Cardano [ADA] faces price rejection at $0.4214, further gains…

![Cardano [ADA] faces price rejection at $0.4214, further gains...](https://ambcrypto.com/wp-content/uploads/2023/02/ada-ben-e1676536406940.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ADA faced a price rejection at $0.4214.

- Demand for ADA in the derivatives market fell sharply, but sentiment remained positive.

Cardano [ADA] posted a 10% hike on 15 February after Bitcoin [BTC] reclaimed the $24k zone. The impressive rally followed strong US retail sales in January. Moreover, retail trade sales increased by 2.3%, according to the US Census Bureau.

Read Cardano’s [ADA] Price Prediction 2023-24

However, ADA’s uptrend momentum slowed at press time after facing a price rejection at $0.4214.

ADA’s sharp recovery slowed – Can the bulls prevail?

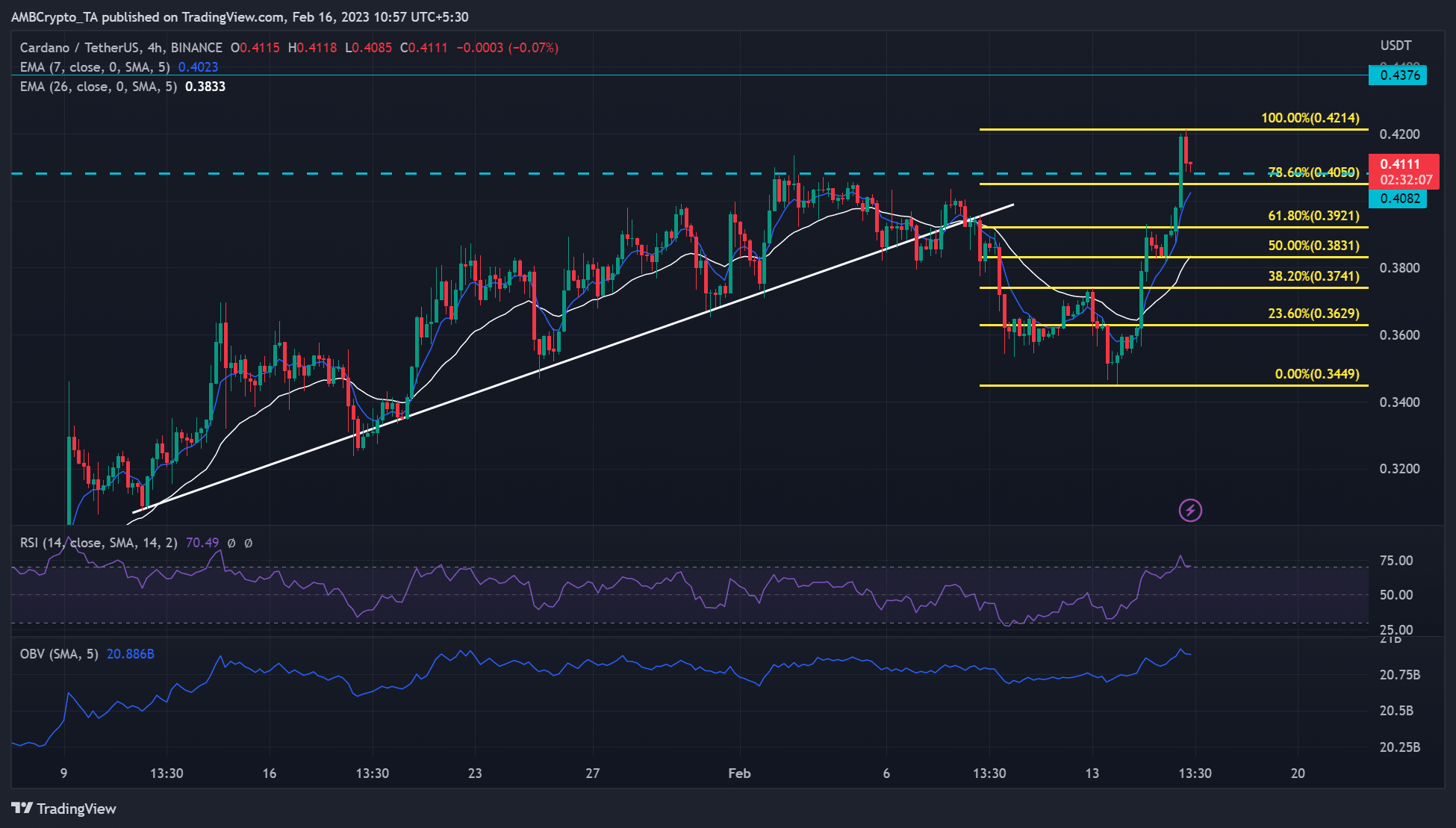

ADA entered February on a bearish note. It broke below the ascending trendline (white) alongside several support levels too. However, it found a steady hold within the 0% and 23.6% Fib pocket levels, allowing bulls to launch a recovery. The recovery was further boosted after BTC reclaimed the $24K zone.

