Cardano [ADA] faces rejection at $0.41, how low can it go?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

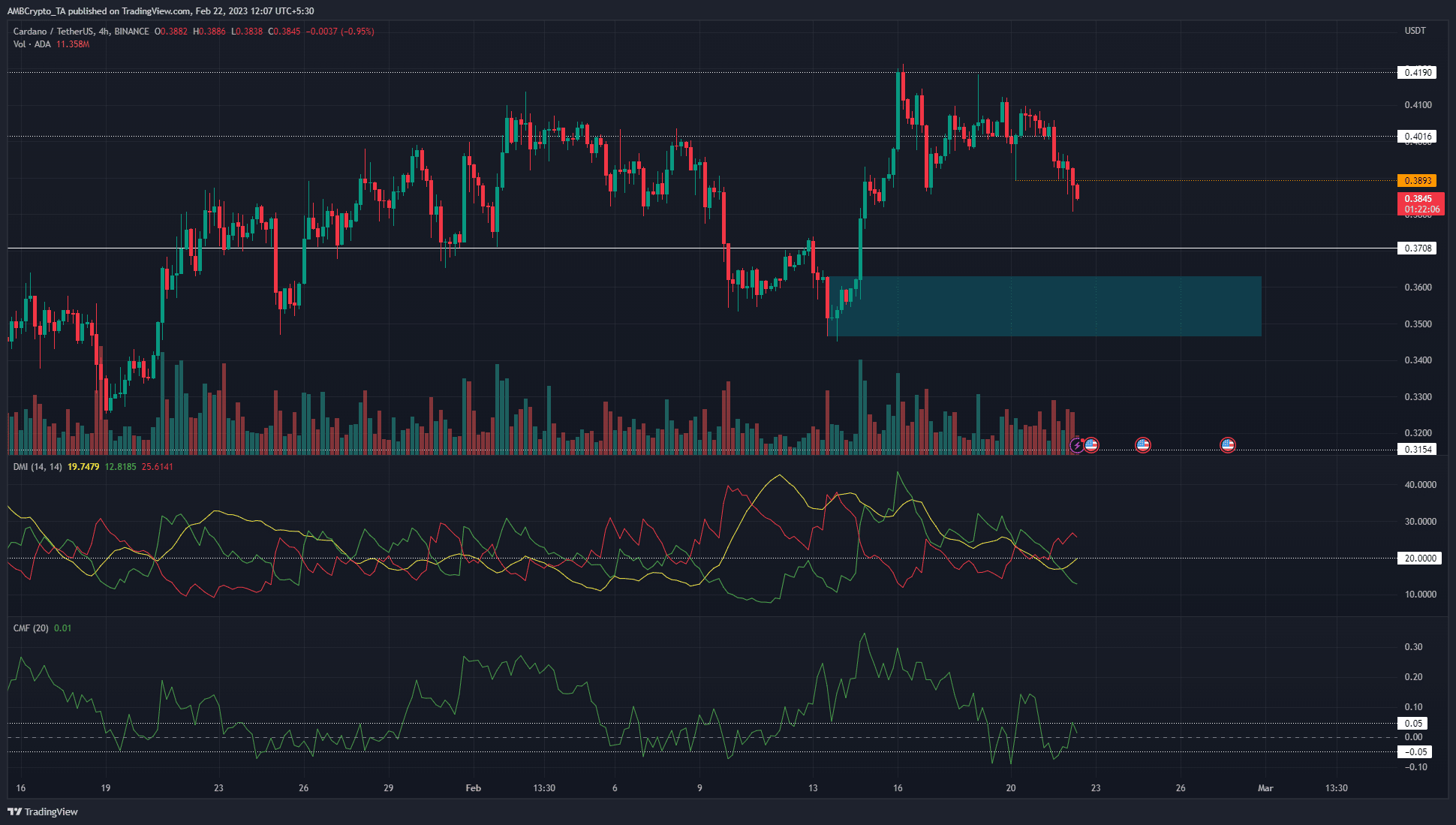

- The H4 market structure flipped to favor sellers.

- A bullish order block to the south could see a reversal.

Cardano [ADA] was unable to hold on to the gains it made in the latter half of the past week. On 15 February, the price ascended from $0.383 to $0.418. At the time of writing, the asset’s price fell below the $0.389 level.

Realistic or not, here’s ADA’s market cap in BTC’s terms

The rise in regulatory pressure in the US recently was also a factor in shifting the sentiment toward fear. However, it was likely that ADA can recover and push higher after a revisit to a crucial zone of support.

The plunge below $0.389 showed that bears had the upper hand

When ADA was trading above the $0.4 mark a few days ago, the market structure on the four-hour chart was bullish. The strong surge past $0.37 on 14 February meant the previous bearish structure was broken. A higher low was subsequently set at $0.389.

Over the past week, the $0.383-$0.39 area has served as support. At the time of writing, Cardano traded at $0.384 and was likely to descend lower.

