Cardano [ADA] sees a decline in key growth metrics in Q4 2022

![Cardano [ADA] sees a decline in key growth metrics in Q4 2022](https://ambcrypto.com/wp-content/uploads/2023/03/suzanne-d-williams-VMKBFR6r_jg-unsplash-e1679124779557.jpg)

- Cardano suffered a decline in financial metrics in Q4 2022.

- However, the daily transactions dApp transactions count rallied during that period.

House to over 1000 decentralized applications (dApps), a new report from Messari revealed that the leading Layer 1 blockchain Cardano [ADA] saw growth and some corresponding declines in Q4 2022.

Titled “State of Cardano Q4 2022,” Messari found that due to the unexpected collapse of cryptocurrency exchange FTX in November, there was a downturn in Cardano’s financial metrics like market capitalization and revenue, as well as activity metrics such as the count of active addresses and total value locked (TVL) on the network.

Nonetheless, despite the hit suffered by the entire market due to FTX’s fallout, Cardano logged increments in daily transactions count, dApp transactions, and engaged staking activity.

Read Cardano (ADA) Price Prediction 2023-24

The quarter came with a few bad tidings

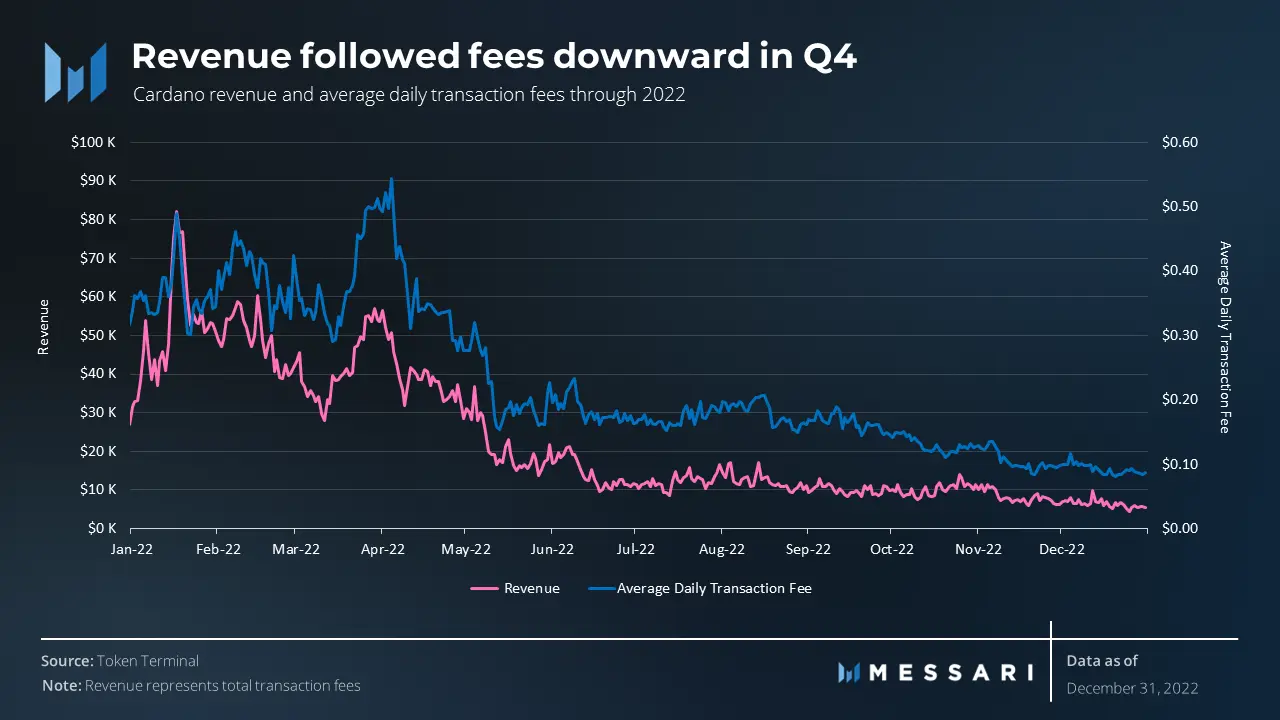

Per the report, the 90-day period under review was plagued by a significant decline in Cardano’s revenue.

According to Messari, Cardano’s revenues are “tightly coupled with fees as they are the source of revenue.”

As such, the 36% decline in transaction fees paid on the network in Q4 2022 culminated in a 28.3% corresponding decrease in revenue during the same period.