The bullish structure could allow a retest of the overhead resistance of $0.4214. As such, short-term bulls could target $0.4214. But bulls might need to clear their positions if ADA breaks below the 78.6% Fib level. The stop loss could be placed below this level.

On the other hand, short-sellers should be cautious of the 78.6% Fib level of $0.4050. It could offer bulls steady ground. Nevertheless, sellers can lock profits here, but a break below it could offer more shorting opportunities at the seven-period EMA of $0.4023 or the 61.8% Fib level of $0.3921. Any further drop could be kept in check by the 26-period EMA.

The RSI and OBV surged, giving bulls the upper hand. But the RSI was in the overbought zone, a ripe condition for a reversal, alongside a massive drop in demand which could complicate further uptrend.

ADA sentiment flipped into positive

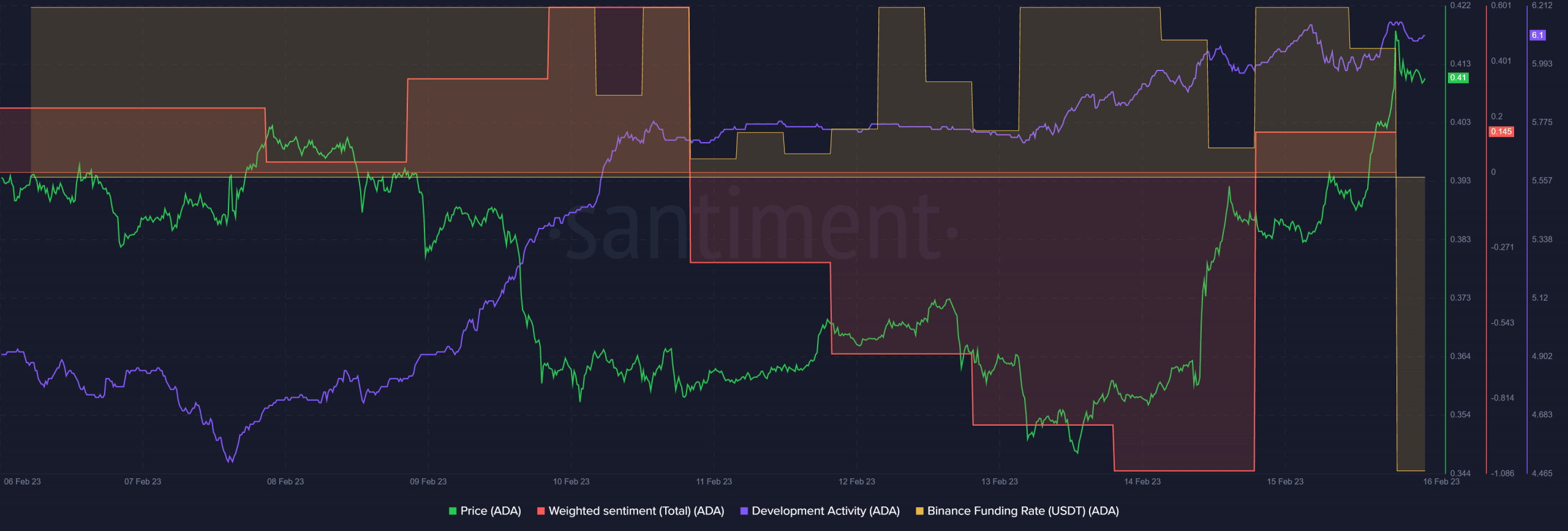

According to Santiment, ADA’s Funding Rate dipped massively at press time. It showed a massive drop in demand in the derivatives market, which painted a bearish sentiment.

Is your portfolio green? Check out the ADA Profit Calculator

Interestingly, the weighted sentiment improved tremendously and flipped to the positive side. In the same period, the development activity and prices increased, which could explain the improved investor outlook on the asset.

However, the drop in demand could further weaken the momentum and give Cardano bears more leverage. If the drop in demand continues, ADA could break below the immediate resistance at 78.6% Fib level $0.4050 and flip the structure into bearish.

![Ethereum's [ETH] short-term price targets - Is the $2,300 resistance too strong?](https://ambcrypto.com/wp-content/uploads/2025/03/Evans-1-min-400x240.png)