaks below the neckline of this pattern at $0.344. The price attempted this bearish breakout on 9 October, before bulls re-entered the market.

If Cardano fails to hold levels above this neckline, the price will likely drop by 8% to test the support at $0.311. For ADA to invalidate this pattern and resume the uptrend, it must break above the resistance level at $0.368.

Technical indicators show THIS

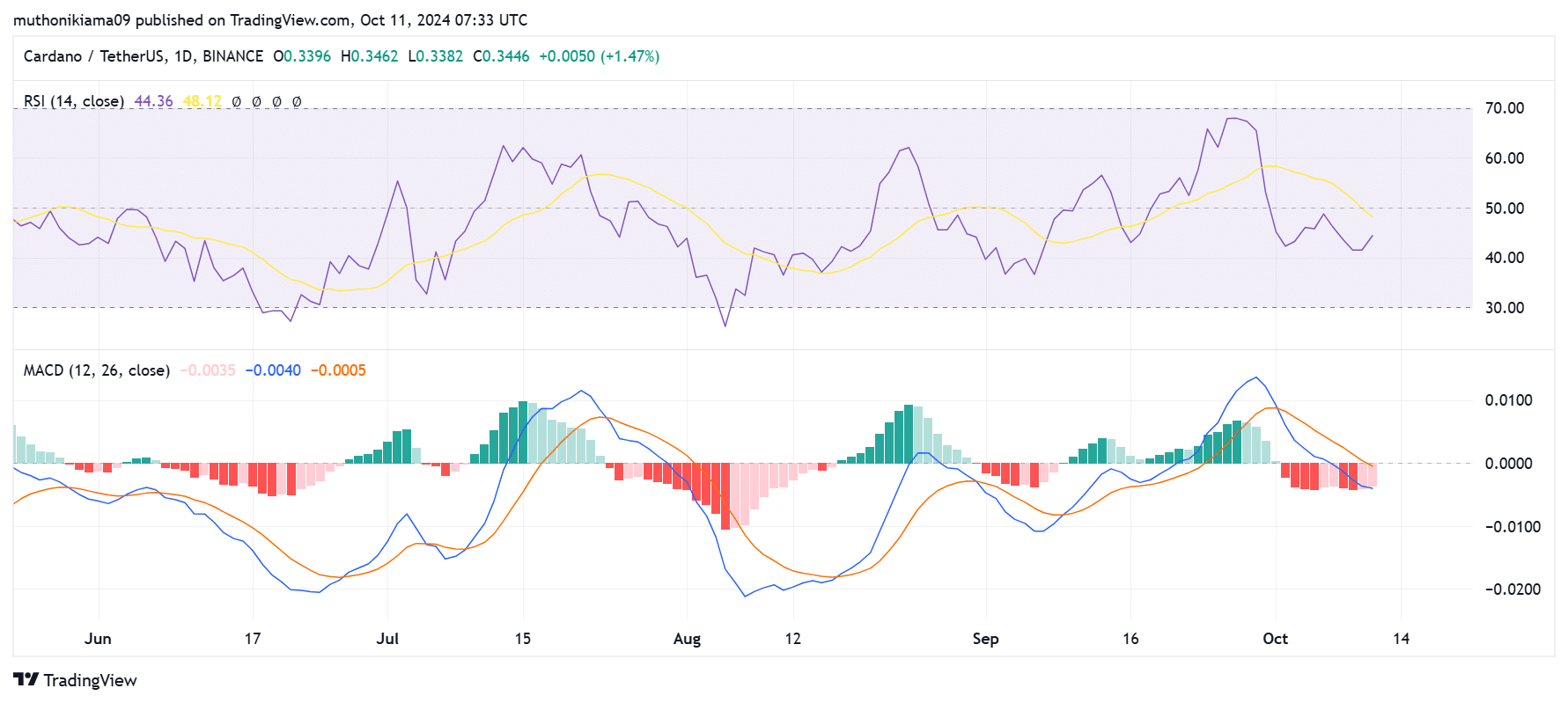

At the time of writing, technical indicators showed that bearish momentum has been in play lately. The Relative Strength Index (RSI) was at 44, indicating that sellers were in control.