The Directional Movement Index showed that the -DI value was above 20, and the ADX was on the verge of crossing over above 20 as well. If that happened, it would be an indication of a strong downtrend.

The CMF was in neutral territory, and a reading of +0.01 at press time did not suggest any pressure from buyers.

How much are 1,10,100 ADAs worth today?

However, bulls can still retain hope. The surge past $0.37 meant that the H4 bullish order block at $0.35 was likely to be a strong zone of demand. A revisit to this area will likely see ADA make another attempt to push past $0.42.

Therefore, the $0.35-$0.36 area is one where short sellers from $0.39 can look to take profit. At the same time, within this zone, bulls could witness a buying opportunity emerge.

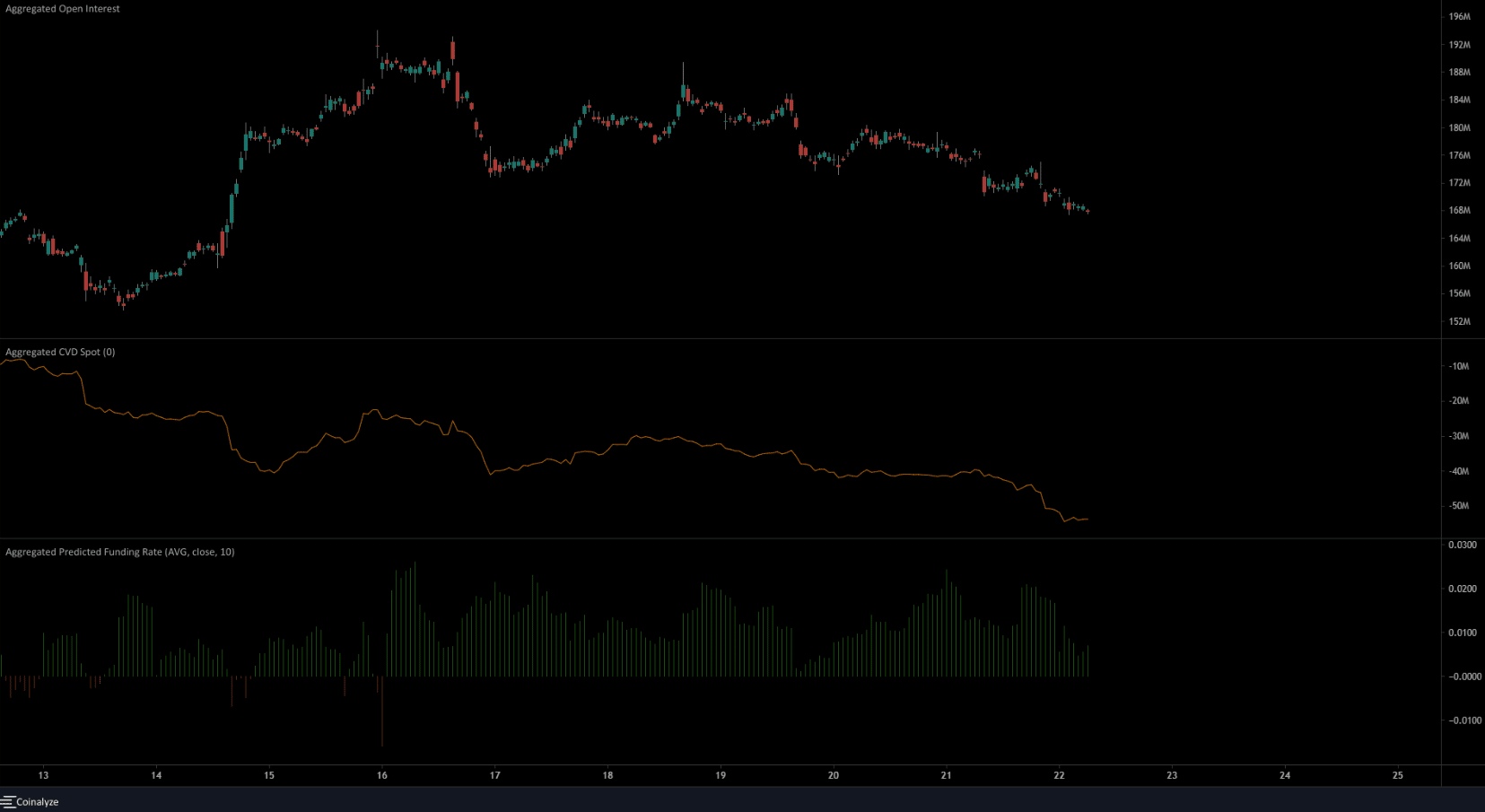

The funding rate dipped but remained positive as Open Interest was also in decline

Source: Coinalyze

Coinalyze’s data agreed with the bearish signals seen on the price charts. The one-hour chart showed the Open Interest was falling alongside the price. This meant that long positions were discouraged but also that a majority of the market was not yet shorting ADA. The positive funding rate also supported this inference.

The spot CVD was in decline over the past couple of days, to highlight rising selling pressure.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)