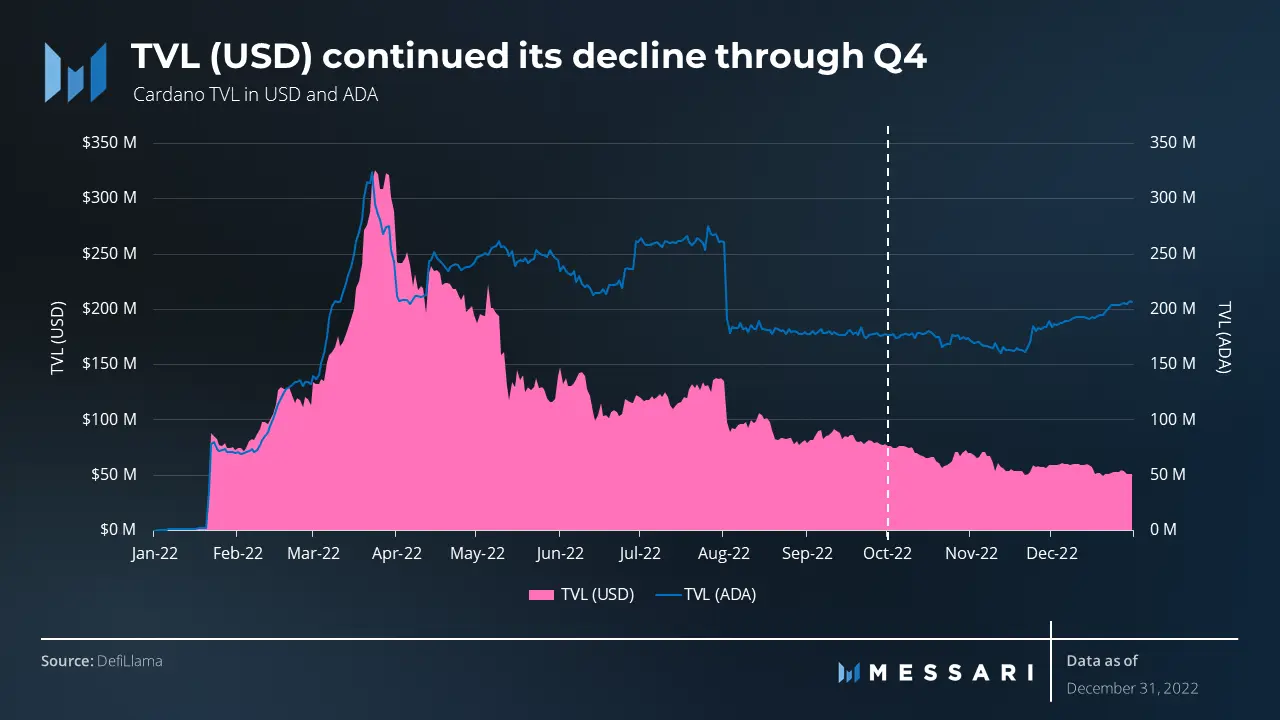

In addition to a decline in revenue, FTX and Genesis’ collapses caused Cardano’s DeFi TVL (USD) to “decline through the 2022 bear market” and to take “a further 34.8% decline in Q4,” Messari found.

Although Cardano’s TVL (ADA) increased by 16.2% in Q4 2022, Messari noted that the steady decline in TVL (USD) during that period was due partially to ADA’s price drop.

Messai found a further drop in Cardano’s market capitalization/ TVL ratio. The report stated,

“Cardano’s market cap / TVL ratio decreased 10.8% to 169.5 in Q4. This ratio is still orders of magnitude larger than that of the main DeFi players, indicating Cardano’s DeFi ecosystem is smaller in both absolute terms and relative terms.”

