Cardano [ADA] retests Q1 price ceiling- Will bulls go forth?

![Cardano [ADA] retests Q1 price ceiling- Will bulls go forth?](https://ambcrypto.com/wp-content/uploads/2023/04/image-1200x800-44.png)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ADA reclaimed its February price level.

- Despite a dip in trading volume, the funding rate remained positive.

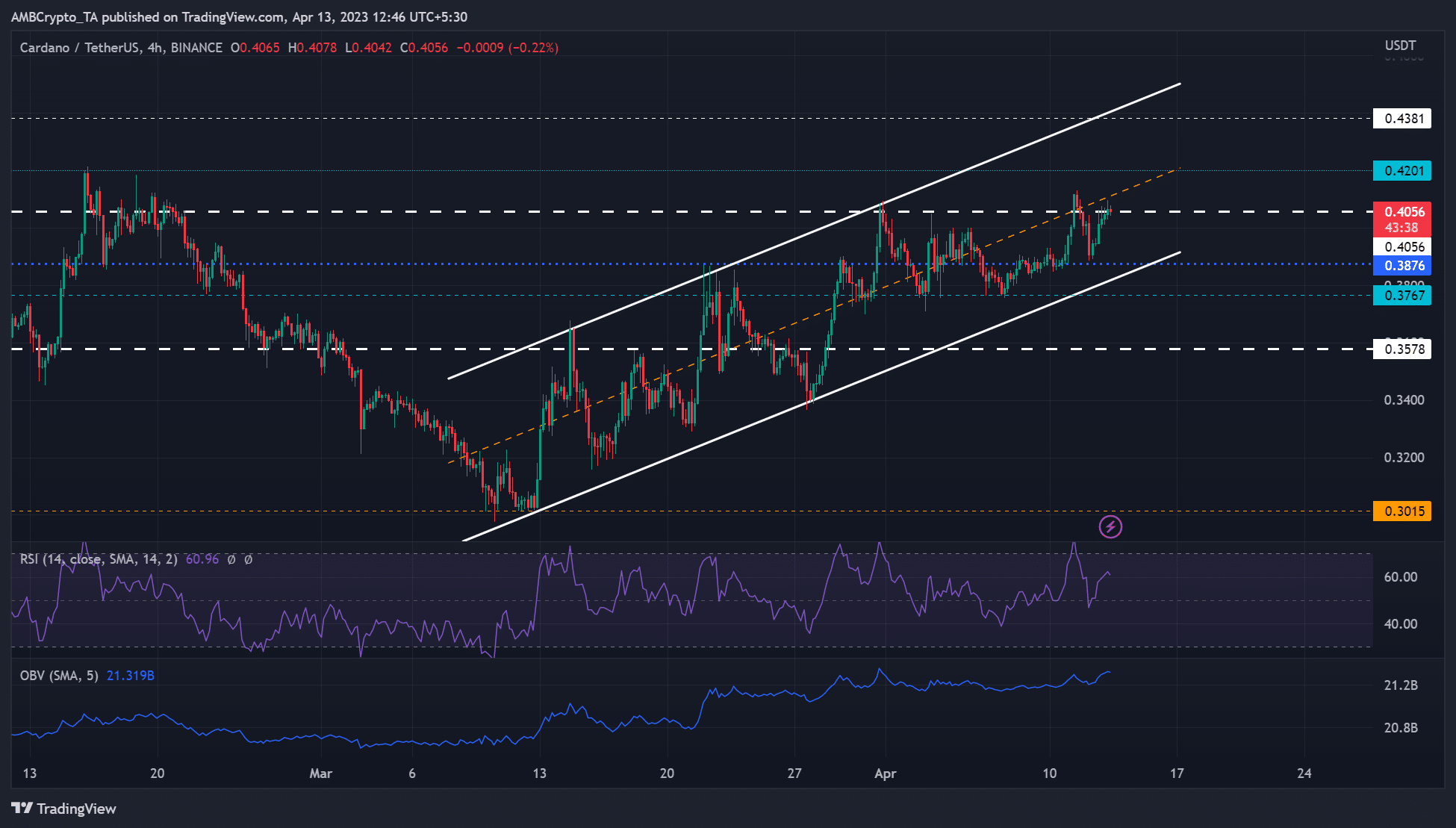

Cardano [ADA] appreciated 35%, recovering all the losses in the second half of February and early March. It rose from $0.3015 to $0.4056, only an inch closer to its first-quarter high of $0.4201. However, the above price ceiling has also acted as a key supply zone in the past.

