Cardano [ADA] repeats 2020 rally: Should you prepare for $1?

![Cardano [ADA] repeats 2020 rally: Should you prepare for $1?](https://ambcrypto.com/wp-content/uploads/2024/04/Cardano-to-turn-bullish-soon-1200x686.webp)

- ADA’s price had dropped by nearly 20% in the last 30 days.

- Metrics and indicators supported the possibility of a bull run.

Cardano [ADA] witnessed a major setback last month as its value plummeted sharply.

However, if historical data is to be believed, then ADA might soon display explosive growth that could allow the token’s price to reach an all-time high.

This hints at a Cardano rally

According to CoinMarketCap, Cardano bled a lot of its market capitalization last month as its value plummeted by nearly 20%.

Though ADA’s price increased by 3% in the last seven days, it was not enough to recover its monthly loss.

At press time, ADA was trading at $0.5087 with a market cap of over $18 billion, making it the 10th largest crypto.

But things might soon turn in ADA’s favor, as the token was mimicking its 2020 price action. Milkybull, a popular crypto analyst, recently posted a tweet highlighting a historical trend.

As per the tweet, an Adam and Eve pattern formed on ADA’s chart, which, the last time it emerged, resulted in a massive bull rally.

To be precise, ADA’s price gained bullish momentum back in 2020 after it exited the pattern. If history repeats itself, then a breakout above the pattern could result in Cardano touching an all-time high in 2024.

Since there were chances of a bull rally, AMBCrypto analyzed Hyblock Capital’s data to look for immediate targets for ADA. As per our analysis, if a bull rally happens, then ADA’s price might first touch $0.52.

The token’s liquidation will rise sharply at that level, which can result in a short-term price correction.

A successful breakout over that level could allow ADA to reach $0.56. However, if things go wrong, investors might witness ADA’s price plummet near $0.49, as it had strong support there.

Which direction is ADA headed?

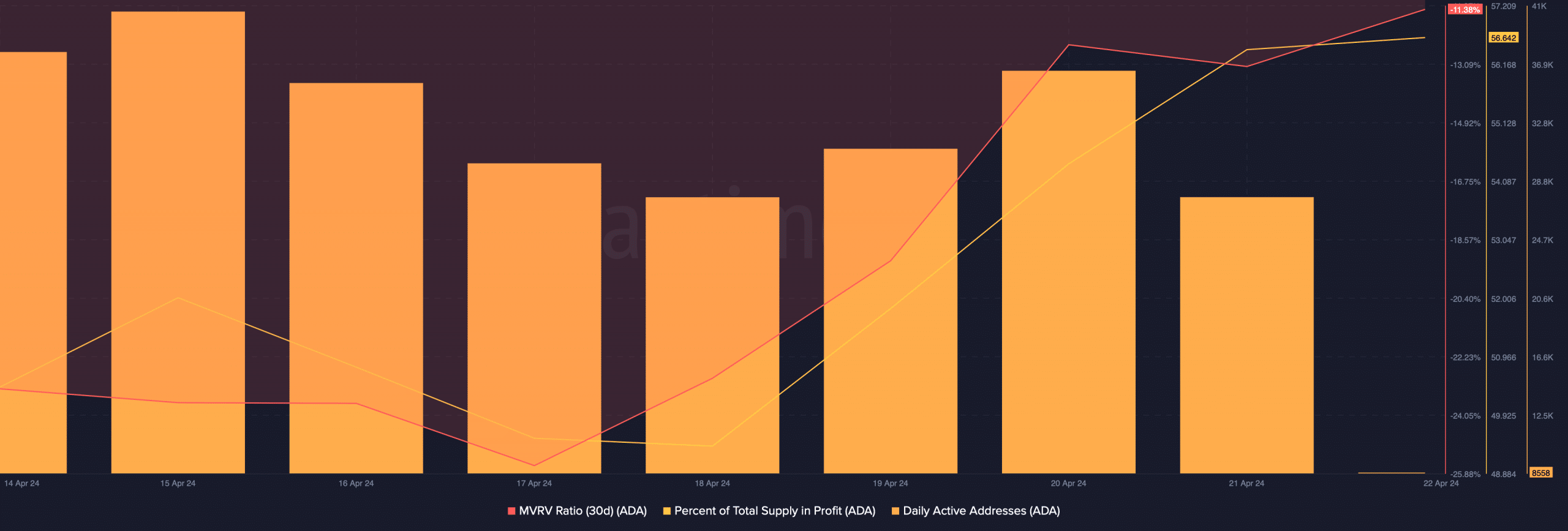

AMBCrypto then checked Cardano’s metrics to see whether they supported the possibility of a bull rally. As per our analysis of Santiment’s data, ADA’s MVRV ratio improved considerably over the last week.

