Cardano [ADA]: Bears remain firmly in control – will bulls see reprieve

![Cardano [ADA]: Bears remain firmly in control - will bulls see reprieve](https://ambcrypto.com/wp-content/uploads/2023/05/image-1200x900-8.png)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Previous $0.3750 support was retested as resistance.

- Trading volumes dipped, along with investor confidence.

Besides the recent Fed rate hike, markets are readjusting to the US debt ceiling debate. In particular, Cardano [ADA] wavered in the past few days, swinging from $0.3750 to $0.3531.

Is your portfolio green? Check out the ADA Profit Calculator

ADA traded at $0.3643 and flashed red at press time, while Bitcoin [BTC] remained stuck in the $27k zone.

Besides the US debt ceiling crisis and key inflation data, the April CPI (Consumer Price Index) is expected to increase price volatility. Inasmuch, here are the key levels macro traders should consider.

Will bears gain more ground?

Near-term bears cracked the $3750 support on 8 May – gaining more ground and leverage. Notably, the support has been a crucial level for bulls since late March.

The attempted recovery by bulls on 8 May was blocked by the $0.3750 level – effectively flipping it to resistance. At the time of writing, price action hovered below it, as RSI and CMF remained negative – a bearish short-term outlook.

As such, ADA could sink to lower support levels at $0.3487 or $0.3368. An extreme downswing could push it to the March lows near $0.3015. These levels can act as shorting targets in such a downtrend scenario.

Contrary to the above, a clearance of the $0.3750 obstacle and resistance level will give bulls little leverage. But the upswing could falter below $0.4000 – a recent high in May. A move beyond this level could set ADA to retest the supply zone at $0.4200.

Trading volumes dipped, denting investor confidence

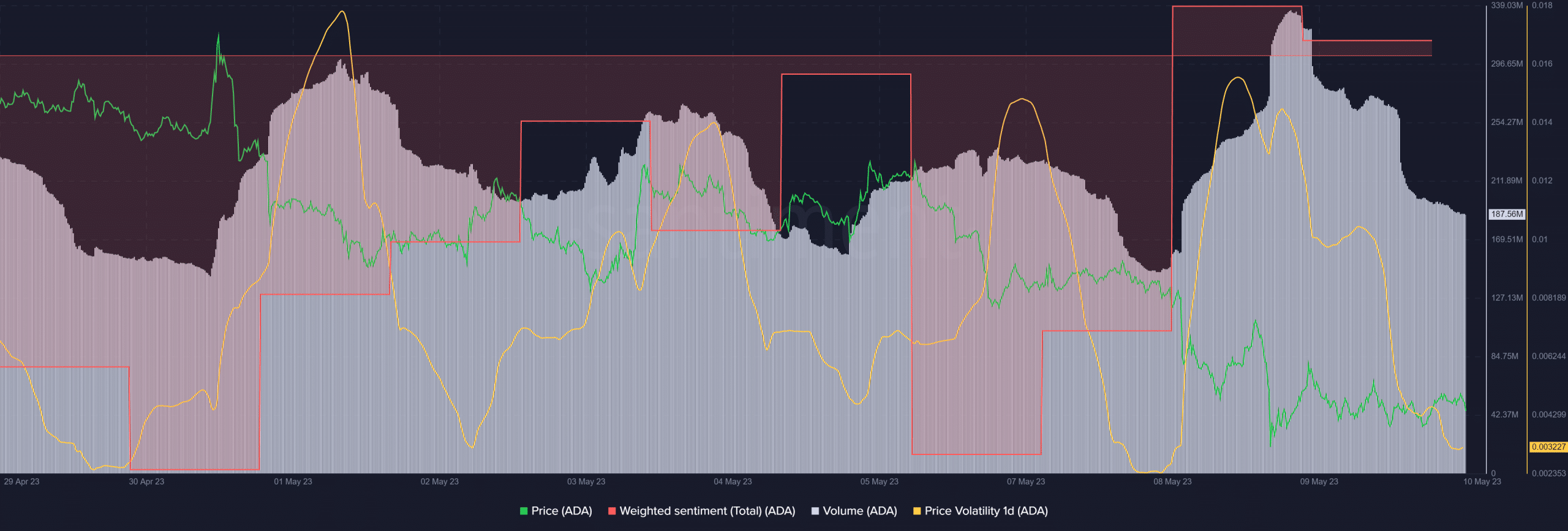

ADA’s weighted sentiment hit its recent low around 6 May. After that, there was a slight improvement, as sentiment flipped to positive on 8 May. Interestingly, trading volumes improved, too, in the same period.

However, both metrics dipped at the time of writing. Trading volume fell from over $300 million on 8 May to around $180 million at press time, which could offer sellers more leverage.

How much are 1,10,100 ADAs worth today?

In the same period, investors’ confidence was shaken, but sentiment remained above the neutral level.

In addition, the daily price volatility dropped, but the inflation data could cause a price surge.