This momentum seemed to be strong as the RSI line dropped below the Signal line.

The Moving Average Convergence Divergence (MACD) had a negative reading and continued to trend below the Signal line. This further supported the bearish case against ADA.

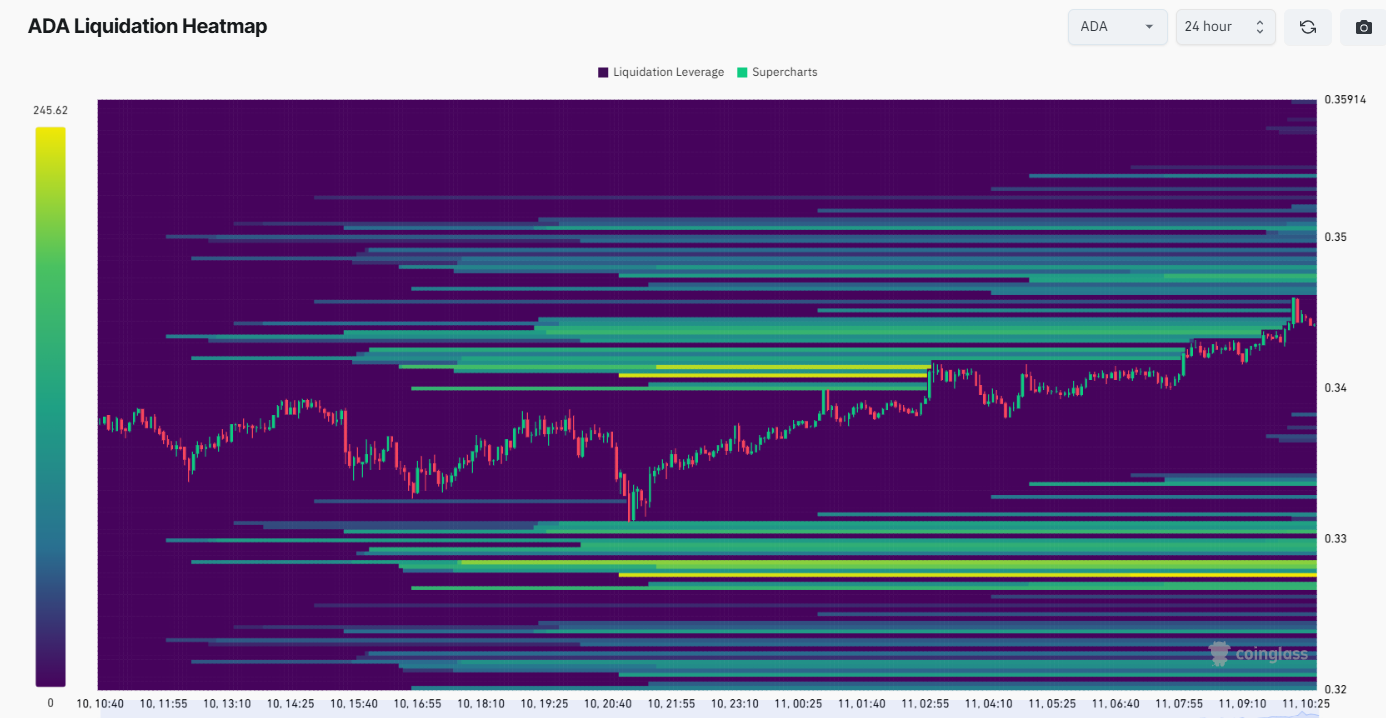

ADA might continue trading sideways due to a cluster of liquidations above its press time price. Such a hot liquidation zone usually tends to act as a strong resistance level.

When there are more possible liquidations above the price and not below the price, it shows that short positions are dominating the market.

Therefore, if Cardano breaks above this zone, it could force these short traders to close their positions, creating buying pressure and a bullish reversal.