Read Cardano [ADA] Price Prediction 2023-24

Will bulls breach the price ceiling?

The channel’s mid-point, alongside the $0.4056, are key obstacles that could expose ADA to more selling pressure if the price action doesn’t close above them.

As such, ADA may retest the immediate support at $0.3876 or the channel’s lower boundary. A bearish breakout, especially if Bitcoin [BTC] drops below $30K, could slow down to $0.3378.

Conversely, a close above the channel’s mid-range and $0.4056 could set ADA to consolidate within the $0.4056 – $0.4201 range. A BTC surge beyond $30.4K will likely inflict an upswing and push ADA to aim at $0.4381.

At the time of writing, the RSI (Relative Strength Index) rebounded from the mid-level, indicating increased buying pressure. In addition, the OBV (On Balance Volume) had an uptick – an increased demand for ADA in the past few days.

Trading volumes dipped; the funding rate remained positive

Is your portfolio green? Check ADA Profit Calculator

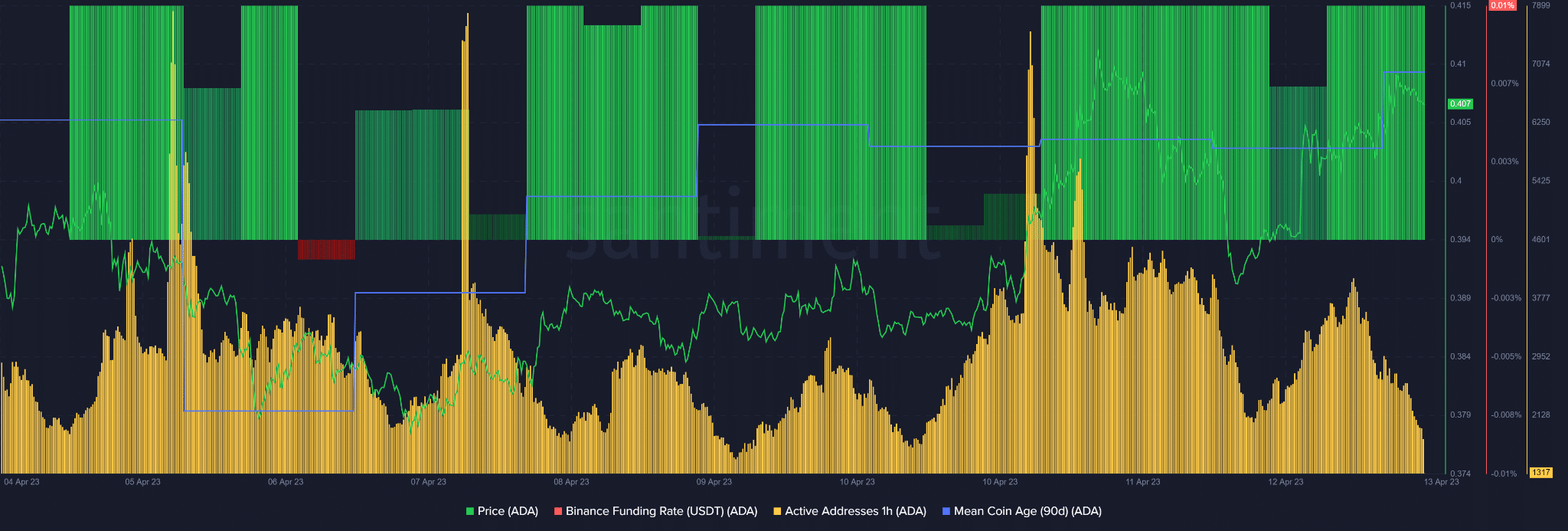

The active hourly addresses dropped at press time, indicating trading volumes dipped. As a result, the price volume divergence could limit bulls from blasting past the $0.4056 resistance level.

However, funding rates remained positive, indicating bulls could have slight leverage. In addition, the mean coin age rose – a wide network accumulation of ADA occurred, which could trigger another rally in the short term.

But investors should track BTC’s price action before making moves. BTC oscillated in the $29.8K – $ 30.4K range and could set ADA to another short-term price consolidation.

On April 12, BTC dropped below $30K after the U.S. CPI data showed consumer price gains slowed while Fed minutes revealed higher rate hikes hadn’t been ruled out entirely.