Another bullish metric was ADA’s percentage of supply in profit, which also went northwards.

However, the crypto’s network activity looked concerning as its daily active addresses declined slightly over the last few days.

Read Cardano’s [ADA] Price Prediction 2024-25

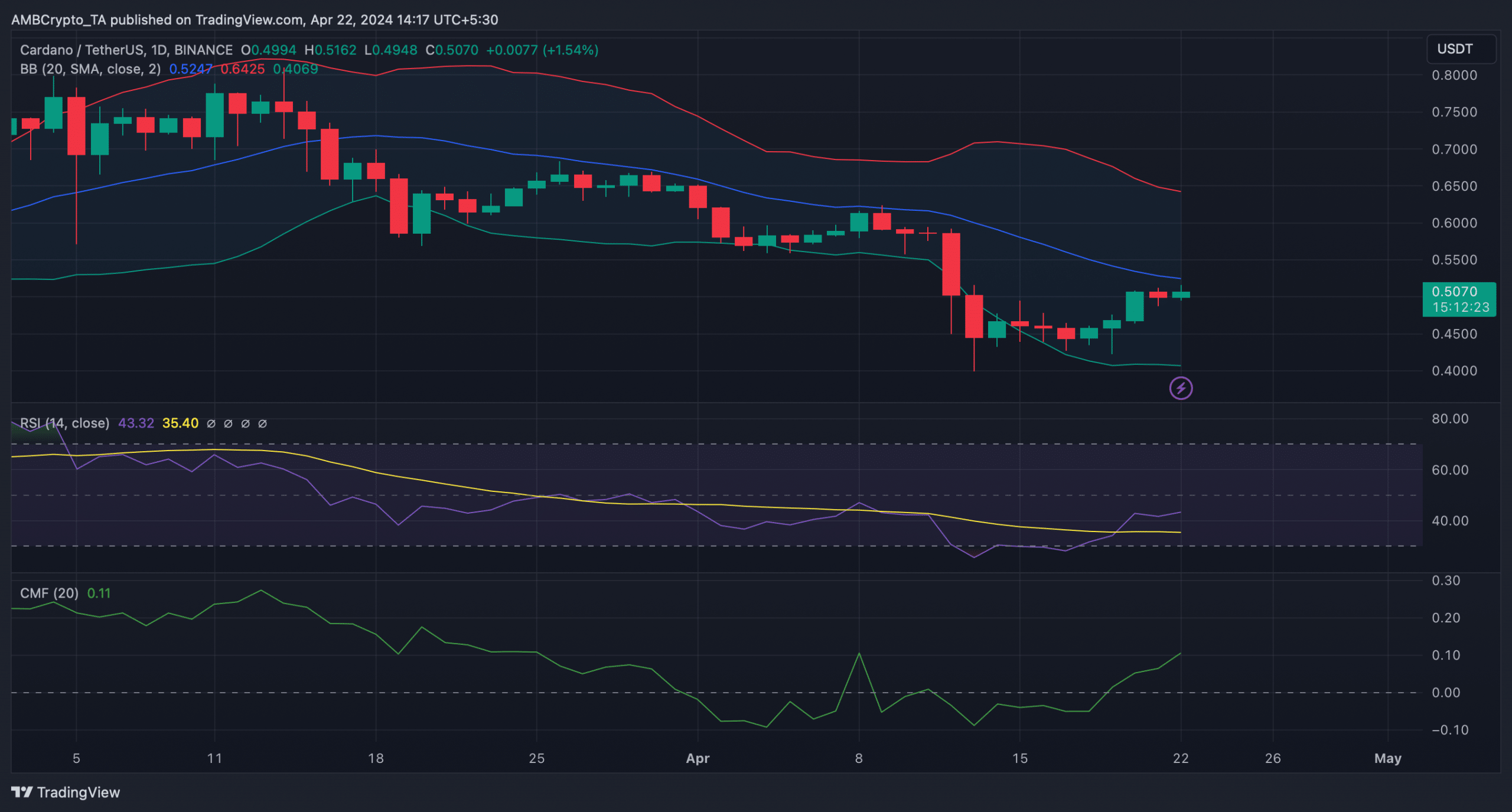

Nonetheless, technical indicators remained bullish. For instance, both the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) registered upticks, hinting at a continued price rise.

The Bollinger Bands pointed out that the ADA price was resting just near its 20-day Simple Moving Average (SMA). A successful breakout above that level could allow ADA to turn volatile in a northward direction.