Cardano wallets in profit

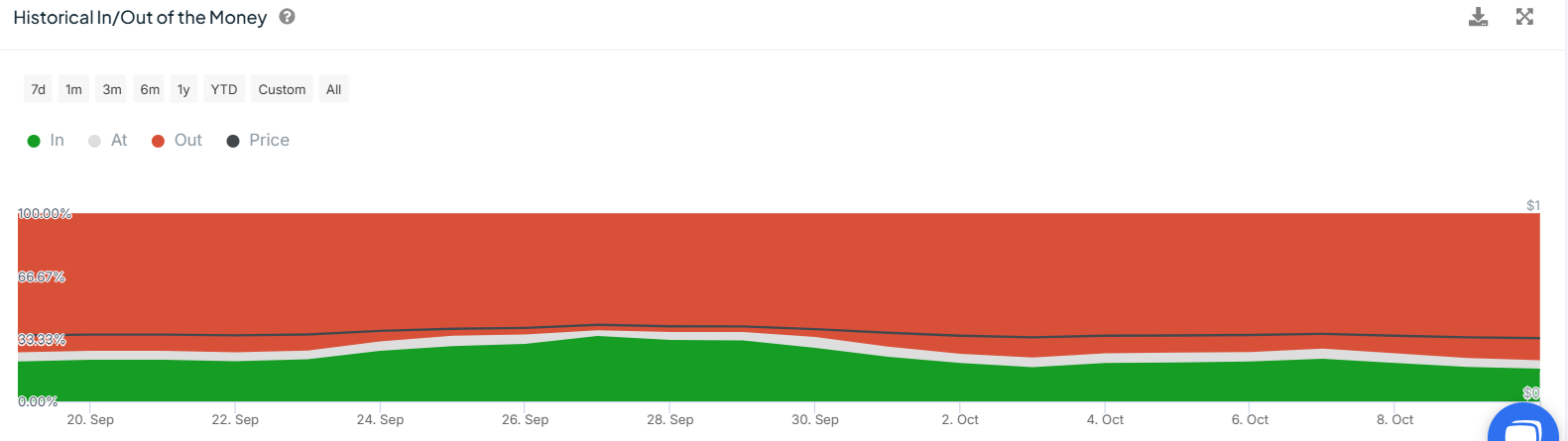

Finally, data from IntoTheBlock revealed that after Cardano’s rally reached exhaustion in late September, the wallets that were “In The Money” (in profits) dropped from 34% to 16% at press time.

At the same time, the wallets in losses surged from 63% to 78%.

This drop in wallet profitability could trigger further bouts of price depreciation for Cardano. Especially if holders choose to sell to minimize losses.

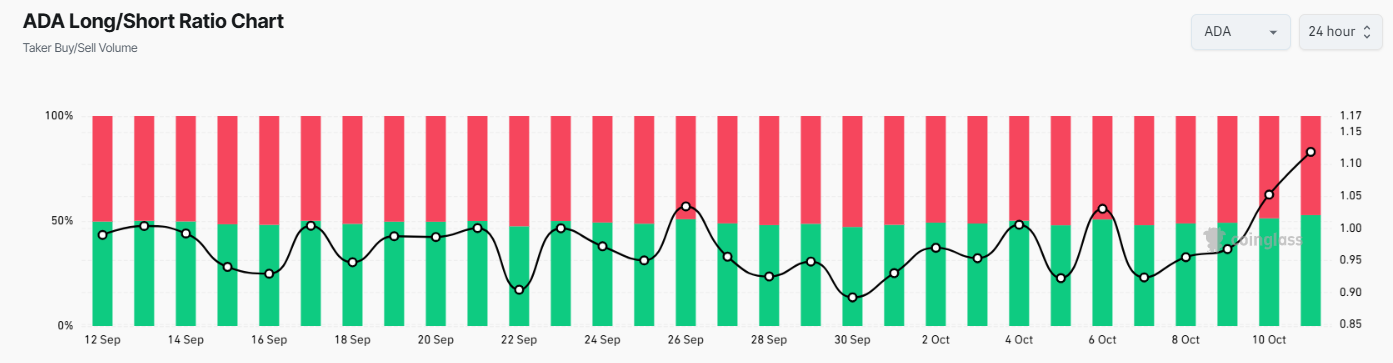

Nevertheless, the sentiment around ADA remains positive, and this could prevent an intense price drop. For instance – The long/short ratio shot up to its highest level since early September. This can be seen as a sign that traders are betting on future price gains.