Cardano achieves a breakout – Could $1.2 be the next stop for ADA?

- Cardano swing traders could wait for a demand zone retest to enter.

- The$0.787 resistance could stall bullish efforts.

Cardano [ADA] investors have waited for this moment for almost three months now. The $0.7 resistance, which also marked an 80-day range high, was finally breached. The buying volume has been good as Bitcoin [BTC] prices stay above $60k.

The on-chain metrics of Cardano were also positive and did not show selling pressure was on the rise. Bitcoin’s stasis above the $60k mark could ignite strong altcoin rallies which ADA might benefit from.

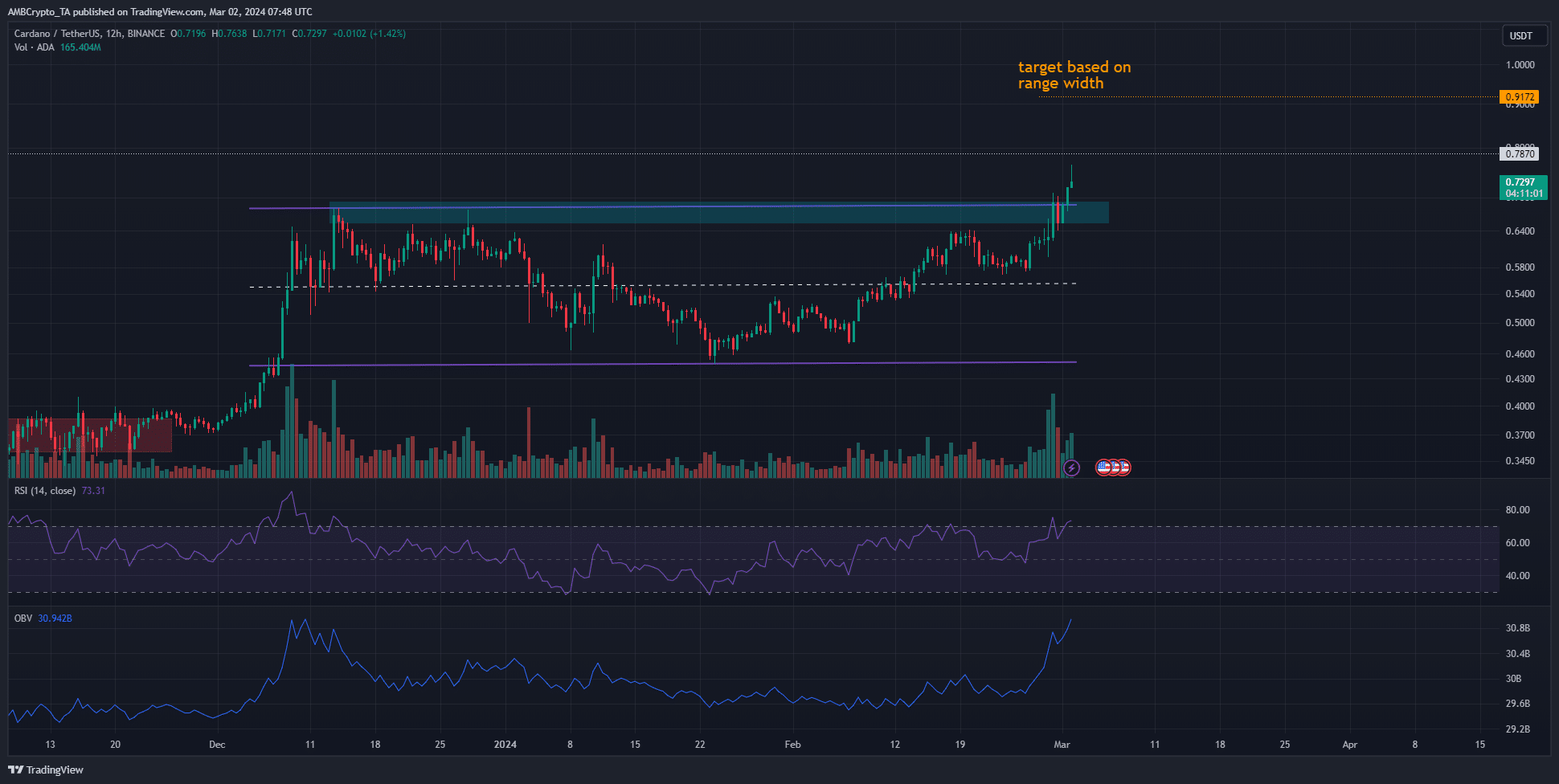

The range breakout and projected target

The near three-month range was plotted in purple. It extended from $0.448 to $0.678. At press time, the range highs were broken, and a retest as a demand zone could occur over the next few days.

Using the range width as a tool, a breakout above the highs would see prices reach $0.9172. This target is 33% above the range highs. The RSI noted strong bullish momentum with a reading of 73. Overbought conditions need not point toward an imminent pullback.

Trading volume was also high upon the breakout, and the OBV rose sharply as buyers flooded in. The indicators reinforced bullish expectations. Beyond the $0.917 target, the next significant resistance levels are at $1 and $0.1246.

The lack of token movement suggests selling activity was minimal

Source: Santiment

The mean coin age saw a downtrend initiated in the second half of February. This move was accelerated on the 26th of February, when the dormant circulation saw a large spike.

This indicated an increased volume of ADA tokens moving between wallets, and outlined selling pressure. However, since then, the dormant circulation has been relatively quiet.

Is your portfolio green? Check the Cardano Profit Calculator

Meanwhile, weighted sentiment reached higher than any day previously in 2024. The MVRV ratio was making new highs not seen since late December, showing holders were at a higher profit.

A spike in the dormant circulation could precede a price correction.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.