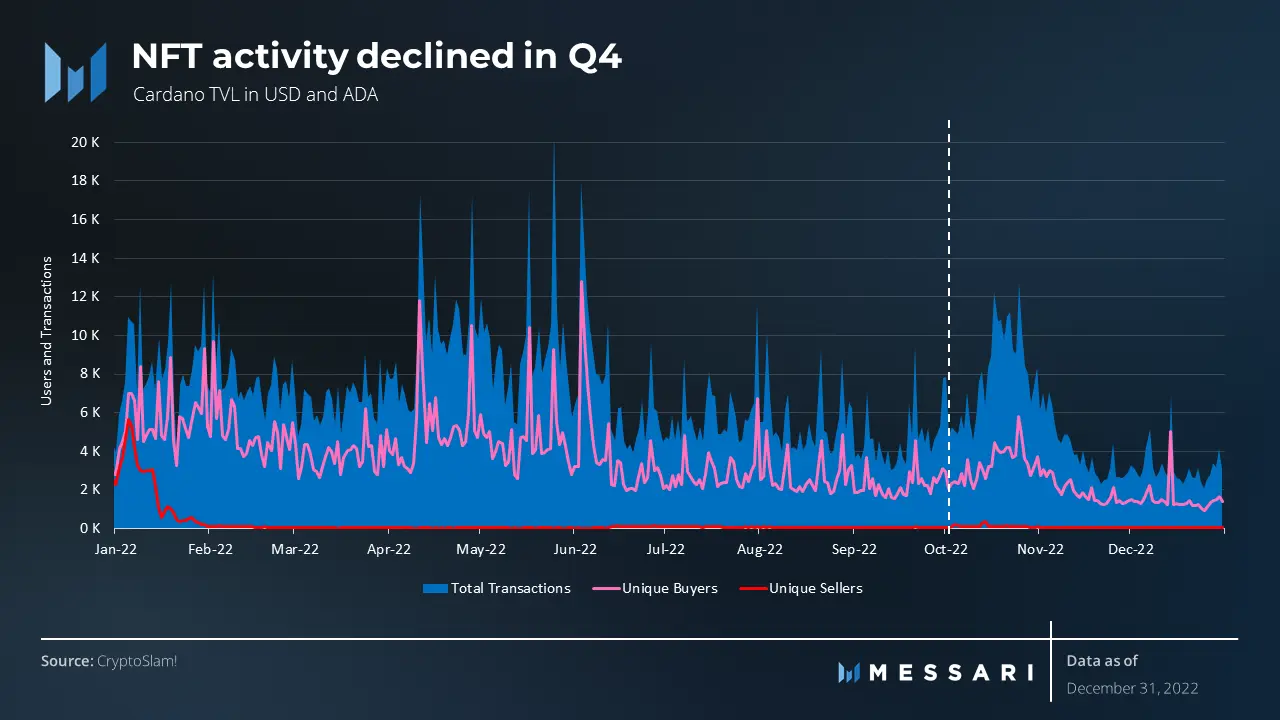

Regarding NFT sales in Q4 2022, Cardano saw a steep fall. According to Messari, the network had a significantly lower number of unique sellers per day than competitors Flow and Polygon.

For most of the quarter, NFT trading volume was flat, with a momentary spike in activity in October due to the launch of OREMOB, an anime profile picture (PFP) project.

How much are 1,10,100 ADAs worth today

Here lies the silver lining

While Cardano’s financial metrics closed Q4 2022 posting declines, the chain’s daily transactions, and dApp transactions rallied by 13% and 16%, respectively.

In addition, according to Messari, developer activity on Cardano intensified during that period as many projects flocked to the chain. Messari noted:

“In Q4, development occurred in areas such as stablecoins, synthetic assets by Indigo Protocol, and new NFT projects.”

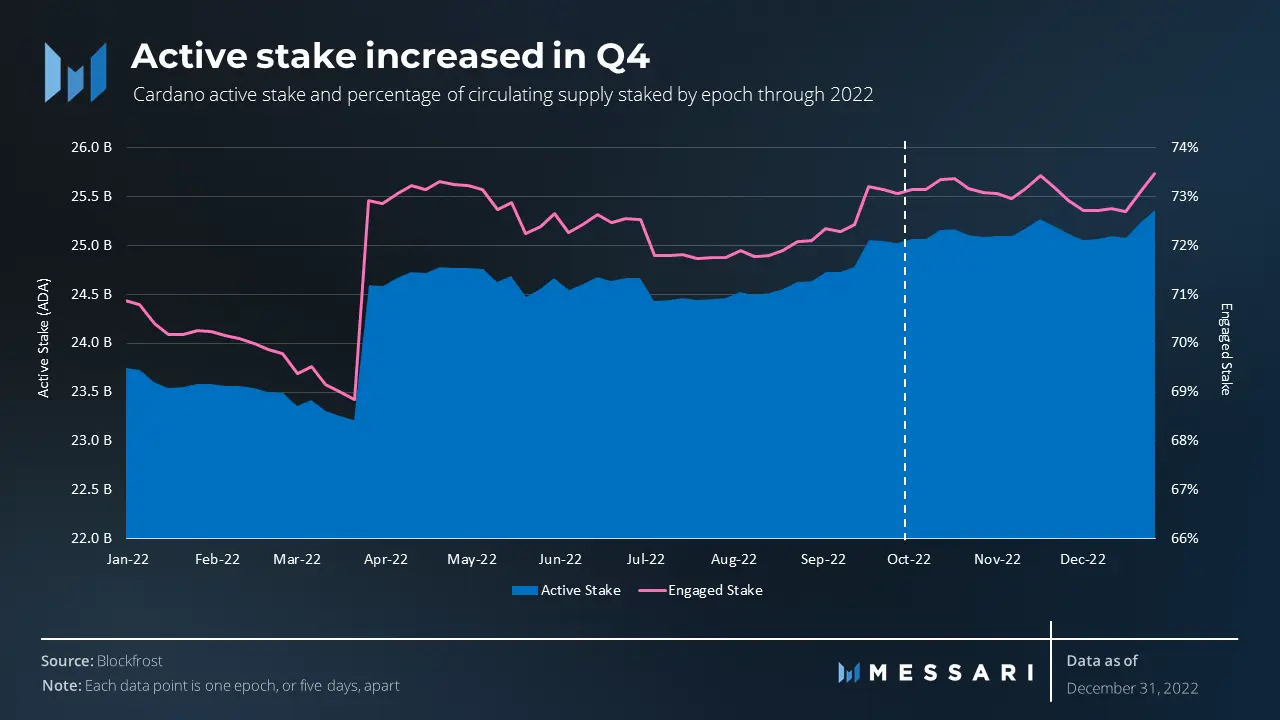

As for staking on the chain in Q4 2022:

“Cardano’s active stake is at an all-time high of almost 25.5 billion ADA. Engaged stake has increased QoQ and YoY, suggesting that the ADA issued to pool operators and delegators is being staked after it’s received. Engaged stake has peaked at the end of Q4 at nearly 74%.”