Cardano [ADA] bulls began to fight against the bearish trend but…

![Cardano [ADA] bulls began to fight against the bearish trend but...](https://ambcrypto.com/wp-content/uploads/2023/03/PP-2-ADA-cover-e1679909638502.jpeg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The range formation was not yet broken but the mid-range was flipped to support.

- Buyers can look to take profit on a move toward the range highs.

Cardano has traded within a range from $0.24 to $0.42 since November. Imminent levels of importance lie at $0.33, $0.35, and $0.42. Bitcoin was also trading beneath an enormous block of resistance in the $28k-$30k area.

Read Cardano’s [ADA] Price Prediction 2023-24

A retracement for Bitcoin could see short-term Cardano holders suffer greater losses. A drop beneath $0.35 and $0.33 appeared likely, but short sellers looking for swing opportunities can wait for a good risk-to-reward trade to present itself.

The $0.35 support region has been defended so far

Over the weekend, Cardano prices hovered above the $0.35 support level. On lower timeframes such as 1-hour, it was observed that the prices declined steadily from $0.363 to $0.349 but did not yet fall beneath this support zone.

On the daily timeframe, the indicators gave mixed signals. The Awesome Oscillator formed a bullish crossover above the zero line a few days ago when ADA broke out above the $0.35 resistance.

But the momentum was not strongly bullish yet. Meanwhile, the CMF showed significant capital flow out of the market with a reading of -0.07, which underlined severe selling pressure.

The Directional Movement Index showed both the ADX (yellow) and the +DI (green) above 20 and highlighted an uptrend in progress. While the price has formed a series of higher lows and higher highs over the past two weeks, this did not constitute an uptrend on the higher timeframes.

Realistic or not, here’s ADA’s market cap in BTC terms

Overall, it was a mixed bag. The price action showed that the range highs near $0.42 could be important this week. Buyers from lower levels can take profits there, while short sellers could keep an eye out for rejection.

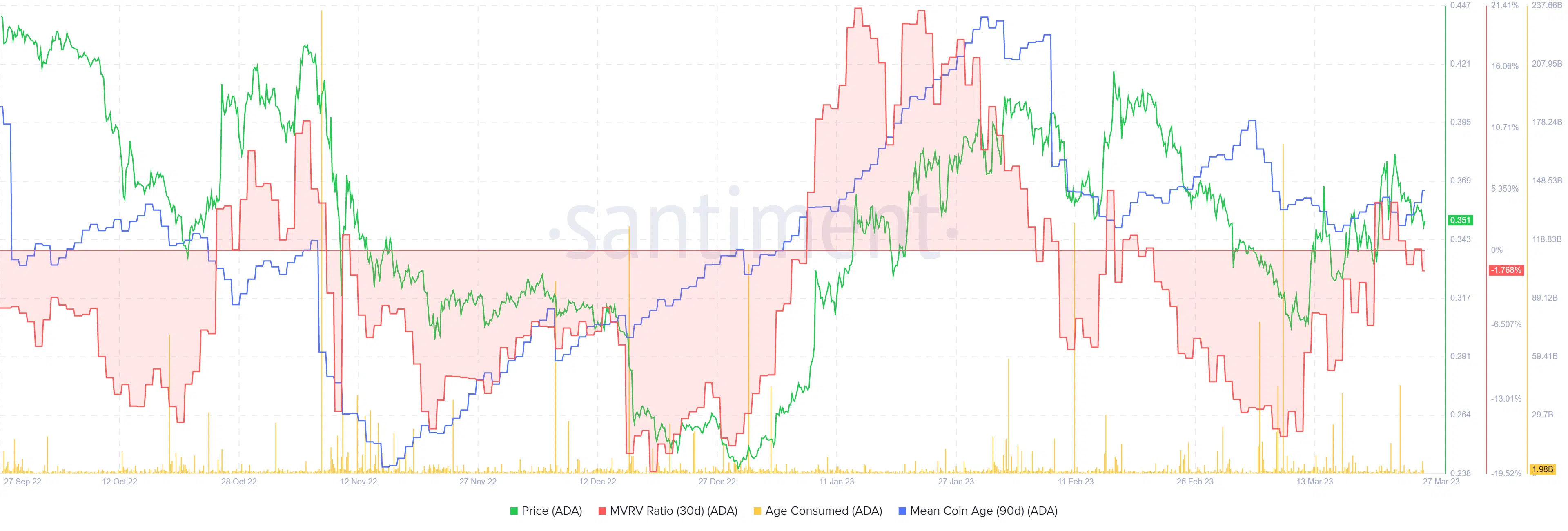

MVRV begins to plummet once again

Source: Santiment

The sentiment of the holders did not appear to be strong as the 30-day MVRV ratio began to slide into negative territory once more. This suggested that Cardano holders were going deeper into a loss, and the selling pressure has not yet ceased.

The mean coin age metric was also in a slow decline since late January. The inference was that accumulation was not seen across the network in the past two months and another wave of selling could be upon us. The age consumed metric saw a spike on 24 March which could signal imminent selling pressure.